Centralised institutions now hold 30% of bitcoin’s supply

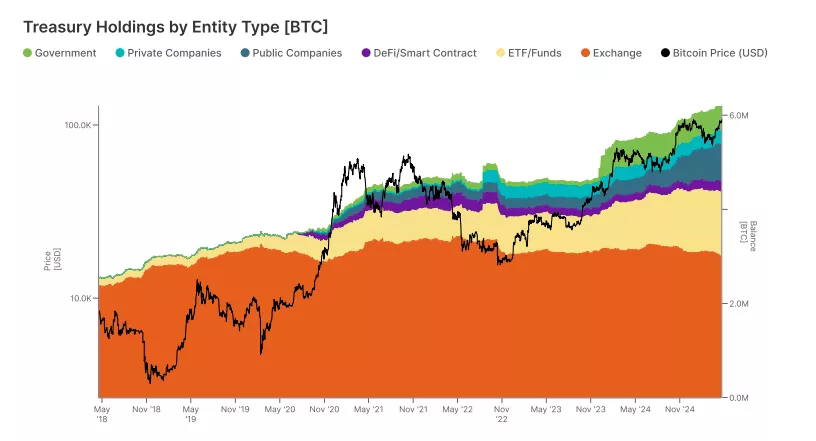

With 30.9% of the available supply of the first cryptocurrency parked in centralised treasuries, the market has undergone a structural shift towards institutional maturity, according to a report by Gemini and Glassnode.

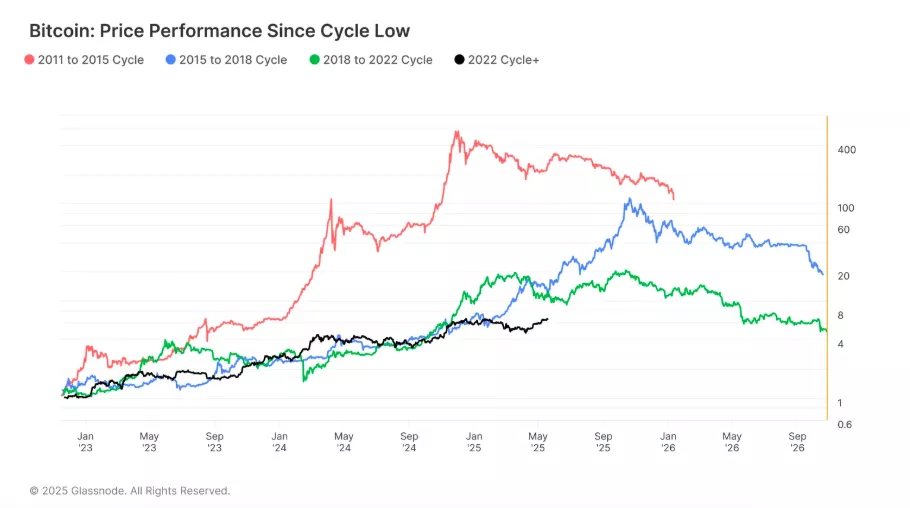

“As adoption has broadened, particularly among sovereign and regulated financial organisations, annualised realised volatility across all time frames — from weekly to yearly — has steadily declined since 2018,” the document says.

On these metrics, the analysts foresee “more resilient and orderly rallies” in digital assets, rather than the abrupt spikes seen previously.

Who holds the reserves

According to the report, 30% of bitcoin’s issuance (~6.14m BTC worth $661bn at the time of writing) sits with 216 entities. They include:

- centralised exchanges;

- ETFs and crypto funds;

- public companies;

- private companies;

- DeFi and smart contracts;

- governments.

