Bitcoin and Solana Trading Volumes Hit Record Highs

- Solana’s turnover in November reached a record $243 billion.

- The blockchain has taken a leading position with 132 million active users.

- An expert noted the formation of a “bullish pullback” pattern as an entry point for long positions.

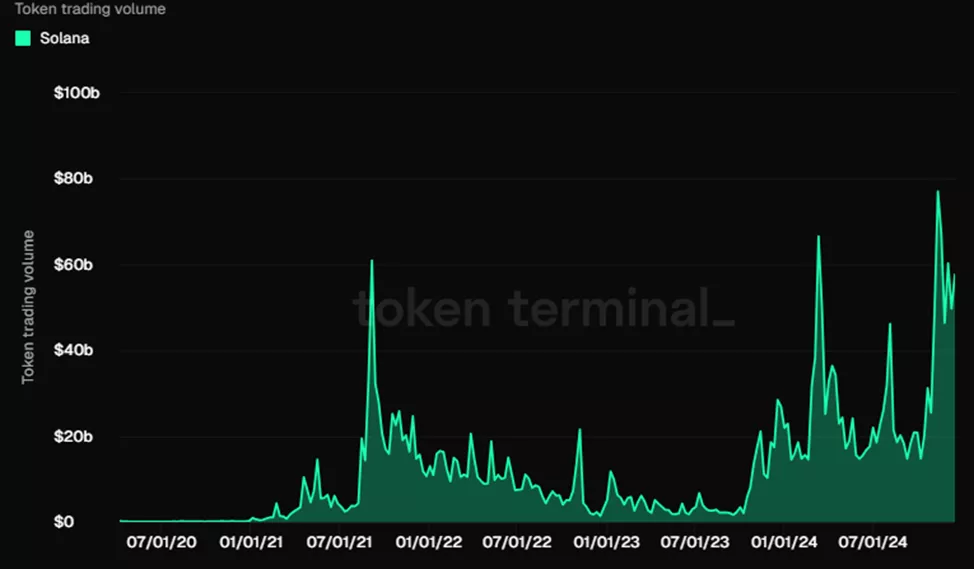

In November, Bitcoin and Solana trading volumes reached record highs of $2.2 trillion and $243 billion, respectively. Ethereum’s volume rose to $1.1 trillion, which is 50% below its peak in 2021, according to Token Terminal.

BREAKING: Monthly trading volume for BTC and SOL is at all-time highs, ETH is still down ~50% from its ’21 peak.

Trading volumes for BTC, ETH, and SOL in November ’24 were $2.2 trillion, $1.1 trillion, and $243 billion, respectively. pic.twitter.com/eCj1rUdm7T

— Token Terminal (@tokenterminal) December 19, 2024

Solana’s average weekly volumes exceeded the 2021 peak by 46%, while Bitcoin and Ethereum metrics remain below the previous bull run levels.

Solana’s turnover is about 20% of Ethereum’s figure, mirroring the similar proportion of the two assets’ market capitalizations.

