Ethereum ETF Inflows Halt After Five Days

On December 30, outflows from spot exchange-traded funds based on Ethereum amounted to $55.4 million. Over the previous four days, investors had poured $349.16 million into these products.

Since their launch, these instruments have attracted $2.62 billion.

AUM fell to $12.3 billion.

The leaders are Grayscale’s ETHE ($4.81 billion) and BlackRock’s ETHA ($3.64 billion). The latter now holds over 1 million ETH.

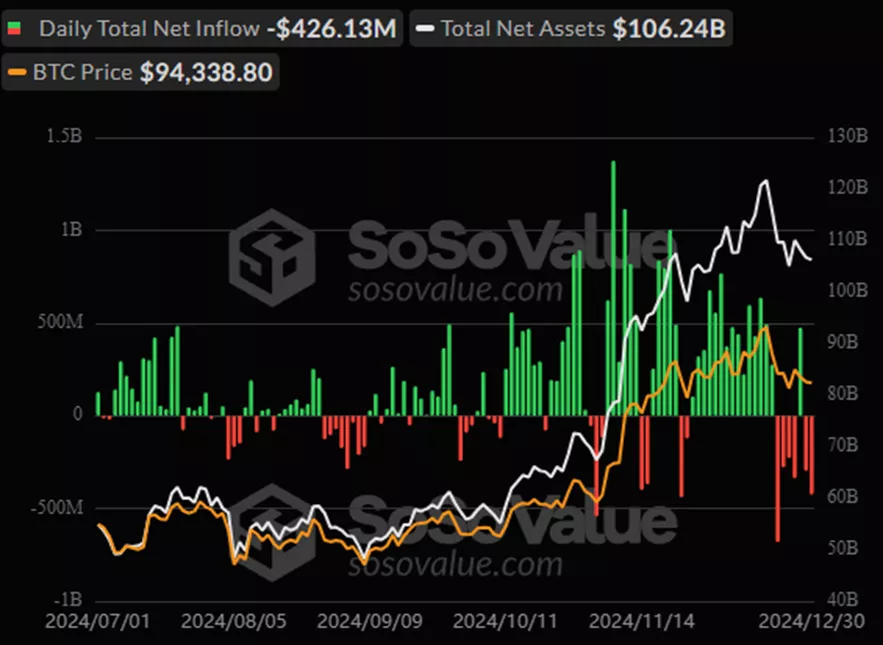

BTC-ETF

On December 30, outflows from BTC-ETF amounted to $426.1 million. This negative trend continued for the second consecutive day.

The cumulative inflow since the approval of BTC-ETF in January reached $35.24 billion.

AUM for these products decreased to $106.2 billion.

49.1% ($52.1 billion) of this amount is attributed to IBIT. Along with Grayscale’s GBTC ($19.35 billion) and Fidelity’s FBTC ($19 billion), BlackRock’s exchange-traded fund has concentrated 85.2% of the sector’s funds.

In December, Volatility Shares filed an application to register futures-based SOL-ETF.

Earlier, Alexander Blum, CEO of Two Prime Digital Assets, predicted the launch of Solana funds by the end of 2025.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!