Kaiko Highlights 2024 in Ten ‘Best Charts’

Kaiko described 2024 as a landmark year for cryptocurrency markets, summarizing it through ten charts.

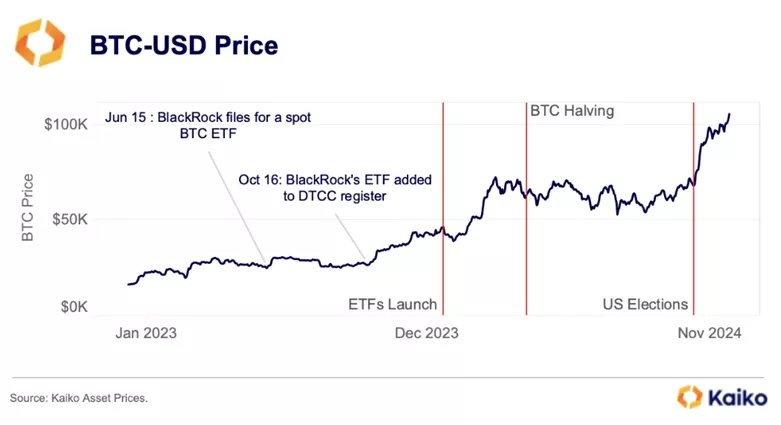

Bitcoin’s Path to $100,000

The market strengthened following the launch of BTC-ETF, with the fourth halving proceeding without surprises. Waves of billion-dollar liquidations did not overshadow the success of digital gold. The price increase since the beginning of the year was approximately 140%.

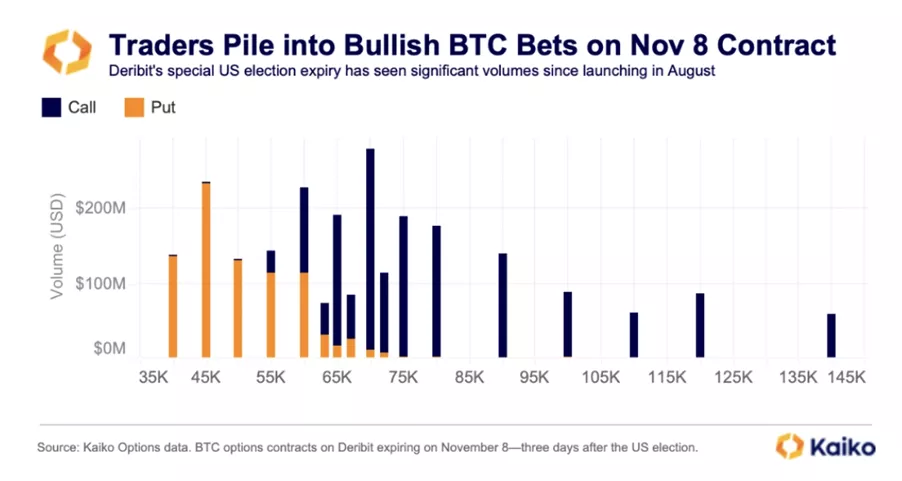

US Elections Energize Bulls

Experts noted the significant role of cryptocurrencies in the presidential candidates’ rhetoric in the US. Bitcoin became a “bet on [Donald] Trump” ahead of the November 5 vote. The dynamics were further boosted by Senate election results favoring pro-crypto legislators.

As a result, by November 11, Bitcoin surpassed $80,000, setting a new ATH above $108,000 in December.