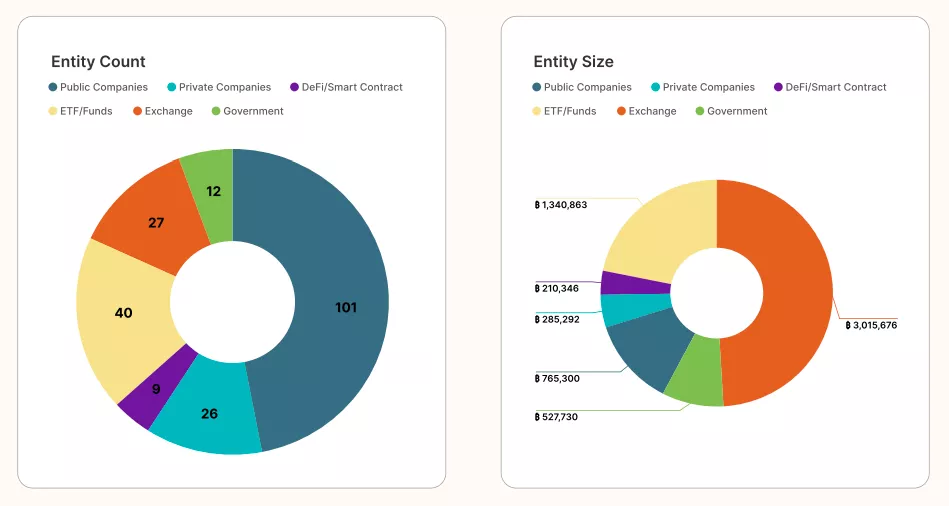

Researchers say the largest stash — 3.015m BTC — is held by 27 centralised exchanges.

By headcount, the biggest group is public companies (101), but by holdings they rank third with 765,300 BTC.

ETFs based on digital gold rank second on both counts. Together, 40 exchange-traded funds hold 1.34m BTC.

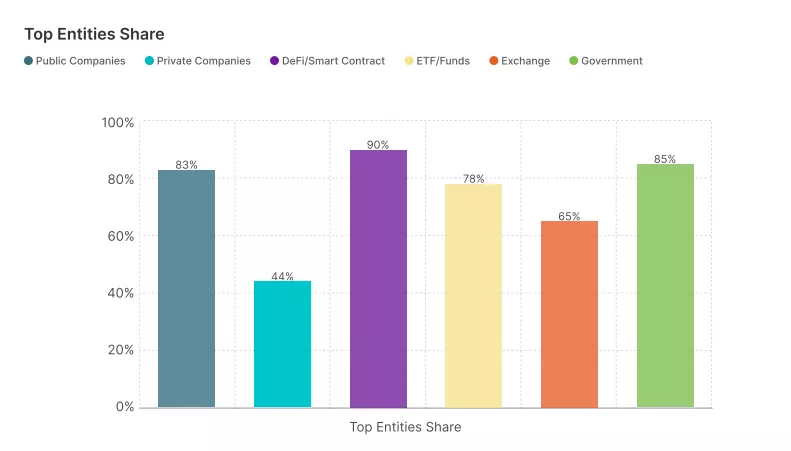

“In almost all institutional categories, with the exception of private companies, the three largest entities control between 65% and 90% of total assets, underscoring the dominance of early adopters in bitcoin treasury management. This trend is especially pronounced in DeFi, public companies and funds, where first movers have shaped the adoption trajectory,” the researchers noted.

