Ethereum ETF Inflows Continue for 18 Consecutive Days

On December 18, inflows into spot exchange-traded funds based on Ethereum amounted to $2.45 million. Over the past 18 days, investors have poured $2.45 billion into these products.

Since their launch, these instruments have attracted $2.46 billion.

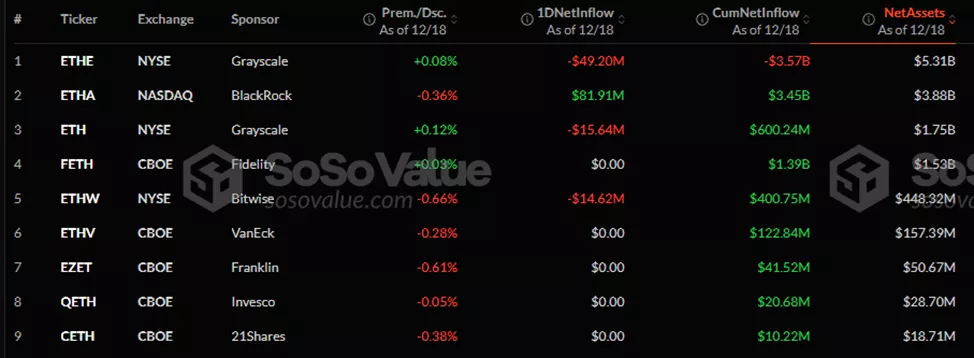

AUM has grown to $14.3 billion.

The leaders are Grayscale’s ETHE ($5.31 billion) and BlackRock’s ETHA ($3.88 billion). The latter now holds over 1 million ETH.

BTC-ETF

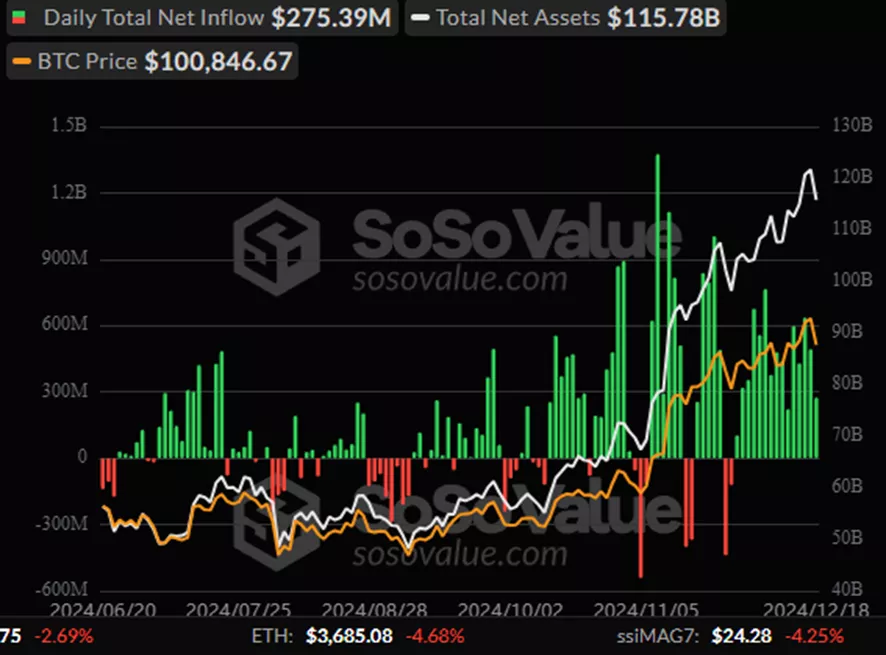

On December 18, inflows into BTC-ETF totaled $275.4 million. This positive trend has continued for 15 consecutive days, with inflows reaching $6.73 billion during this period.

The cumulative inflow since the approval of BTC-ETF in January has reached $37 billion.

AUM of these products has increased to $120.7 billion.

48.4% ($56.1 billion) of this amount is attributed to IBIT. Along with Grayscale’s GBTC ($21 billion) and Fidelity’s FBTC ($21 billion), BlackRock’s ETF has concentrated 84.8% of the sector’s funds.

According to Sygnum’s calculations, each $1 billion inflow into BTC-ETF pushes Bitcoin up by 3-6%.

Previously, YouHodler exchange’s top manager Ruslan Lienkha highlighted the potential for staking inclusion in Ethereum-ETF. Bernstein shares this view.

Some experts believe that the success of ETH-ETF could propel the second-largest cryptocurrency by market capitalization to a new all-time high.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!