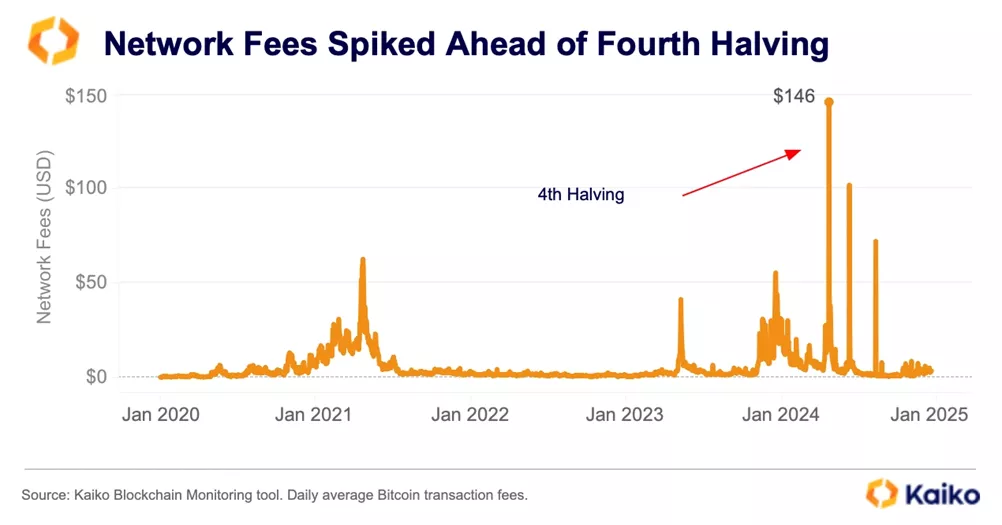

Bitcoin Network Fee Surge Before Halving

Shortly before the halving on April 19, the average fee in the Bitcoin blockchain soared to a record $146. By comparison, in Ethereum, the metric was $3. The cause was the launch of Runes.

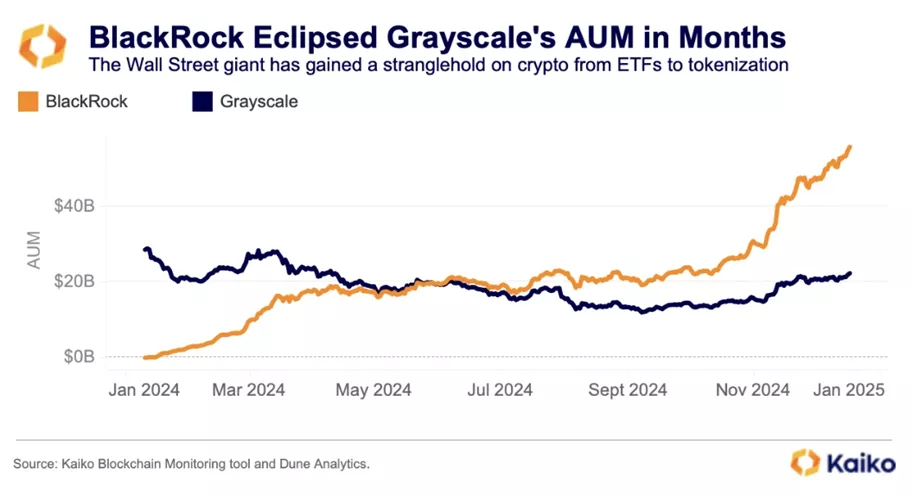

BlackRock’s IBIT Overtakes Grayscale’s GBTC

The AUM of BlackRock’s IShares Bitcoin Trust ETF (IBIT) exceeded $50 billion since the approval of BTC-ETF in January.

Grayscale’s GBTC, as the sole mechanism for investing in digital gold, offered uncompetitive terms for buying/redeeming shares, quickly losing its position.

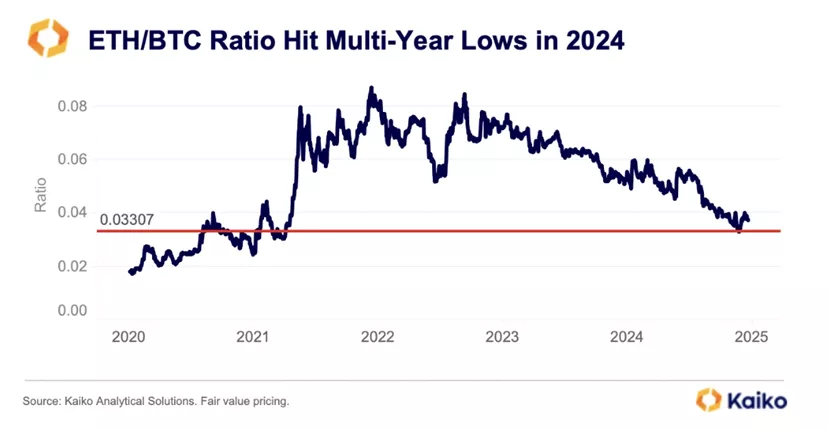

Decline of ETH/BTC

Throughout 2024, the ETH/BTC rate declined, reaching its lowest point since March 2021 (0.033).

Kaiko attributed this to a shift of funds to Solana due to high fees in March and the meme coin frenzy in the fourth quarter. Additional pressure came from the absence of staking in the launched ETFs.

