The Trump factor: 1,057 BTC move after years of dormancy

- Some bitcoin holders were spooked by Trump’s “liberation” tariffs.

- Ethereum’s on-chain picture remains negative.

- XRP faces the threat of a head-and-shoulders reversal.

CryptoQuant spotted 1,057 BTC, dormant for 7–10 years, suddenly on the move.

1,057 Bitcoin that hadn’t moved in 7–10 years just woke up.

Long-term holders may be preparing to sell. https://t.co/A6I7Mo3ljX

— CryptoQuant.com (@cryptoquant_com) April 3, 2025

The trigger may have been equity-market panic after Trump’s “liberation” tariffs.

Corporate buying didn’t help

CryptoQuant estimated large-company bitcoin purchases in January–March 2025 at 91,781 BTC.

The increase was driven by:

- Tether — 8,888 BTC;

- Strategy — 81,785 BTC;

- Metaplanet — 2,285 BTC;

- Semler Scientific — 1,108 BTC;

- The Blockchain Company — 605 BTC.

Analysts listed potential buyers of the leading cryptocurrency in the second quarter:

- Marathon Digital: share sale worth $2bn;

- GameStop: issuance of convertible bonds for $1.5bn.

Even so, this activity did not halt bitcoin’s 12% slide.

They attributed the drop to long-term holders “unloading” 178,000 BTC and ETF investors selling about $4.8bn.

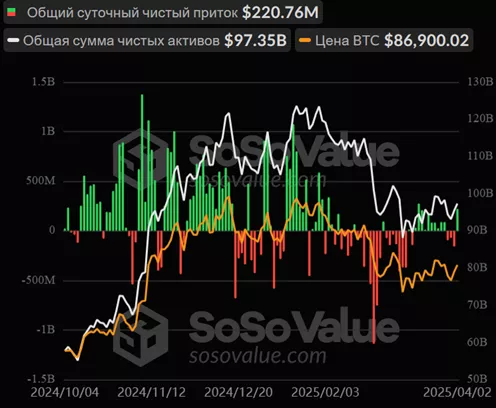

Money is still coming in

On April 2, inflows into exchange-traded products reached $220.8m — the highest in three weeks.

Cumulative net inflows rose to $36.24bn. AUM stood at $97.35bn.

On April 2 the biggest contributions came from ARKB by ARK Invest & 21Shares ($130.2m) and FBTC by Fidelity Investments ($118.8m).

Ethereum’s twilight?

Separately, CryptoQuant addressed the dynamics of the second-largest cryptocurrency. Analysts linked ETH/BTC falling to its lowest since 2020 to an unfavourable on-chain picture.

The number of active addresses has been steadily declining since the start of the year, while average fees have hit record lows.

As on-chain activity stagnates, the burn rate has fallen to its lowest level since The Merge, further intensifying inflationary pressure after the Dencun upgrade.

Risks of an XRP price “halving”

The XRP chart shows the risk of a head-and-shoulders reversal, warned technical analyst Peter Brandt.

Don’t shoot the messenger.

Your favorite Beanie Baby/Pet Rock crypto displays a classic complex H&S top. This could become bullish if 3.0 is exceeded, otherwise the implications is a decline to 1.07. If you have an issue with this, take it up with Magee and Edwards $XRP pic.twitter.com/nHaIgn8uP4— Peter Brandt (@PeterLBrandt) March 28, 2025

The price has approached the neckline in the $1.9–2.0 range. A break below could send it to $1.07.

To avert that scenario, bulls need to push the price back above $3.

BitMEX co-founder Arthur Hayes argued that if bitcoin holds $76,500 through US tax day on April 15, the market will shed uncertainty and volatility caused by US trade tariffs.

Earlier in March, CryptoQuant founder and CEO Ki Young Ju said the bull market had ended for digital gold. He expects prices to decline or move sideways over the next six to 12 months.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!