Governments lag

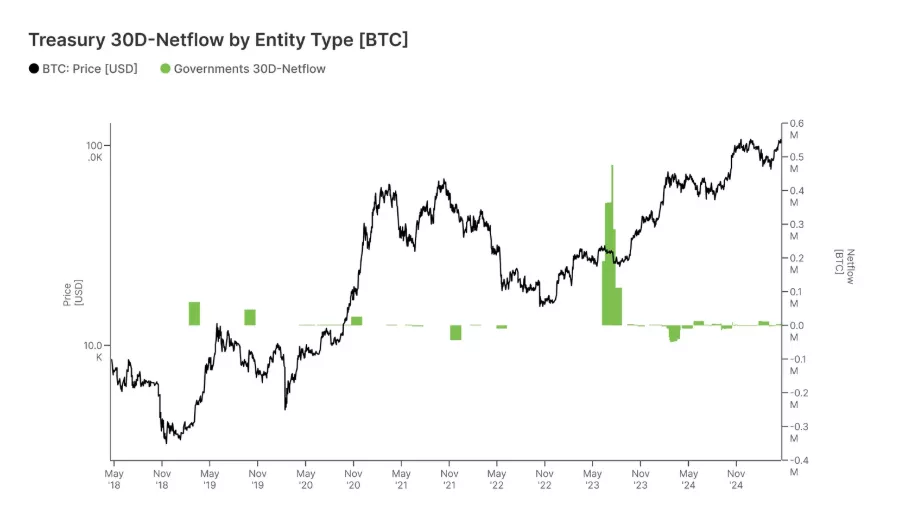

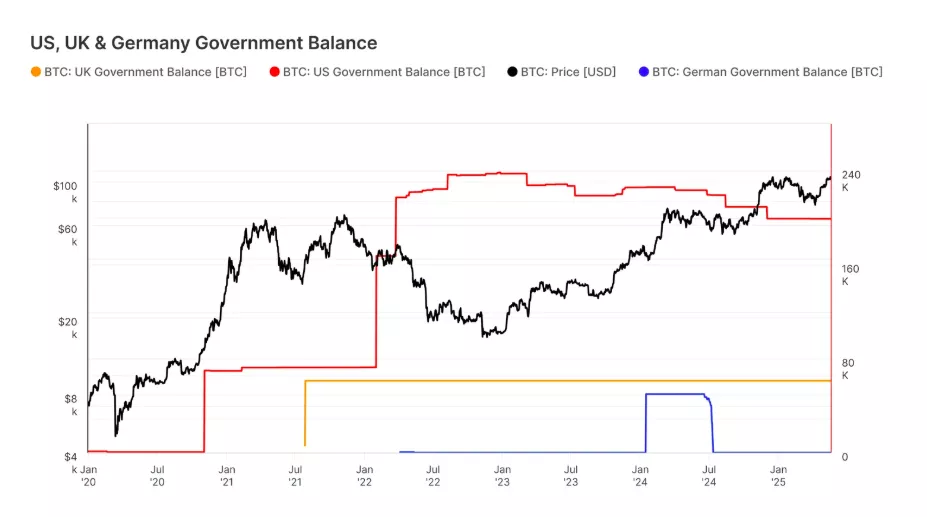

Unlike active market participants, state treasuries seldom rebalance.

Their wallets show infrequent movement and weak correlation with bitcoin’s cycles, yet hold enough to sway markets when coins are sold or shifted, the experts noted.

“This trend is especially evident in the government treasuries of the United States, China, Germany and the United Kingdom, where most coins are acquired through law-enforcement actions rather than market participation,” the analysts said.

The United States remains the largest state holder with a balance of ~200,000 BTC. Two seizures account for most of it:

- 69,369 BTC from the Silk Road case, seized in November 2020;

- 94,643 BTC seized in relation to the Bitfinex case in February 2022.

These coins have now been designated the basis of the US strategic bitcoin reserve under an executive order by President Donald Trump.

The researchers also observe that the United Kingdom has been accumulating bitcoin via the National Crime Agency.

Germany actively seized coins in domestic investigations, but officially liquidated all its holdings of the first cryptocurrency in April 2025.

“[Government] reserves constitute a structurally distinct class — dormant, yet capable of influencing markets when activated,” the report’s authors stressed.

