Analysts spot Bitcoin whales shifting from accumulation to selling

Holders of wallets with balances of at least 10,000 BTC have shifted from buying to distributing coins, while investors with smaller positions continue to accumulate digital gold, according to CoinDesk.

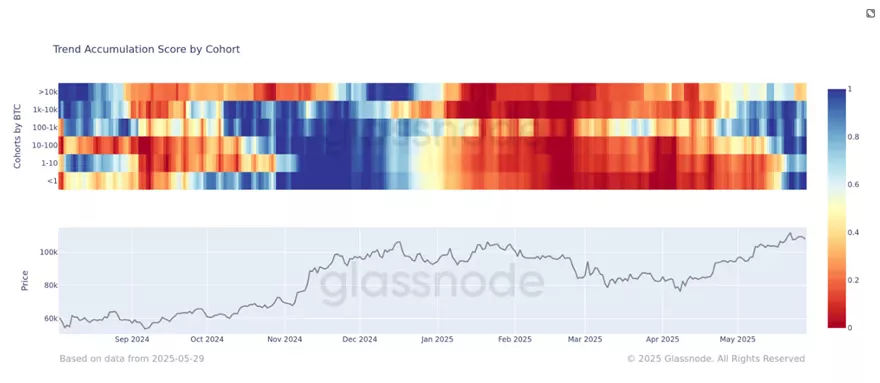

These conclusions stem from changes in the Accumulation Trend Score, which tracks the intensity of accumulation across address cohorts.

For the largest holders, the reading has fallen to 0.4. The metric ranges from 0 (selling dominance) to 1 (buying dominance).

Whales began adding to positions in April, when bitcoin’s price dipped to $75,000. The current shift reflects a desire to lock in gains near the ATH and to protect against a potential halt in the rally.

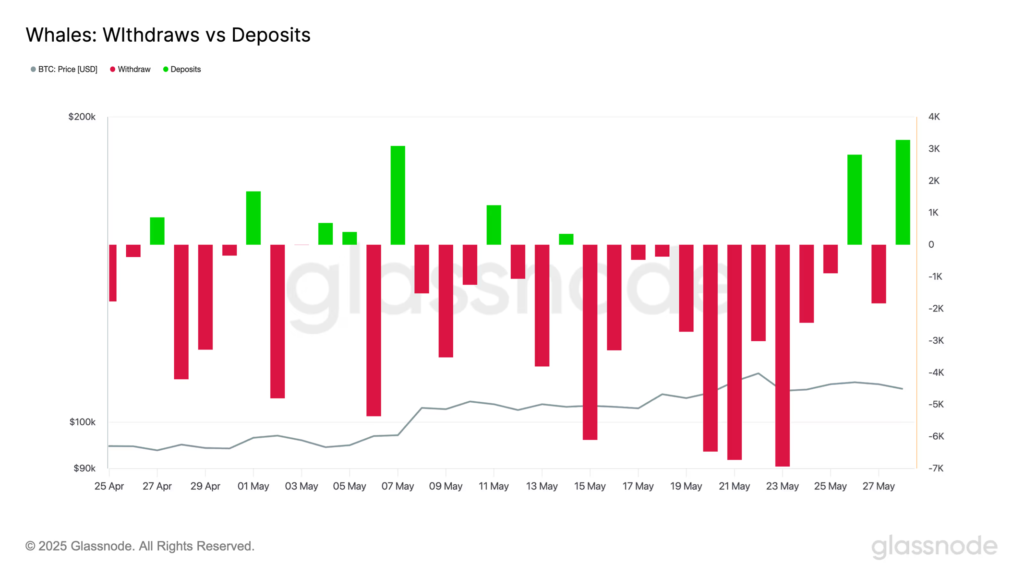

On-chain analysis is complemented by flow data showing how large players move coins between exchanges and self-custody. In two of the past three days, whales have resumed depositing bitcoin to accounts on CEX, a pattern typically associated with impending sales.

