Opinion: Crypto Market Pauses Amid US-China Geopolitical Tensions

- Bitcoin is expected to consolidate within the $80,000-90,000 range.

- The US Treasury will inject an additional $100 billion into the financial system by the end of April.

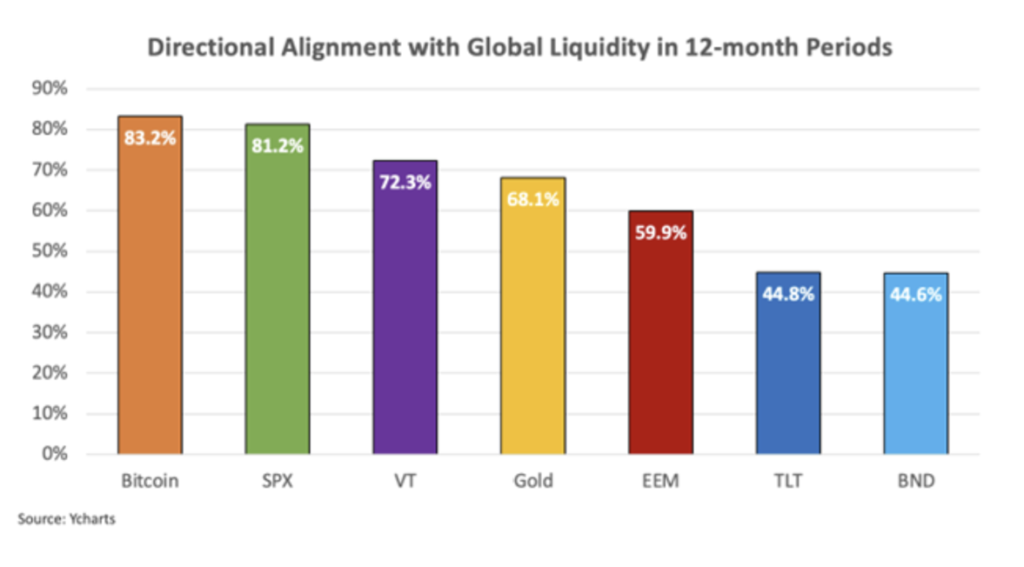

- The correlation between bitcoin’s price and global liquidity changes stands at 83%.

In bitcoin options expiring by June, puts dominate as market participants hedge against potential “surprises” from the US-China trade war, according to a report by QCP Capital.

Asia Colour — 14 Apr 25

1/ Markets are going all-in — even as US-China trade tensions hit fever pitch. With the US imposing a staggering 145% tariff on Chinese imports and China retaliating at 125%, risk assets have surprisingly stabilised. At these levels, tariffs have become…

— QCP (@QCPgroup) April 14, 2025

Over the longer term, the perception of digital gold is becoming more constructive, experts noted.

They believe that in the near future, the price of the leading cryptocurrency will continue to consolidate within the $80,000-90,000 range.

Who Will Blink First: The US or China?

“Washington seeks leverage, while Beijing desires a breather. However, neither state can afford to show weakness. Meanwhile, the US is negotiating not only with China but also with bond markets and itself,” the review states.

Analyst and MN Trading founder Michaël van de Poppe highlighted the increase in money supply according to aggregate M2.

A great chart, which shows the M2 Supply is rallying back upwards.

If the correlation remains, then I assume that we’ll see #Bitcoin rally to an ATH in this quarter.

This would also imply a rise in CNH/USD, a fall in Yields, a fall in Gold, a fall in DXY, and a rise in #… pic.twitter.com/wLCabG6kdN

— Michaël van de Poppe (@CryptoMichNL) April 15, 2025

“If the correlation remains, then bitcoin will rise to a new record this quarter. This would also imply a rise in CNH/USD, a fall in yields [of US government bonds], a decrease in gold prices, […] and a rise in altcoins,” the expert predicted.

The Role of the US Treasury

Macro analyst known as TomasOnMarkets pointed out the use of $500 billion in US Treasury balances at the Fed since February 12.

? Fed liquidity is rising

Net Federal Reserve Liquidity has increased by around $500bn since February.

It’s not really having any positive impact on risk asset prices with everything else going on.

But it is happening.

Here’s what is occurring and what to expect next…… https://t.co/VZJgGnDySS pic.twitter.com/IIsDJBuABq

— Tomas (@TomasOnMarkets) April 13, 2025

As a result, the net volume of liquidity in the financial system soared to $6.3 trillion, which, in his view, creates a favorable backdrop for the price increase of the leading cryptocurrency.

According to the specialist’s calculations, by the end of April, the figure will reach $600 billion. If debt ceiling negotiations extend to August, net liquidity could rise to a multi-year high of $6.6 trillion. This would provide a “tailwind” for digital gold, TomasOnMarkets added.

According to research by financial analyst Lyn Alden, bitcoin historically moved in line with global liquidity 83% of the time.

Technical analyst Peter Brandt holds a bearish view. He urged not to draw far-reaching conclusions after the asset’s price broke through the descending trendline.

Lots of amateur chartists are noting this trendline.

Of all chart construction, trendlines are the LEAST significant. A trendline violation does NOT signify a transition of trend $BTC

Sorry pic.twitter.com/GpSBFMW5Aq— Peter Brandt (@PeterLBrandt) April 15, 2025

“A violation […] does not signify a change in trend. Sorry,” he wrote.

Earlier, Compass Point analyst Ed Engel and experts from Bravos Research reached similar conclusions about the prospects for the leading cryptocurrency’s price growth amid changes in the M2 money aggregate.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!