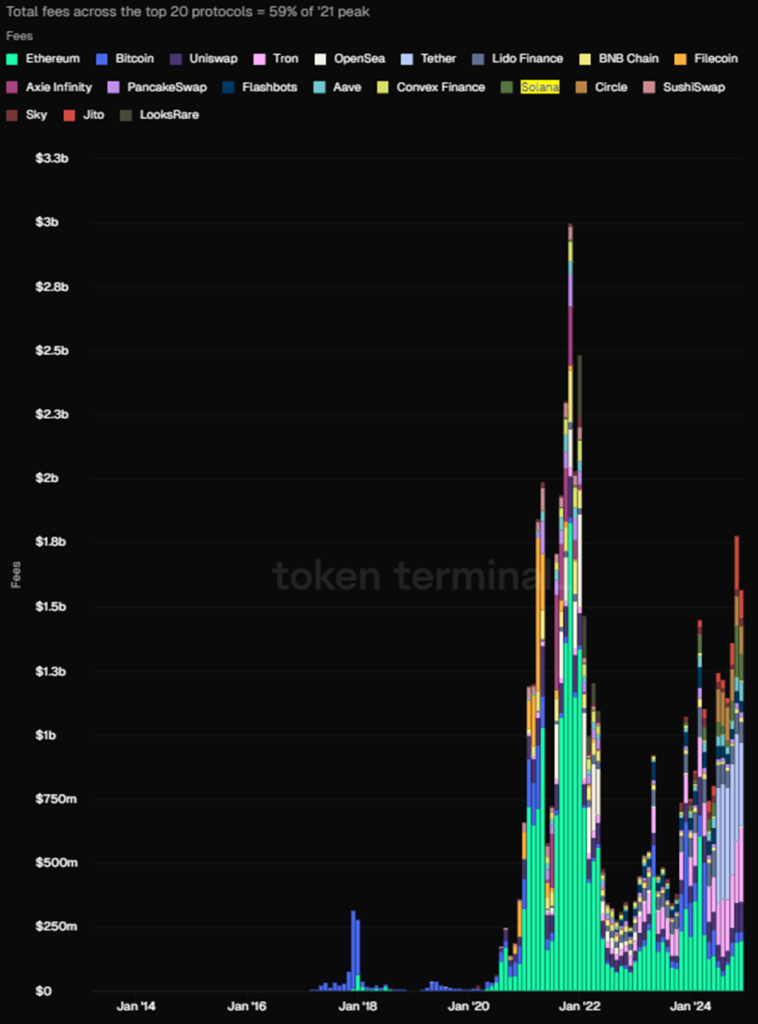

In terms of fees, Ethereum’s share in November was 18% (61% in 2021), while Solana’s was 18.5% (0.2%).

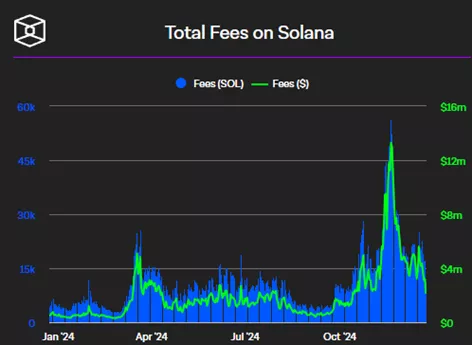

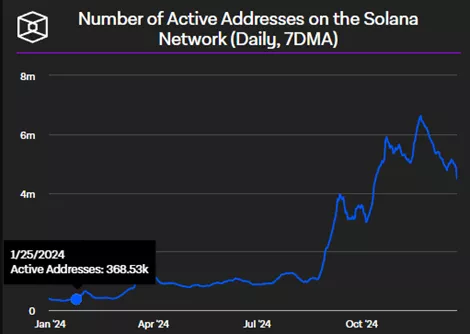

Solana has taken a leading position with 132 million active users. Compared to November 2021, this figure has jumped by 81 million, doubling the combined value of all blockchains at that time.

In December, on-chain metrics have weakened.

Glassnode’s Perspective

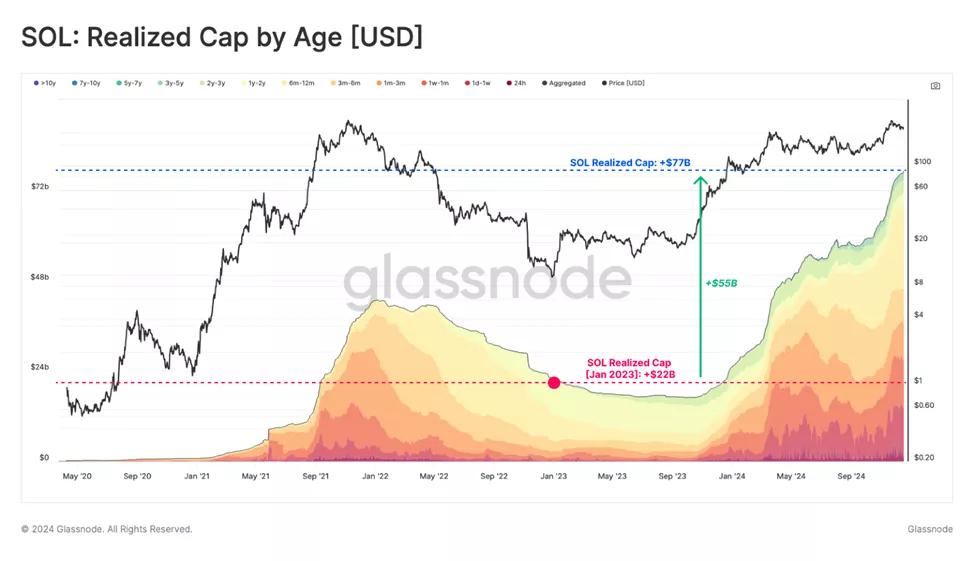

Glassnode noted the resilience of Solana’s net inflow since September 2023. Previously, the daily value reached a record $776 million.