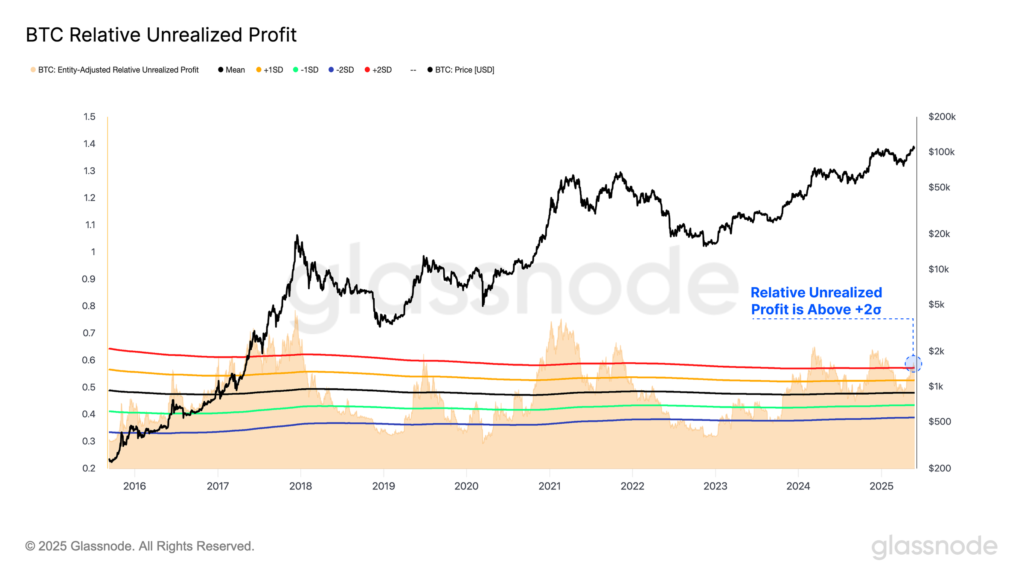

Analysts estimate that the run-up toward the ATH pushed unrealized profits above two standard deviations. Historically, that has signalled the market’s entry into a euphoria phase.

Subsequently, investors have tended to face brief volatility spikes and a reversion of the metric toward equilibrium — only on 16% of all trading days do “paper” profits exceed that threshold.

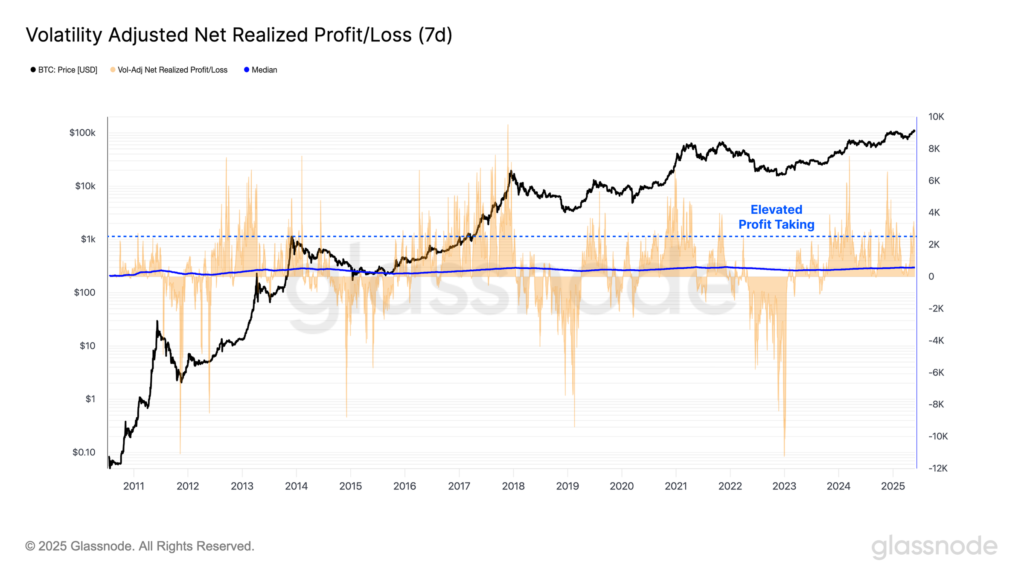

At present, selling intensity has yet to reach extremes. By the specialists’ count, net realized profit (7 DMA) is below the readings seen in 14.4% of all trading days.

