Experts Predict Bitcoin’s Return to $95,000 Amid ‘Bear Exhaustion’

Signs of seller exhaustion after Bitcoin touched the 200 DMA suggest a potential rebound. This conclusion was reached by CoinDesk.

Experts referred to the daily candlesticks on February 28 and March 4, which featured two long lower wicks and small bodies, formed at a key support level. This pattern indicates a potential shift in momentum from bears to bulls.

The recovery could extend to resistance at $95,000, and if surpassed, the next target could be $100,000.

A more successful attempt to break below the 200 DMA would trigger a new wave of selling, experts noted.

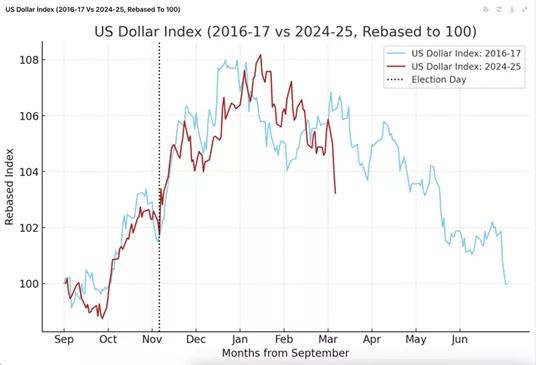

Separately, analysts highlighted a sharp weakening of the US dollar index, which creates conditions for renewed bullish confidence.

“DXY above 100 usually pressures risk assets, but as it fell below 105, Bitcoin rose above $88,000, similar to 2017 when the index dropped below 90 and the first cryptocurrency surged to $20,000,” the review states.

Experts pointed to the upcoming US Labor Department employment report on Friday. Maintaining the unemployment rate at 4% could lower Treasury yields and increase the chances of a Federal Reserve rate cut at the March meeting, they noted.

According to the CME FedWatch Tool, traders expect the Federal Reserve to ease monetary policy in May with a probability of 43.1%.

Back in March, former BitMEX CEO Arthur Hayes predicted Bitcoin’s rise to $1 million following the Federal Reserve’s shift to monetary easing in response to a US economic recession.

Earlier, CryptoQuant CEO Ki Young Ju suggested a prolonged consolidation of the asset within a broad range (e.g., $75,000-100,000), as observed in early 2024 before prices returned to an upward trajectory.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!