Sygnum: Institutional Inflows to BTC-ETFs Boost Bitcoin by 3-6% per $1 Billion

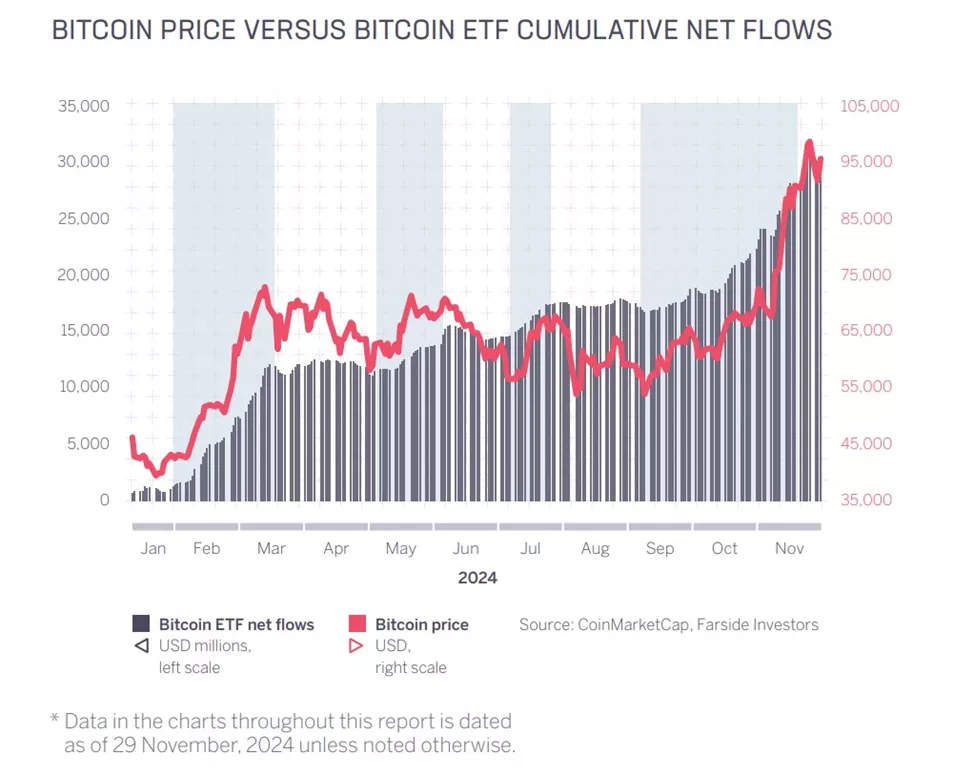

Institutional capital exerts a “multiplicative effect” on Bitcoin: each $1 billion inflow into BTC-ETFs pushes prices up by 3-6%. This is according to a report from the regulated crypto bank Sygnum.

Growing interest from institutional investors is setting the stage for a “demand shock” in 2025. Analysts noted the potential for increased purchases by governments, endowments, and pension funds.

The adoption of cryptocurrency-supportive laws in the United States will be crucial.

The establishment of a favourable regulatory framework by the US Congress will also influence the dynamics of altcoins. Experts highlighted the need for rules that relieve projects from the “burden of compliance [with laws] that they cannot reasonably meet.”

Key among these are the Financial Innovation and Technology Act (FIT21) and the Stablecoin Payments Act.

The US also requires regulations for non-custodial wallets, cryptocurrency mining, and DeFi. Until then, “exceptionally strong drivers for Bitcoin […] will limit the price prospects of altcoins,” the report states.

Experts also pointed out signs of a bubble forming in meme coins. They attributed this to the weak growth of users in most dapps and use cases, leading to speculation.

BlackRock Recommendations

In its December review, the BlackRock Institute suggested investors allocate 1-2% of their capital to Bitcoin. They believe the asset has the greatest potential for returns before it becomes widely adopted.

BlackRock Institute (BII) stated in its December 2024 “Investment Perspectives” that Bitcoin, as part of a multi-asset portfolio, may have the greatest return potential before it is widely adopted. The report recommends that investors control the allocation ratio to 1%-2% to…

— Wu Blockchain (@WuBlockchain) December 12, 2024

Analysts identified factors driving the further popularization of digital gold:

- unrestricted and instant cross-border transactions;

- decentralized nature and lack of government influence on supply;

- immunity to the effects of budget deficits, rising national debt, and inflation, which undermine the value of national currencies.

From November 5 (Donald Trump’s victory in the US elections) to December 9, US spot Bitcoin ETFs attracted approximately $9.9 billion, increasing the total asset value in the funds to $112.7 billion.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!