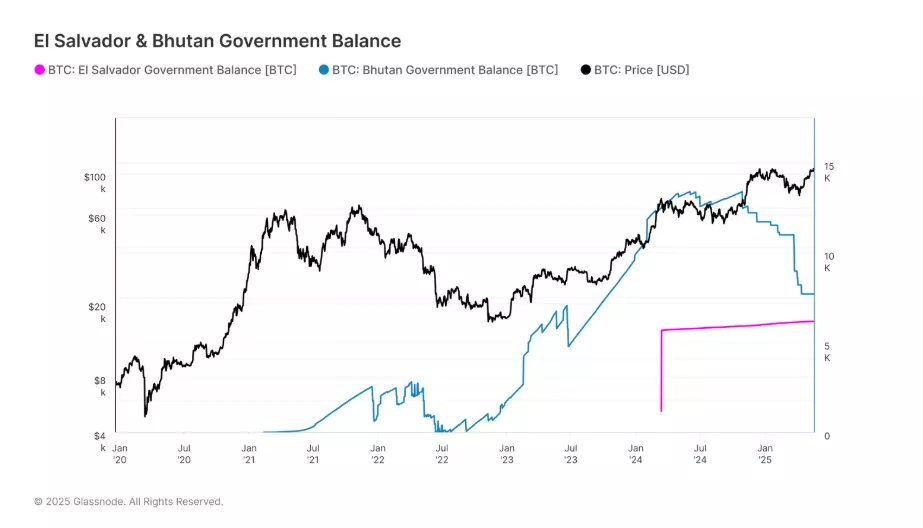

The study notes ongoing purchases by the authorities of El Salvador and the Kingdom of Bhutan. The analysts believe their actions provide “legitimacy for bitcoin as a sovereign-level asset, encouraging broader institutional participation and market stability”.

Structural evolution

Bitcoin remains a risk asset, but its integration into traditional finance via ETFs and other instruments has made price action more “reliable and less driven by speculative extremes”, according to Gemini.

“Structural evolution has not eliminated upside potential, but it has altered its profile. Instead of explosive spikes, recent cycles have produced more resilient and orderly rallies. This consistency reinforces institutional confidence and positions bitcoin as a long-term macro asset suitable for strategic allocation alongside traditional stores of value,” the researchers explained.

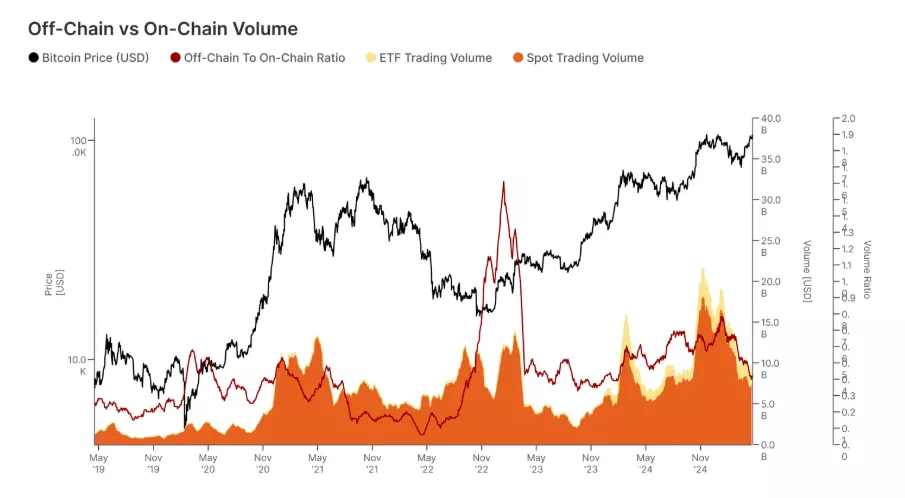

Institutional adoption is also evident in the shift in trading volumes: most now resides on centralised exchanges, ETFs and derivatives venues. As big players have entered the crypto market, activity has migrated from on-chain settlement to off-chain infrastructure, the analysts concluded.

Earlier, Bernstein predicted corporate bitcoin reserves would reach $330bn by 2029.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!