Bitcoin Hyper unveils an SVM‑based layer‑2 for Bitcoin

The Bitcoin Hyper team has published a white paper for a layer‑2 that promises fast transactions and smart contracts for Bitcoin via integration with the Solana Virtual Machine (SVM). On May 8, the project launched a presale of its native HYPER token.

The $HYPER Pre-Sale is now LIVE!

Get up to speed ?https://t.co/yzXqAckjDw pic.twitter.com/sij7UFBOcb

— Bitcoin Hyper (@BTC_Hyper2) May 8, 2025

A modular approach to scaling

Bitcoin’s protocol limitations have spawned L2s that take different approaches to scaling. Lightning Network is a web of payment channels between users, while the Stacks Network sidechain runs its own Proof‑of‑Transfer consensus, combining Proof‑of‑Stake and Proof‑of‑Burn.

The Bitcoin Hyper team has opted for a modular architecture, with different components handling specific tasks.

At the core of the L2 is a modified version of the Solana Virtual Machine. The choice of SVM over the more common Ethereum Virtual Machine is explained by several factors:

- optimisation. SVM was originally developed using eight performance‑oriented technologies. It can process transactions in parallel, significantly increasing network throughput;

- Rust. In the Solana ecosystem, smart contracts are called programs and are largely developed in Rust. The language provides compile‑time memory safety, reducing the risk of critical vulnerabilities.

The Bitcoin Hyper team claims its SVM implementation achieves even lower latency than Solana’s own.

The bridge between Bitcoin mainnet and the L2 operates via a two‑way peg. To deposit to Bitcoin Hyper, a user sends coins to a special multisignature address.

After the required number of confirmations on Bitcoin, an equivalent amount of wrapped tokens is automatically minted on the L2. They can be used to interact with smart contracts.

The withdrawal process is as follows:

- The user initiates the burn of wrapped tokens and submits a withdrawal request specifying the recipient address on Bitcoin.

- After a finality period (to protect against block reorganisations), the coins are unlocked and sent to the stated address.

According to the white paper, the team plans to launch the Bitcoin Hyper mainnet in the third quarter of 2025.

What the token is for

The native HYPER token serves several roles:

- fees. All L2 operations require payment in HYPER;

- staking. Holders will be able to delegate to validators to help secure the network;

- protocol governance. Once a DAO launches, tokens will be used to vote on proposals for the project’s development;

- expanded access. Decentralised applications may require a certain amount of HYPER to access premium features.

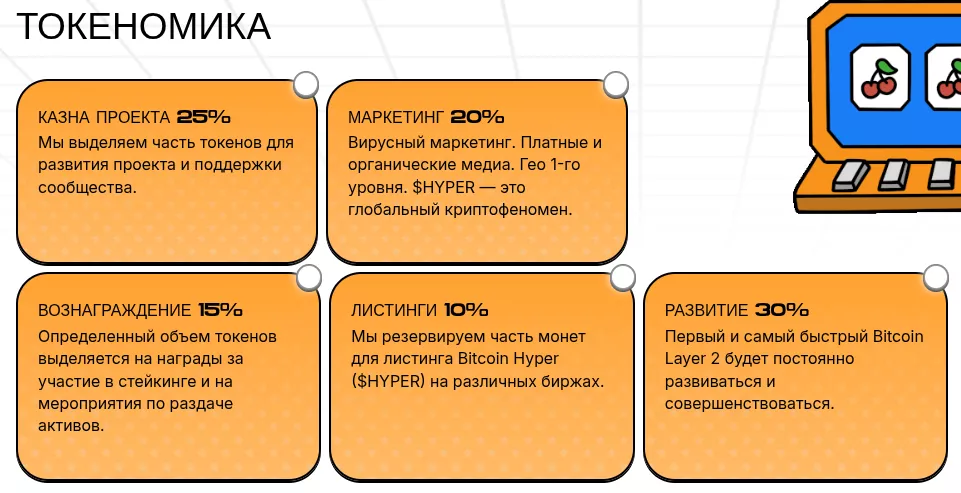

Total supply is 21 billion HYPER. Tokens are allocated as follows:

- 25% — project treasury;

- 20% — marketing;

- 15% — staking rewards and airdrops;

- 10% — exchange listings;

- 30% — development.

HYPER presale

The sale runs as a series of rounds with rising prices. Each stage lasts 72 hours or until its HYPER allocation is exhausted. According to the white paper, the starting price was $0.0115. At the time of writing HYPER is on sale at $0.012125.

Tokens can be purchased for Ethereum (ETH), USDT (ERC‑20, BEP‑20), BNB or fiat via the Web3Payments system. To receive HYPER, connect a wallet such as MetaMask or Best Wallet.

One advantage for early investors is the ability to stake acquired tokens at high annual yields (410% at the time of writing). Tokens staked during the presale will be locked for seven days after TGE.

“Rewards are issued at a rate of 199.77 HYPER per block on the Ethereum network. Rewards will be paid out over two years; they can be claimed after the presale ends,” the project’s website says.

Prospective buyers should note that at the presale stage only technical documentation exists. The Bitcoin Hyper team plans to launch the L2 in the third quarter of 2025 and to pursue listings on a DEX and a CEX in the fourth.

It should also be understood that exchange listings do not guarantee sufficient liquidity to sell HYPER without materially moving the price. The success of L2s depends not only on technology but also on community activity and overall market conditions.

Earlier, ForkLog published a piece about the presale of the Best Wallet (BEST) token.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!