We observe that #Solana has consistently maintained a positive net capital inflow since early September 2023, with only minor outflows during this period.

This sustained influx of liquidity has assisted in stimulating growth and price appreciation, achieving a remarkable peak… pic.twitter.com/ypuwTdhrmc

— glassnode (@glassnode) December 24, 2024

According to the analysis of realized profit by “age” of coins, about 51.6% of the total volume is attributed to coins acquired in three time ranges: from one day to a week, from a week to a month, and from six months to a year.

Experts believe this indicates Solana’s perception as an investment opportunity for all market participants.

The sharp recovery in Solana’s price after the FTX collapse reflected a significant influx of new funds into the asset.

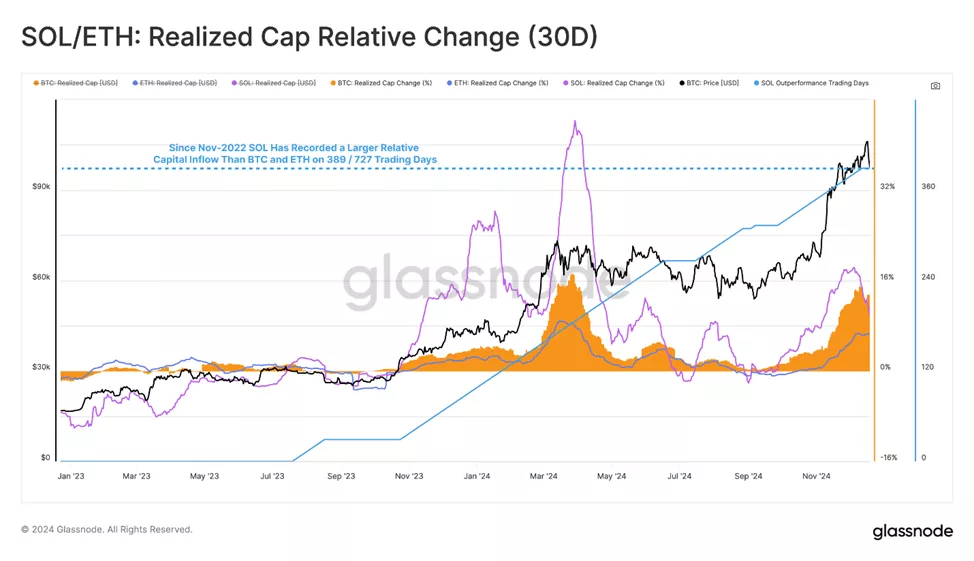

Since December 2022, when Solana hit its low, its 30 DMA of relative change in realized capitalization has outperformed Bitcoin and Ethereum in 389 out of 727 trading days.

The realized capitalization indicator for inflows active in the last seven days for Solana has surpassed Ethereum for the first time in history. This underscores the asset’s strong demand profile, according to Glassnode.

In conclusion, experts analyzed the asset’s “overheating” based on the MVRV ratio.

This serves to determine price ranges that indicate extreme divergences in investor returns from the long-term average. Historically, breakthroughs above one standard deviation coincide with long-term peaks.

Currently, the price is consolidating between the average and the +0.5 standard deviation range. This suggests opportunities for the continuation of the bull run.

Technical Outlook

CoinDesk analyst Omkar Godbole reported the emergence of a “bullish pullback” pattern.

This formation is seen as a low-risk trading opportunity for breakout traders.

In financial markets, the best entry point often appears briefly and can be easily missed. Currently, Solana “offers a timely second chance for those who missed the bullish breakout.”

Since December 23, the rate has risen by more than 7% to $193, rebounding from former resistance turned support.

This line, connecting the March and July highs, along with the line drawn through the April and August lows, formed a large descending channel that remained relevant from March to October.

In early November, quotes broke out of the range, confirming a bullish trend. The price quickly rose to above $260, followed by a pullback to the breakout point.

The specialist emphasized that the signal will lose relevance if the rate falls back into the channel.

Earlier, CEO of Two Prime Digital Assets Alexander Blum predicted the launch of a SOL-ETF by the end of 2025.

On November 21, CBOE submitted relevant applications to the SEC from VanEck, 21Shares, Canary Funds, and Bitwise Asset Management.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!