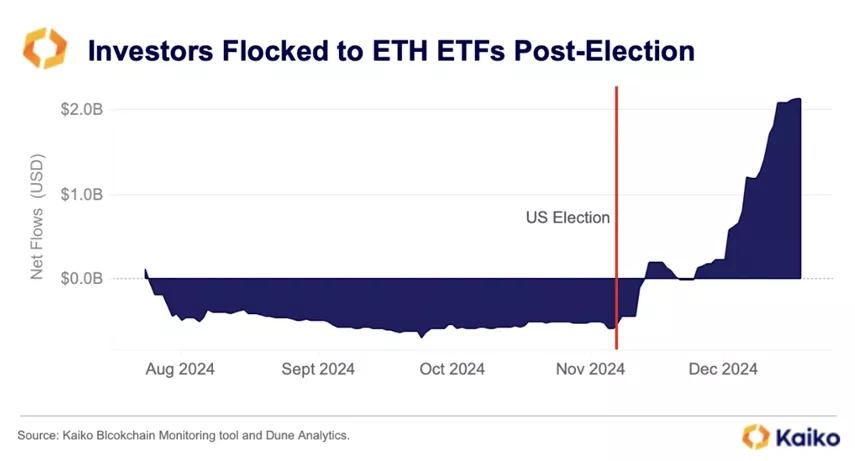

Sluggish Start for ETH-ETF

After their launch in July, Ethereum-ETFs gained popularity slowly, partly due to bets on closing the discount in Grayscale’s product.

The situation changed with the November elections, which raised expectations of an improved regulatory landscape. Consequently, from late November, a wave of inflows formed over 18 days, during which investors directed $2.45 billion into the instruments.

Kaiko called Ethereum “one of the main winners” of the US elections. Experts forecasted a clarification of the SEC‘s position regarding the asset’s status and the inclusion of staking in the product.

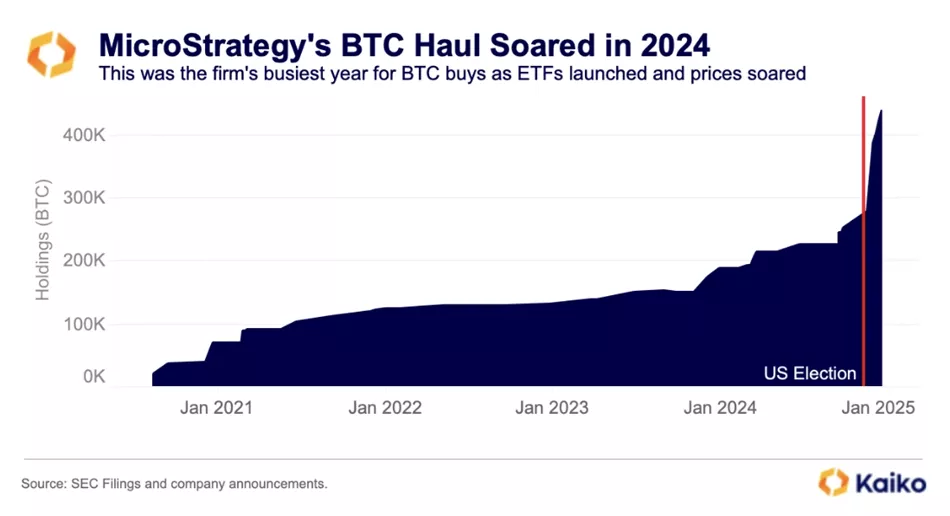

MicroStrategy’s Record Bitcoin Purchases

Since January, MicroStrategy acquired over 249,850 BTC, accelerating purchases after the US elections, nearly doubling its Bitcoin balance in the last month. The company issued convertible bonds, raising concerns about its financial stability.

Kaiko recalled the initiative to create a US Bitcoin reserve. Senator Cynthia Lummis’s proposal suggests purchasing up to 1 million BTC over five years.

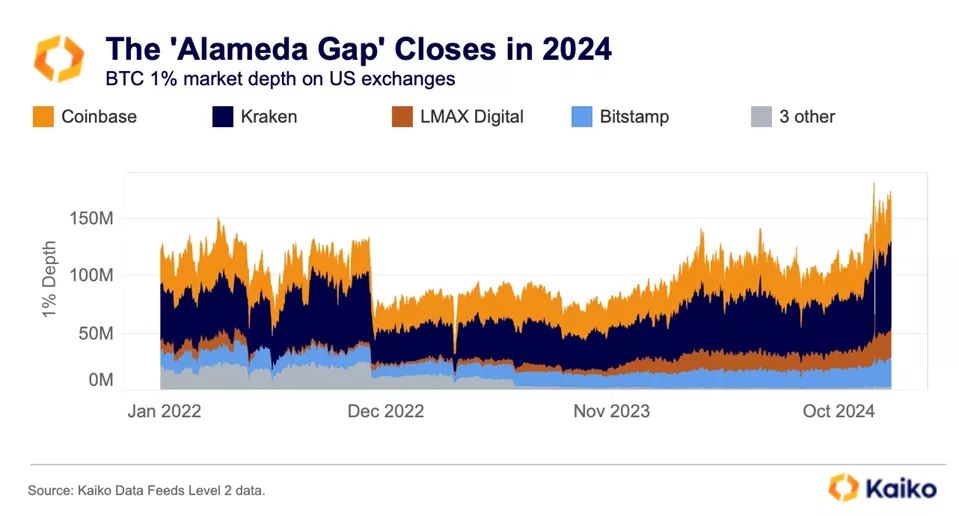

Liquidity Recovery After FTX Collapse

Kaiko noted the filling of the Alameda gap, referring to the drop in market depth within 1% of the average price on US platforms. This occurred after the bankruptcy of FTX and its associated market maker Alameda Research.

