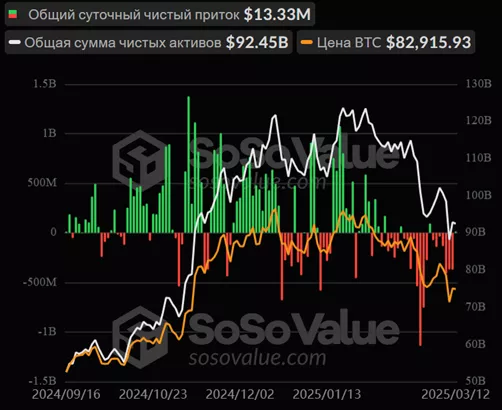

Bitcoin ETF Outflows Halt After Eight Days

On March 12, inflows into spot ETFs based on digital gold amounted to $13.33 million. Over the previous seven days, investors had withdrawn $1.54 billion from these products.

The cumulative inflow increased to $35.4 billion. AUM reached $92.45 billion.

Since its launch in January 2024, the exchange has recorded only 21 days of net outflows.

On March 12, ARKB from ARK Invest & 21Shares contributed the most to the positive trend with $82.6 million.

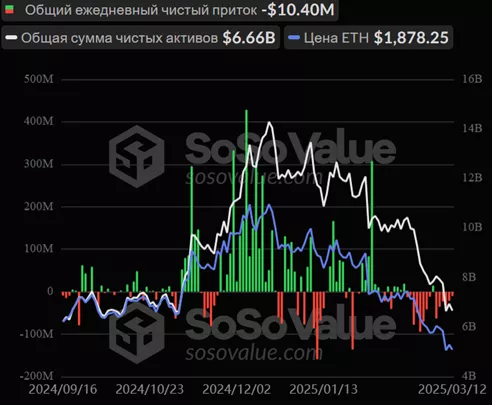

ETH-ETF

The negative streak of inflows into spot Ethereum-ETFs extended to six days. On March 12, clients withdrew $10.4 million from these products, bringing the total for the period to $181.4 million.

The cumulative inflow decreased to $2.63 billion. AUM fell to $6.76 billion.

New SEC Application

On March 12, the CBOE on behalf of Invesco Galaxy proposed to the SEC to allow authorized participants to use a physical creation and redemption model for the company’s Bitcoin and Ethereum-based products. The regulator has taken the application under review.

In January 2025, the exchange submitted a similar proposal on behalf of ARK Invest and 21Shares regarding their Bitcoin and Ethereum ETFs.

On March 11, the Commission extended the review period for several applications to launch spot ETFs based on XRP, Solana, Litecoin, and Dogecoin.

Earlier, Standard Chartered forecasted continued outflows from BTC-ETFs. According to Bitwise, up to $50 billion is expected to flow into these structures in 2025.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!