Institutional Investors Increase Bitcoin Holdings Above $100,000

On May 8, Bitcoin surpassed the $100,000 mark. The primary driver of this growth is the activity of institutional investors, who are increasing their investments through ETFs. According to Farside Investors, on May 7, the net inflow into spot funds amounted to $142.3 million.

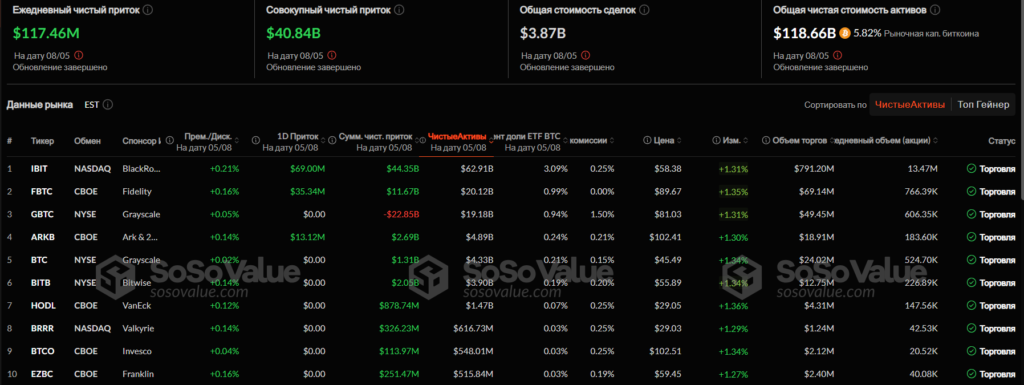

The leader was the ARK 21Shares Bitcoin ETF (ARKB) with $54 million, followed by Fidelity ($39 million) and BlackRock ($37 million). The latter, according to Arkham Intelligence, purchased 86 BTC for $8.4 million in a single transaction.

Analyst Alex Obchakevich from Obchakevich Research noted the sustained interest of major players:

“The inflow of funds indicates the actions of hedge funds and asset managers who continue to accumulate Bitcoin through regulated instruments.”

On May 8, ETFs received an additional $117 million, including $69 million into the BlackRock fund (IBIT).

Obchakevich linked the rise in Bitcoin to a strengthening correlation with Nasdaq (0.75). According to him, the positive dynamics of the index on May 8-9 supported the cryptocurrency.

The only fund with outflows was the Grayscale Bitcoin Trust (GBTC). The analyst attributed this to high fees (1.5%) and macro factors:

“Investors are moving to cheaper alternatives due to the instability of GBTC.”

The expert believes that the trend of purchases will continue unless there are sharp geopolitical or economic shocks.

Earlier, on May 5, investors directed $425.5 million into spot ETFs based on digital gold.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!