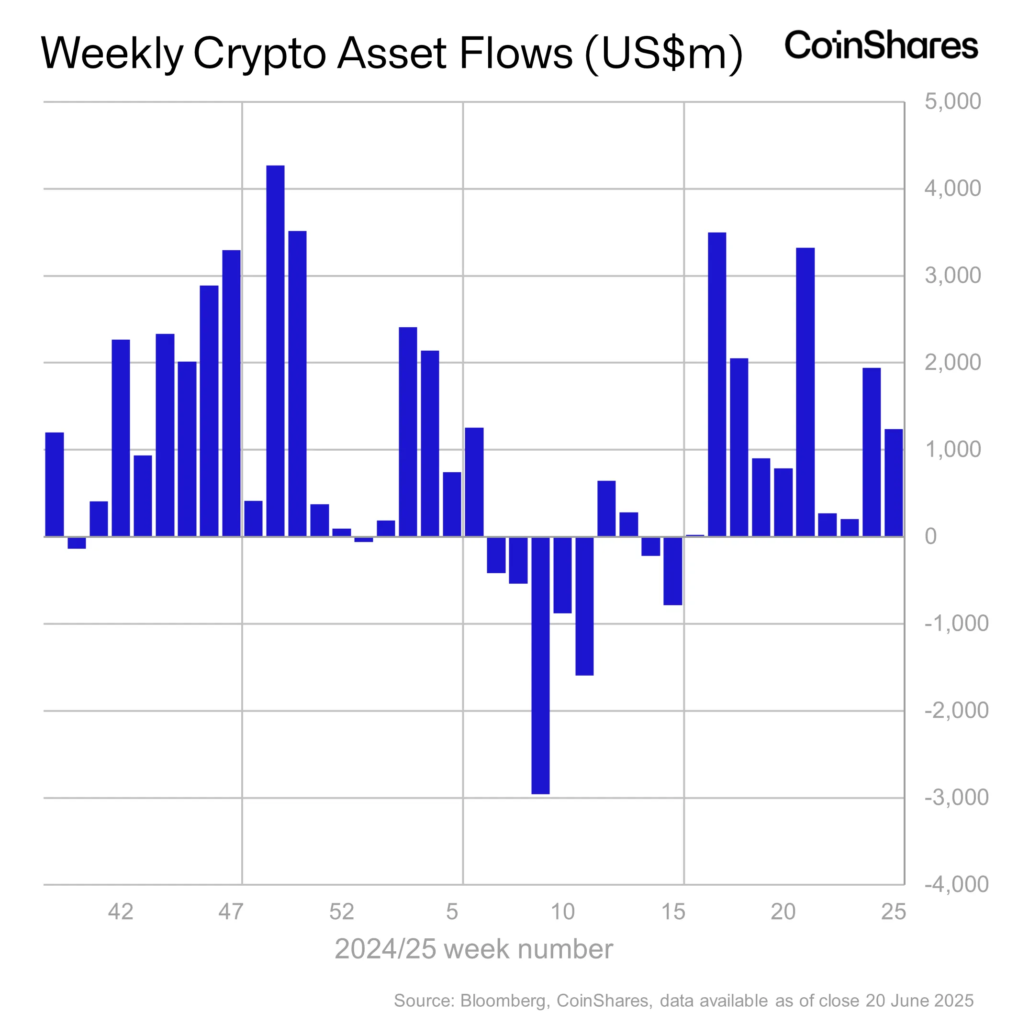

Crypto Funds See Tenth Consecutive Week of Inflows, Surpassing $15 Billion Year-to-Date

Despite rising geopolitical tensions, capital continued to flow into cryptocurrency investment products managed by firms such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares for the tenth consecutive week, according to a report by CoinShares.

Last week, the total inflow amounted to $1.24 billion, bringing the year-to-date figure to a record $15.1 billion.

“The sharp increase in activity at the start of the week subsided in the latter half—likely due to the Juneteenth holiday in the US and reports of the country’s involvement in a conflict with Iran,” wrote James Butterfill, head of research at the company.

Regionally, the US continues to lead with $1.25 billion. Inflows were recorded from Canada and Germany—$20.9 million and $10.9 million, respectively. Hong Kong and Switzerland showed negative dynamics—-$32.6 million and -$7.7 million, respectively.

