Analyst warns bitcoin’s bull phase may soon end

The MVRV indicator does not yet point to a reversal in bitcoin’s price, but the current upswing is likely nearing its end, said CryptoQuant analyst Yonsei_dent.

“Despite geopolitical risks, bitcoin recovered confidently and returned to levels above $106,000. However, the momentum captured by the MVRV ratio has begun to weaken,” the specialist noted.

The indicator reflects the ratio of bitcoin’s market value to its realized capitalization. In particular, it helps assess how far the asset may be overvalued.

“Historically, the direction and reversals of the 365-day moving average of MVRV have coincided with market-cycle peaks. The slope is flattening now—this may indicate weakening momentum,” the expert explained.

Yonsei_dent suggested this could be a sign the current phase of the cycle is ending. Investors, therefore, “should focus on risk management and capital reallocation.”

In the expert’s view, bull markets have often ended with a sharp price spike—a kind of “final push” before the peak.

“Tactical opportunities may still exist, but on-chain metric signals should not be ignored over the long term,” the specialist concluded.

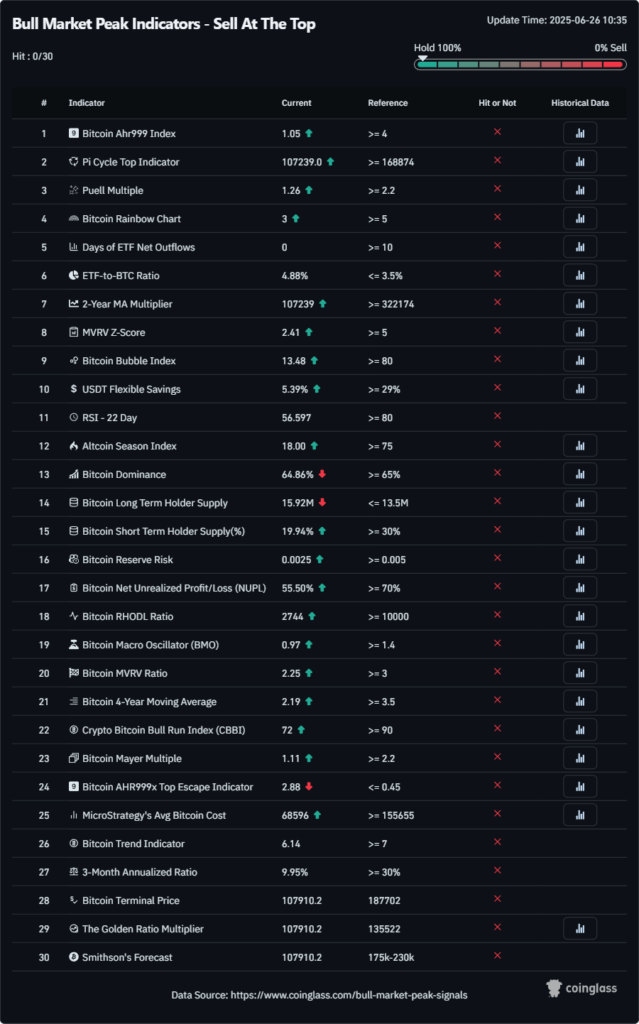

Notably, none of the indicators presented on CoinGlass currently signals a cyclical top or the advisability of selling cryptoassets.

The Binance factor

Yonsei_dent’s colleague Darkfost found that monthly inflows of cryptocurrency to the largest exchange, Binance, have fallen to 5,700 BTC.

“[This is] a historically low level—even below the last bear market. The metric is nearly three times lower than when the $100,000 mark was first reached,” the expert noted.

Following the FTX collapse in late 2022, monthly inflows of digital gold to Binance reached 24,000 BTC—“reflecting mass selling and panic.”

In current conditions, Darkfost interprets weaker inflows as rising interest in long-term storage of cryptoassets, which “may set the stage for a short-term rally.”

“However, the situation remains unstable, and uncertainty is high,” the expert stressed.

According to CoinGecko, Binance remains the most liquid exchange “at all levels of market depth”.

1/ Binance leads $BTC liquidity across all depth levels ?

• Median $BTC orderbook depth across 8 CEXes: $20–$25M per side.

• @binance holds 32% (~$8M), ahead of @bitgetglobal ($4.6M) & @okx ($3.7M).

• Only Binance has >$1M per side while other CEXes trailing with <$500K. pic.twitter.com/zRIBqnTVWw— CoinGecko (@coingecko) June 26, 2025

On-chain activity is falling, but HODLers remain steadfast

Overall, according to the CryptoQuant Network Activity Index, on-chain activity on the Bitcoin network is approaching a four-year low.

The aggregate gauge includes the following key metrics:

- number of active addresses;

- daily transaction volume;

- number of UTXO;

- demand for block space.

On the other hand, among long-term holders of the first cryptocurrency there is no broad urge to lock in profits.

Analyst Avocado_onchain believes the current relatively calm market may foreshadow “a new big move”.

At the time of writing, bitcoin is trading around $107,340. The asset’s gain since the start of the year is ~15%, according to CoinMarketCap.

CryptoQuant contributor Carmelo Aleman forecast a bitcoin price peak above $200,000 in 2025.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!