Bitcoin Surges to $100,000 Following Delay in US Tariffs on Mexican and Canadian Imports

In the early hours of February 4, the price of the leading cryptocurrency rebounded to $100,000. The catalyst was reports of a 30-day suspension by Washington of the introduction of 25% tariffs on goods from Mexico and Canada following negotiations between the countries’ leaders and the US president.

Claudia Sheinbaum and Justin Trudeau agreed to pursue policies aimed at stopping the flow of illegal drugs and immigration into the neighboring country.

On the morning of February 4, market sentiment was dampened by news of the implementation of 10% tariffs on all imports from China to the US.

In response, Chinese authorities will impose 15% tariffs on US coal and LNG starting February 10, as well as 10% on crude oil and agricultural products.

Additionally, Beijing has launched an antitrust investigation against Google and established control over the export of rare earth metals.

According to Reuters, unlike the leaders of Mexico and Canada, Donald Trump does not intend to speak with Chinese President Xi Jinping until the end of the week.

The US president warned of a possible further increase in tariffs on Chinese goods if Beijing does not take measures to stop the flow of fentanyl—a highly dangerous opioid.

Initial Market Reaction

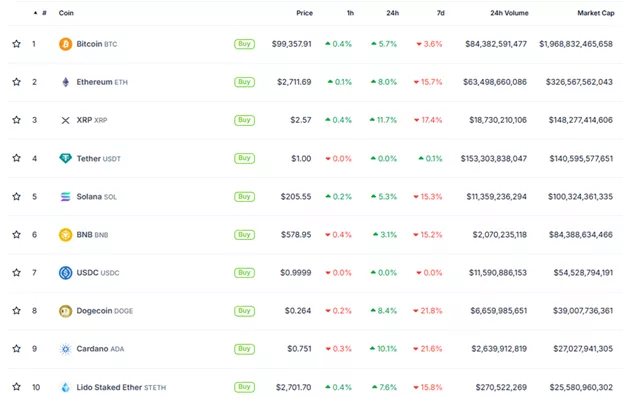

At the time of writing, the price of the leading cryptocurrency had fallen below $100,000, standing at $99,200.

Daily growth rates of Bitcoin weakened to 5.3%. Ethereum rose by 7.8% over the same period, reaching $2707.

Among the top 10 by market capitalization, Cardano (+10%) and XRP (+11.6%) led in recovery activity.

The cryptocurrency fear and greed index rose to 72 points, indicating a zone of greed.

Impact of Trade Wars on Prices

According to Goldman Sachs, there is a risk of a 5% drop in the US stock market in the coming months due to declining corporate profits as a result of trade wars.

Strategists at Morgan Stanley and RBC Capital Markets expressed similar bearish skepticism. The latter suggested a potential 5-10% pullback in stock prices.

Solana Titan founder Chris Chang told Cointelegraph about the attractiveness of digital assets for US investors amid potential inflationary pressures due to increased import tariffs.

Head of research at Derive.xyz, Sean Dawson, noted the potential for a crypto market recovery despite ongoing trade tensions. He cited Trump’s signing of an executive order to create a sovereign wealth fund as a reason.

On February 3, US Treasury Secretary Scott Bessent stated that he expects the initiative to be implemented within the next 12 months. Although digital gold was not mentioned when signing the order, coins owned by the authorities may be directed into the fund, according to CoinDesk.

On February 2, Bitcoin fell below $100,000 following Trump’s imposition of import tariffs on goods from China, Canada, and Mexico.

The next day, the negative sentiment intensified—the crypto market faced the largest liquidation in history.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!