“For the second consecutive week, bitcoin products saw an inflow of $1.1 billion. Despite the price correction, investors used the dip as a buying opportunity. This is also confirmed by small outflows from short products—only $1.4 million,” added Butterfill.

Ethereum has seen inflows for the ninth consecutive week—amounting to $124 million. The total investment volume has reached $2.2 billion over the period. This is the longest series of inflows since mid-2021 and a sign of sustained investor interest in the asset, noted the expert.

What About ETFs?

Spot bitcoin-based exchange-traded funds attracted $1.02 billion over the past week.

Net inflows into these instruments have continued for nine consecutive days. The total assets under management (AUM) of ETF provider companies reached $126.54 billion. The cumulative inflow since the beginning of the year is $46.6 billion.

Ethereum funds ended last week with an outflow of $11.34 million. The total AUM stands at $9.6 billion.

Preparing for a Recovery?

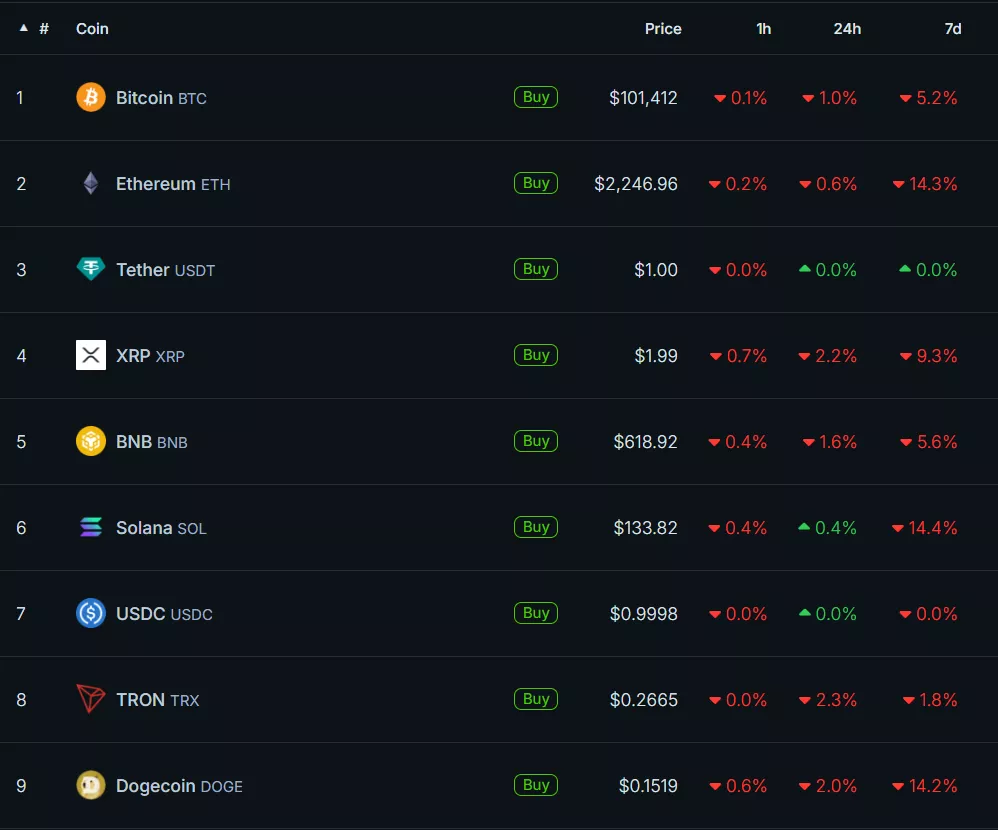

Over the past week, bitcoin fell by 5.2%, while Ethereum, Solana, and Dogecoin dropped by more than 14%.

The following chart shows that since the beginning of the year, Ether has significantly lagged behind digital gold in terms of price dynamics:

“Despite short-term volatility and cautious market sentiment, long-term structural demand is strengthening,” noted BRN’s lead analyst Valentin Fournier in a conversation with The Block.

In his view, Texas authorities and companies like Metaplanet “are cementing bitcoin’s status as a strategic reserve, laying the groundwork for recovery after the correction.”

Fournier also suggested that Solana may recover faster than most other assets. Meanwhile, Ethereum, despite a temporary decline in institutional investor interest, could regain its position as volatility decreases.

Back in June, senior Bloomberg exchange analyst Eric Balchunas predicted a “summer of altcoin ETFs.”

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!