The market neutralized negative effects through price growth and an increase in participants, experts indicated.

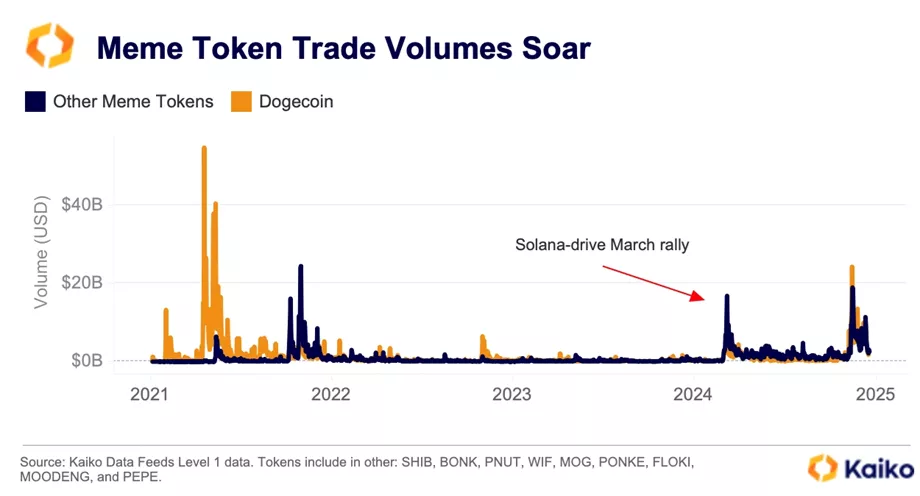

Meme Coin Frenzy

The catalyst for the market segment boom was the launch of the Pump.fun platform on the Solana blockchain.

An additional factor was Donald Trump’s victory in the US presidential election, which renewed interest in Dogecoin. It was later announced that the Department of Government Efficiency (DOGE) would be led by billionaire Elon Musk and former US presidential candidate Vivek Ramaswamy.

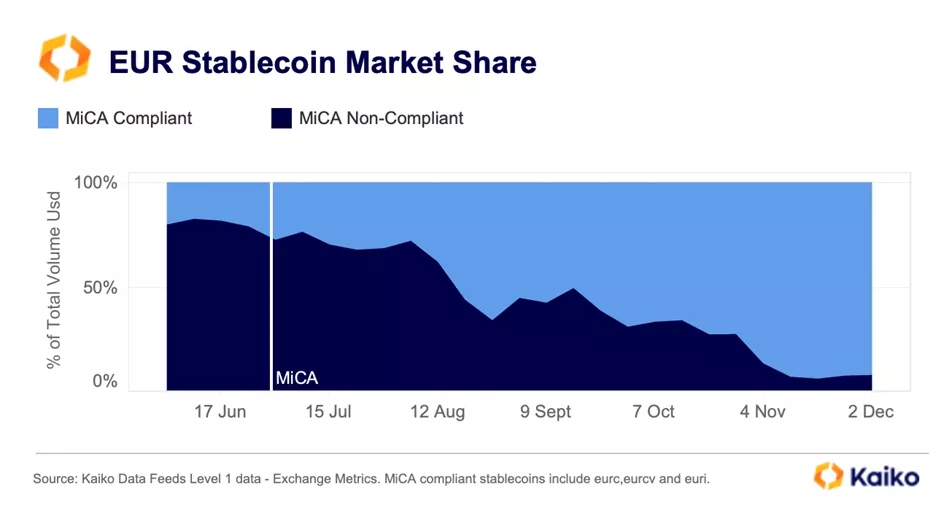

Stablecoin Market Transformation Post-MiCA

The enactment of MiCA led to a wave of delistings of non-compliant stablecoins on CEX.

By November 2024, MiCA-compliant “stablecoins” like Circle’s EURC, Societe Generale’s EURCV, and Banking Circle’s EURI captured a record market share of 91%.

CoinGecko previously identified meme coins as the main trend among traders in 2024.

Earlier, the community expressed doubts about the long-term popularity of AI agents.

During the New Year holidays, ForkLog’s editorial team will traditionally release a series of materials summarizing the year. Happy holidays!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!