Crypto Funds Reverse Outflows with $664 Million Influx

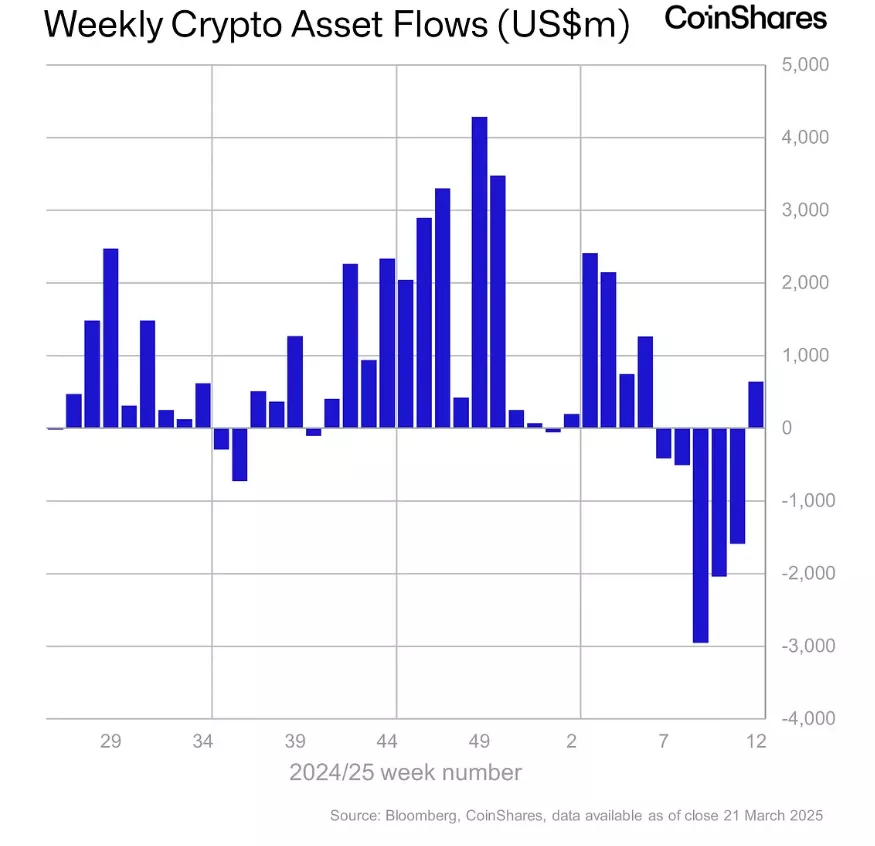

Between March 15 and 21, net inflows into cryptocurrency investment funds reached $644 million, breaking a five-week streak of outflows that totaled $5.4 billion, according to CoinShares.

The volume of assets under management has increased by 6.3% since the low on March 10.

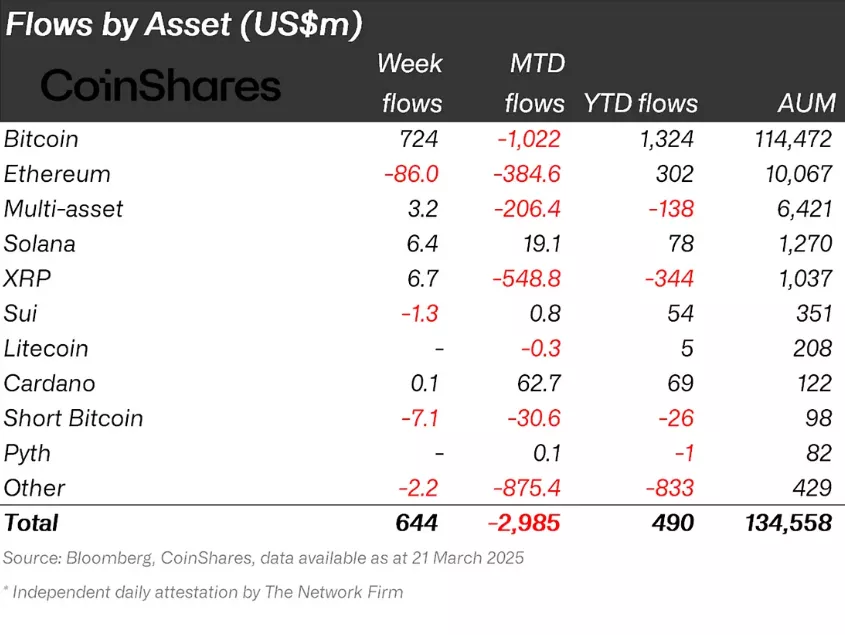

The majority of inflows were directed towards Bitcoin instruments, totaling $724 million. Structures allowing short positions on the digital gold saw outflows of $7.1 million.

Ethereum funds experienced the largest losses, with $86 million withdrawn. Other altcoin-based instruments also saw outflows, including Sui (-$1.3 million), Polkadot (-$1.3 million), TRON (-$0.95 million), and Algorand (-$0.82 million).

Funds based on Solana added $6.4 million, while Polygon and Chainlink attracted $0.4 million and $0.2 million, respectively.

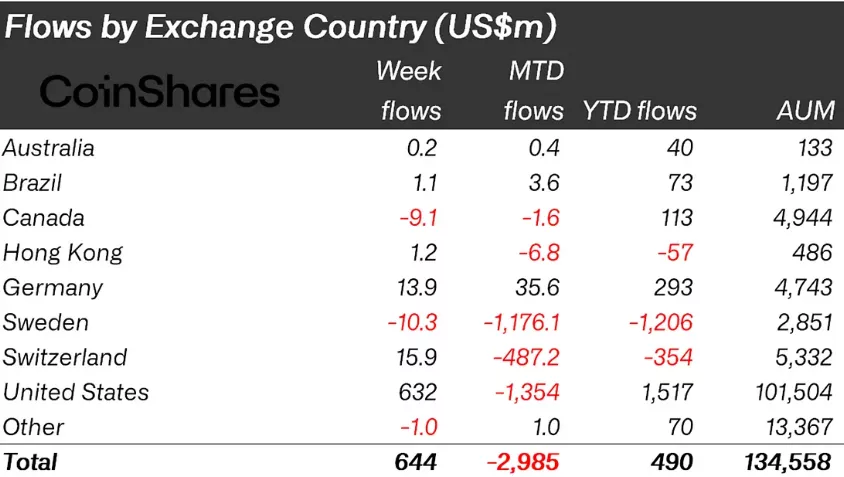

Geographically, the majority of inflows were concentrated in the United States ($632 million). Positive results were also recorded by investors in Switzerland ($15.9 million), Germany ($13.9 million), and Hong Kong ($1.2 million).

Experts noted that inflows were recorded daily throughout the week following 17 days of outflows. This indicates a shift in sentiment towards digital assets, according to CoinShares.

Back in February 24, the price of Bitcoin surpassed $87,000 amid easing concerns over potential U.S. import tariffs.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!