Darknet Marketplace Huione Expands Operations Despite ‘Closure’ Announcement

The illicit online platform Huione continues to operate and expand its transaction volumes, despite a recent announcement of its closure. This is according to a report by Chainalysis.

On May 13, the fraudulent marketplace Haowang Guarantee, associated with Huione, announced its closure. The decision was attributed to the mass blocking of accounts and channels on Telegram.

However, Chainalysis data indicates that the platform’s activity has not decreased. It continues to process transactions worth billions of dollars, demonstrating resilience against public infrastructure blockades.

Ineffective Sanctions

On May 1, the FinCEN proposed disconnecting Huione Group from the American financial system. The agency accused the company of assisting the North Korean hacker group Lazarus Group in laundering cryptocurrencies.

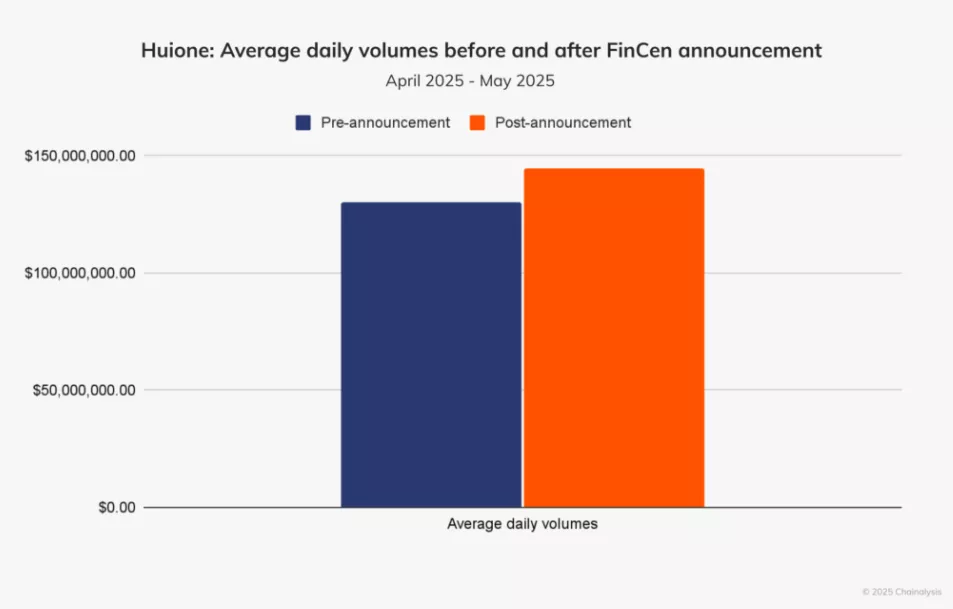

According to Chainalysis, such measures typically result in immediate loss of access to the U.S. financial system, as banks avoid regulatory risks. However, transaction data shows this had minimal impact on Huione’s operations.

Experts noted that transaction volumes not only did not decrease but even increased. According to their data, Huione avoids centralized exchanges under U.S. jurisdiction.

Scale of Operations

These conclusions are also confirmed by analysts at TRM Labs. In a report dated May 30, they indicated that since 2021, Huione Group has received at least $81 billion in cryptocurrencies. This significantly surpasses the volumes of the Russian darknet market Hydra, which stands at about $5 billion, the specialists emphasized.

Experts noted that Huione is a central hub for a wide range of cybercriminal activities, including fraud, hacks, and “romance bait” schemes.

Chainalysis also reported that the Huione cryptocurrency exchange resumed operations under a new domain, Huione.me, retaining the old logo. The project’s social media accounts, including Telegram channels for VIP sellers, remain active.

The platform also trades its associated token XOC and promotes the stablecoin USDH to circumvent sanctions.

How Money Laundering Services Operate

The platform offers several types of “money movement” services:

- transfers to cards — often with restrictions for different types of users, which may indicate client verification to protect against law enforcement;

- fiat-to-stablecoin exchange — often in person or through unregistered intermediaries;

- multi-level laundering — complex schemes with multiple sources of funds and conversion paths;

- physical exchange — highlights the real logistics of online operations.

A New Approach Needed

According to Chainalysis experts, the situation with Huione reflects a broader problem in combating sophisticated criminal organizations. New strategies are required for effective counteraction against such structures.

Efforts must extend beyond national borders, analysts believe. International partnerships between financial intelligence units, law enforcement, and regulators are necessary to track transaction flows and intermediaries.

Blockchain analysis also plays a crucial role. Effective counteraction against ecosystems like Huione requires not only stricter regulation but also coordinated international efforts, specialists noted.

Back in January, Elliptic analysts named the online marketplace the largest illegal trading platform. Following the publication of the study, the platform attempted to distance itself from Huione Group by changing its name to Haowang.

In April, the UN expressed concern about money laundering through mining. According to the organization, the platform plays a key role in this shadow segment.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!