Cold Snap in the US Adversely Affects Mining Industry

The rise in electricity prices in the US due to a temperature drop in the southern part of the country has led to the first decrease in Bitcoin mining difficulty in four months and a decline in cryptocurrency miners’ revenues. This is reported by The Block, citing a report by Luxor.

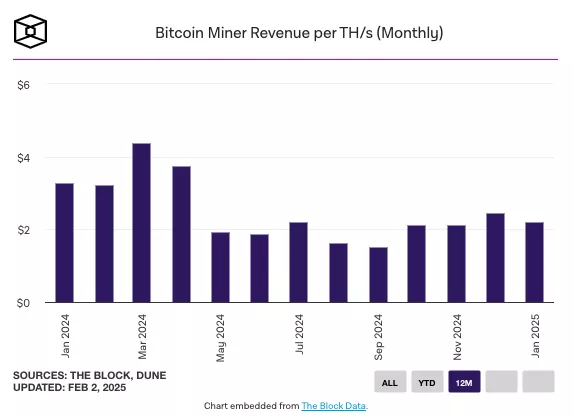

Miners’ revenue fell from $2.46 per TH/s in December to $2.19 per TH/s in January.

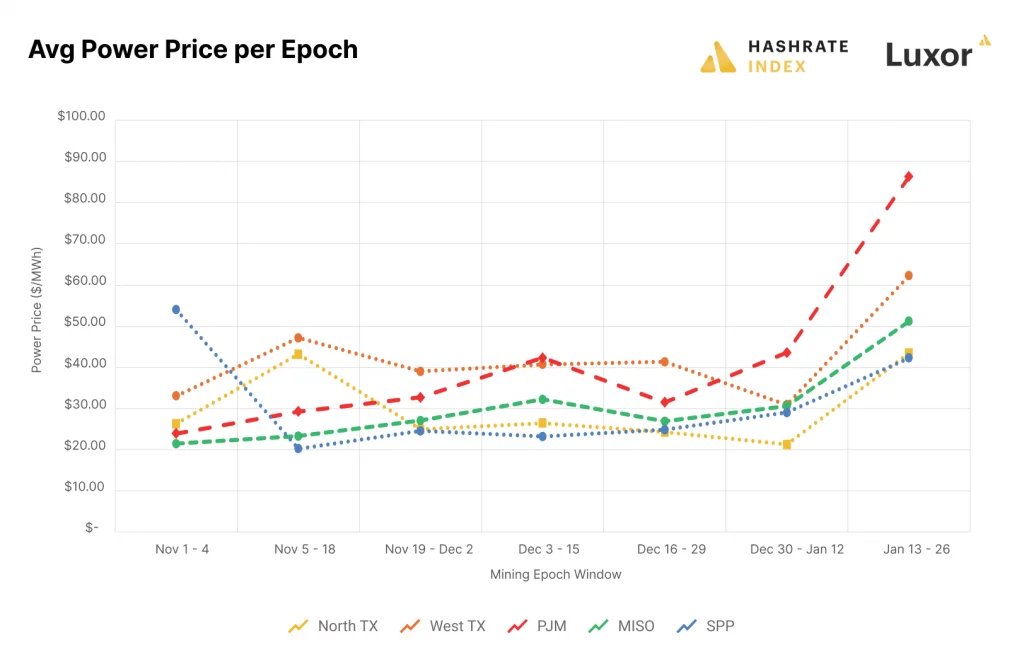

“High electricity prices have led to an increase in unprofitable mining hours, as cold weather has driven up power costs and reduced uptime (especially in the East, Southeast, and Texas),” noted Luxor analysts.

The company estimates that the US currently accounts for 36% of the global Bitcoin hashrate, with Texas contributing about 17%.

“When mining becomes less profitable in regions with significant network hashrate, the likelihood of a negative difficulty adjustment increases. This occurred on January 26, when weather-induced economic contraction led to the first negative adjustment in four months,” experts explained.

Luxor considers the decrease in mining difficulty and revenues to be a temporary phenomenon. They believe the figures will return to growth once the weather changes in the United States.

Meanwhile, Julio Moreno, head of research at CryptoQuant, noted that the Bitcoin mempool is practically empty, and fees are at 1 sat/vB. Transaction activity on the network has fallen to levels last seen in March 2024.

The Bitcoin mempool is practically empty and fees are at 1 sat/vB.

Transaction activity on the network is at the lowest since March 2024. pic.twitter.com/0wTwkBICYv— Julio Moreno (@jjcmoreno) February 1, 2025

Earlier, Fidelity analysts suggested that the trend of declining transactional revenues for miners could become long-term, but it does not pose a threat to blockchain security.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!