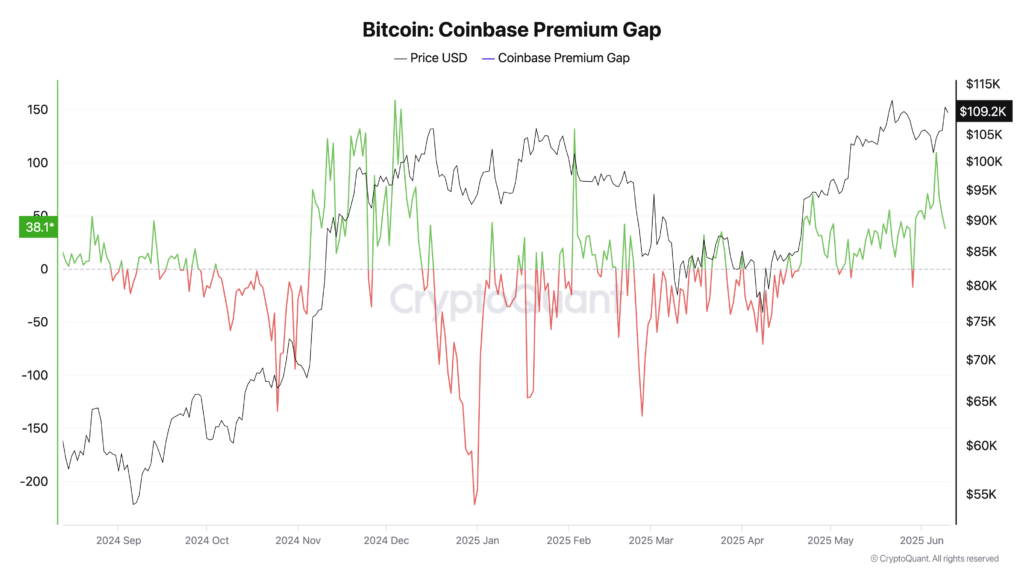

Coinbase Premium Hits Four-Month High Amid Bitcoin Surge

As Bitcoin rallies to $110,000, the Coinbase premium has reached levels last seen in February.

This indicates “pressure from American buyers, which supports the trend,” noted CryptoQuant analyst known as Crypto Dan.

“Positive movement without signs of overheating is a typical pattern of a growth phase following a correction. It suggests optimistic market movements in the second half of 2025,” the expert explained.

The Coinbase premium represents the difference between the elevated cryptocurrency rates on the largest American digital asset exchange and quotes on other trading platforms.

The rise in this indicator may indirectly point to increasing demand from institutional and other large investors.

Synergy Effect

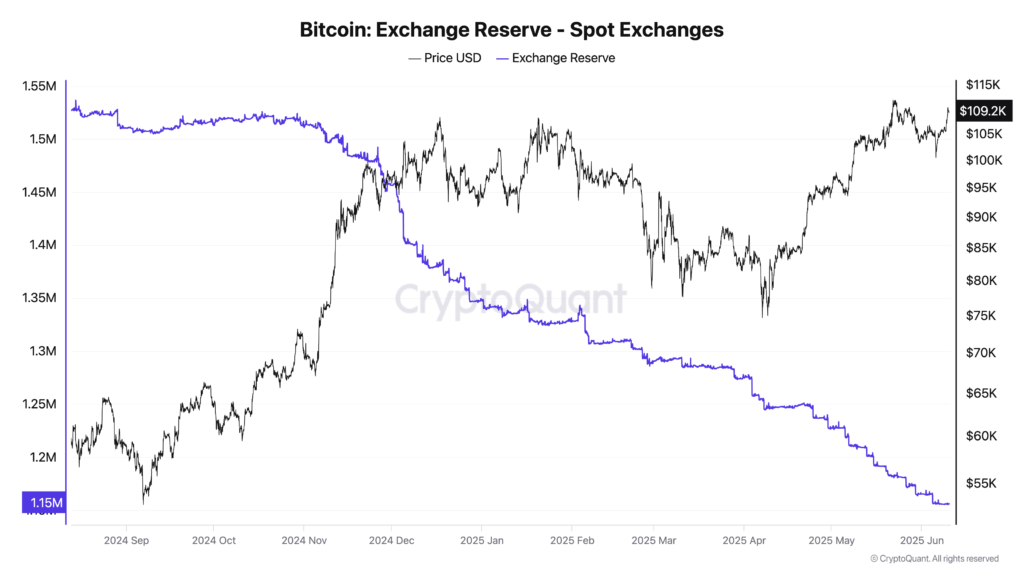

Another CryptoQuant analyst, BaykusCharts, highlighted decreasing Bitcoin reserves on CEX as an additional bullish factor.

“As Bitcoin moves towards $110,000, what are investors doing? The answer is simple: they are withdrawing BTC from exchanges. Slowly but surely, with firm determination,” the expert noted.

The decline in Bitcoin reserves on CEX may indicate a reduction in potential future selling pressure.

According to BaykusCharts, since July 2024, the supply of digital gold on exchanges has decreased by ~35% — from 1.55 million BTC to 1.01 million BTC.

This trend also reflects a growing interest in non-custodial or cold storage of crypto assets, allowing market participants to maintain full control over their funds without relying on centralized platforms.

“People are not selling — they are holding. They are not engaging in day trading, but are hodling for the long term,” BaykusCharts explained.

Not Yet Extreme

Experts at Glassnode noted massive liquidations of short positions amid Bitcoin’s 3.5% rise over the past day.

#Bitcoin price rose nearly 3.5% in the past 24 hours, reaching a high of $110.3K. Derivatives suggest potential overheating (rising short liquidations, increasing long-side premium, and growing open interest). However, funding rate uptick is only modest ??

— glassnode (@glassnode) June 10, 2025

However, according to their observations, funding rates in the derivatives market showed a rather modest increase. Values range from 0.0003% to 0.023%.

Thus, while speculative activity has increased, “extreme conditions have not yet arrived.”

As reported, Bitfinex analysts predicted a new Bitcoin peak in July — at $125,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!