The Resilient Holders Outshine FOMO Traders: Expert Analyzes Bitcoin Market Dynamics

The market is witnessing a clash between speculative short-term Bitcoin holders and long-term investors, with the latter emerging victorious. This observation was made by CryptoQuant author known as IT Tech.

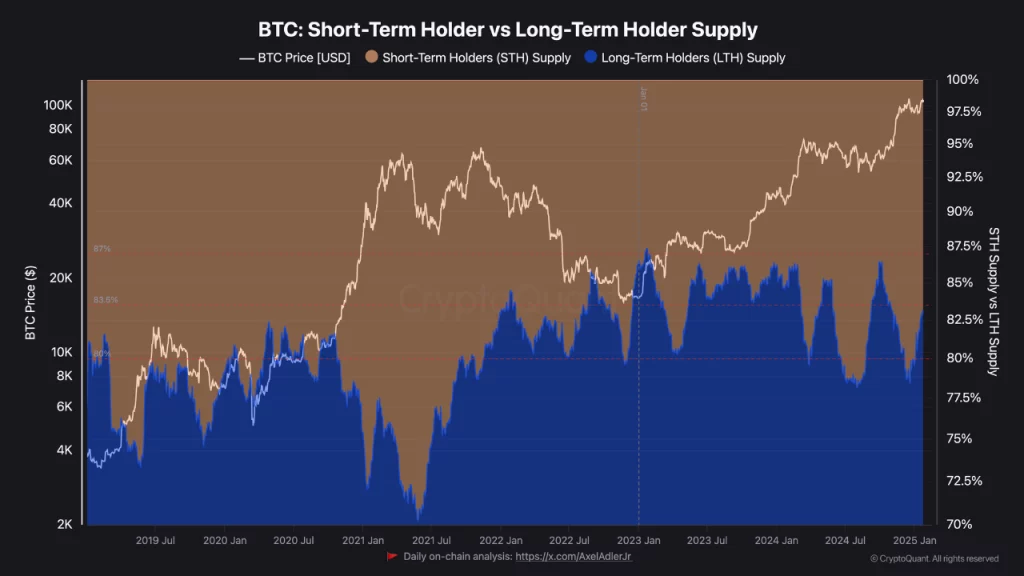

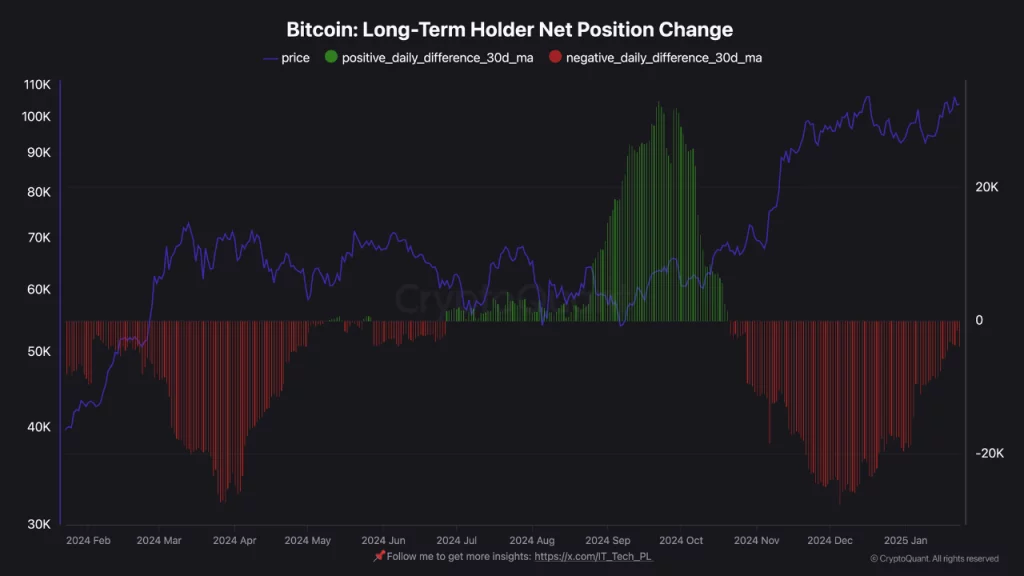

According to the analyst, the dominance of supply by LTH remains high, indicating strong confidence in growth. The “diamond hands” continue to accumulate during price dips and strategically take profits during upward movements.

IT Tech believes that such controlled behavior supports a bullish long-term outlook by limiting selling pressure.

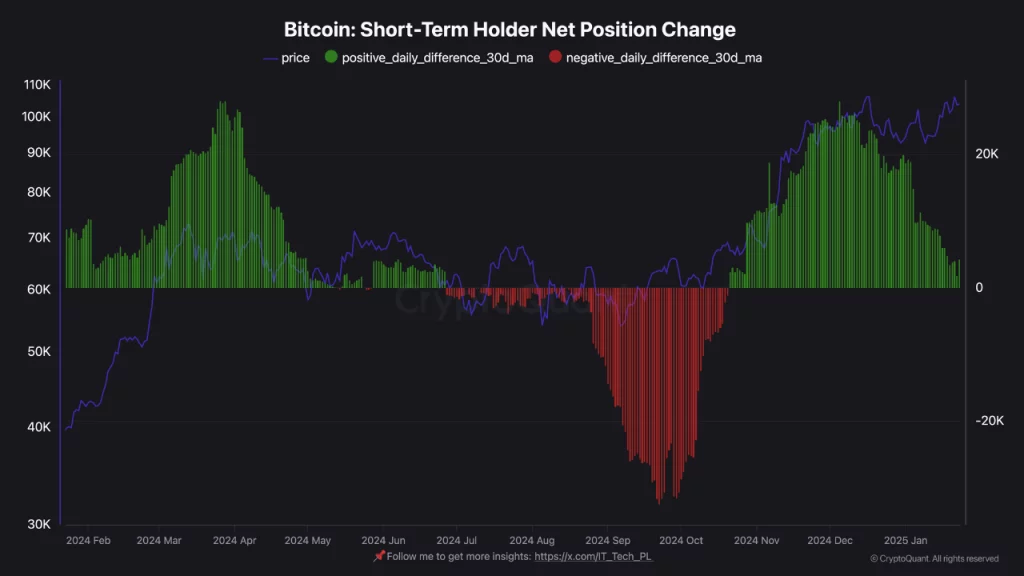

Meanwhile, short-term holders (STH) show increased activity during price rallies. This indicates speculative interest and entries driven by FOMO.

Significant fund movements during corrections point to the exit of “weak hands,” causing temporary volatility.

As LTH hold a significant portion of Bitcoin’s supply, the crypto market is “maturing,” according to the analyst. The reduced influence of STH enhances stability, although their speculative behavior still leads to price fluctuations.

“The current Bitcoin structure, where long-term holders lead and short-term holders act on speculation, sets an optimistic tone for 2025. Strategic profit-taking by LTH could create healthy pullbacks, opening opportunities for new accumulation,” concluded IT Tech.

Earlier, CryptoQuant analysts discovered that since the election of Donald Trump, Bitcoin has been supported by large investors. The digital holdings of whales increased from 16.2 to 16.4 million BTC, while smaller participants reduced their assets from 1.75 to 1.69 million BTC.

As reported by Glassnode, hodlers have returned to accumulating Bitcoin after a sharp sell-off at the $100,000 level.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!