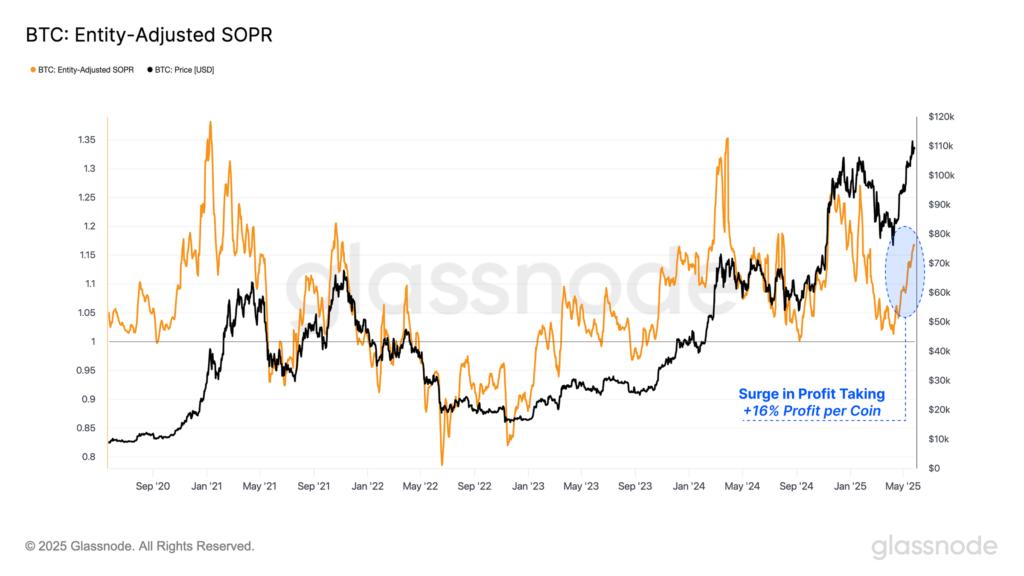

The SOPR indicator likewise points to room before extremes. The average realized profit has reached 16%. Only on 8% of trading days in history has the metric climbed higher.

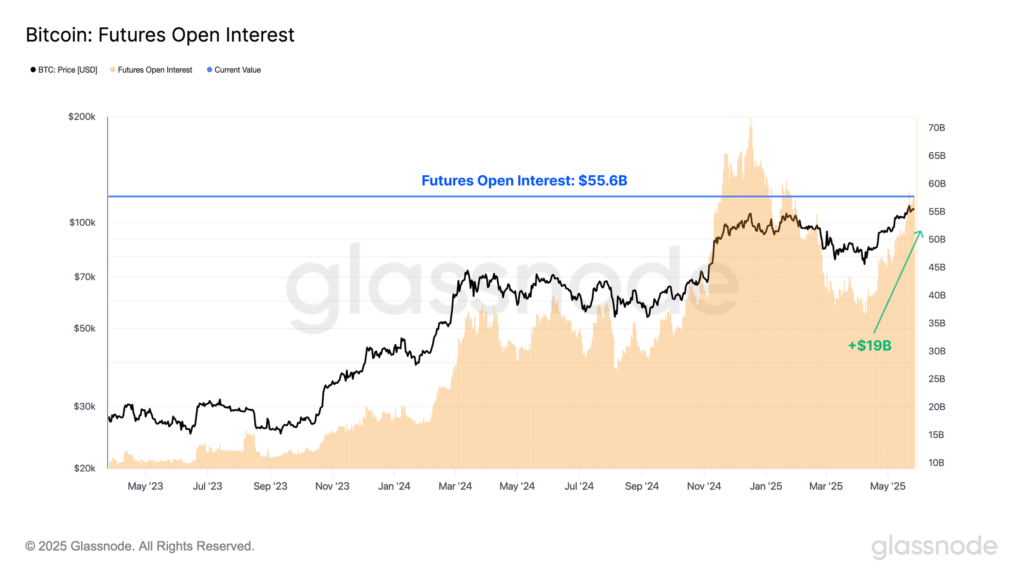

The derivatives market shows rising leverage among investors. Since April, open interest in bitcoin futures has increased by 51%, reaching $55.6 billion from $36.8 billion. Options are up 126% — from $20.4 billion to $46.2 billion.

These figures reflect a broader base of participants using derivatives, which can indicate both greater confidence in the market’s prospects and heightened risks tied to higher leverage.

Finally, the experts identified potential resistance and support. In a correction, the rate could fall to the $91,800-95,900 area, where the 111 DMA, the 200 DMA and the estimated cost basis of short-term investors cluster. Another such level is $100,200 (0.5 standard deviation from MVRV).

A “ceiling” for prices may emerge near $119,400 (one standard deviation from the above-mentioned indicator).

“The market has reached a certain heat. But it still has room to run before investors’ unrealized profit exceeds the extreme level (one standard deviation from MVRV)”, the review says.

On 30 May, the Deribit platform will see the expiry of bitcoin options with a notional value of $10.1 billion. Based on current metrics, the first cryptocurrency could face a sharp move in prices.

In contracts settling in June-July, activity is concentrated in calls with strikes at $115,000 and $120,000.

Earlier, CoinDesk presented six charts of various indicators confirming a solid foundation for bitcoin to break above $100,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!