Ethereum’s Price Trajectory: From $1,700 to $6,000

Should the second-largest cryptocurrency by market capitalization maintain a position above $2,500, its price could potentially “rebound to $4,000 or even $6,000,” according to expert Ali Martinez.

If #Ethereum $ETH holds above $2,500, it could rebound toward $4,000 or even $6,000. However, if $2,500 fails as support, the next target shifts to $1,700! pic.twitter.com/2uHOzheEVd

— Ali (@ali_charts) February 5, 2025

Conversely, if the $2,500 level fails, the next target becomes $1,700, the technical analyst asserts.

In his view, it is not crucial whether the asset is inflationary or deflationary. The key question is whether the aforementioned level will hold, where 12.18 million wallets acquired approximately 63 million ETH.

It doesn’t matter whether Ethereum is inflationary, deflationary, or whatever. What truly matters is whether it holds this support level. https://t.co/mxnNWgtHJ5

— Ali (@ali_charts) February 5, 2025

According to Martinez’s observations, capital continues to flow from Bitcoin and Ethereum into stablecoins.

Capital continues to flow out of #Bitcoin and #Ethereum into stablecoins. No signs of altseason yet! pic.twitter.com/k7cDphNn7i

— Ali (@ali_charts) February 6, 2025

“No signs of altseason yet!” the specialist emphasized.

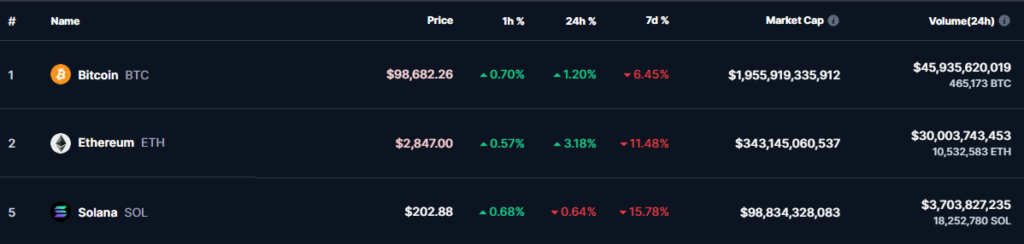

At the time of writing, the weighted average price of Ether stands at $2,844. Over the past 24 hours, the asset has risen by 3.13%, but has fallen by 11.6% over the past seven days.

In September 2022, Ethereum’s supply volume increased to levels observed during the transition of the second-largest cryptocurrency by market capitalization to PoS.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!