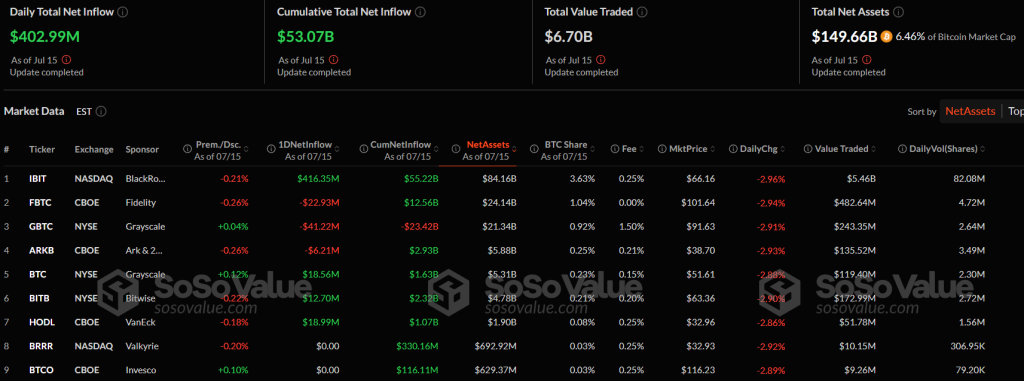

Bitcoin Spot ETFs Attract $403 Million in a Day, Cumulative Inflows Surpass $53 Billion

Net inflows into spot Bitcoin exchange-traded funds (ETFs) continued for the ninth consecutive day, with $402.99 million added in the past 24 hours.

Leading the net inflow was BlackRock’s IBIT with $416.35 million, followed by VanEck’s HODL with $19 million. Grayscale’s Mini Bitcoin Trust and Bitwise’s BITB also recorded capital inflows.

Conversely, three funds experienced outflows:

- Grayscale’s GBTC saw an outflow of $41.22 million;

- Fidelity’s FBTC had an outflow of $23 million;

- ARKB from Ark & 21Shares recorded an outflow of $6.21 million.

The cumulative net inflow into exchange-traded funds has exceeded $53 billion. The total assets under management (AUM) by Bitcoin ETF providers are nearing $150 billion. Over the past nine days of net inflows, AUM has increased by $4.4 billion.

“Since April, Bitcoin ETFs have consistently recorded inflows, reflecting growing interest from institutional investors and corporate treasuries,” noted Min Jong, an analyst at Presto Research.

According to him, sustained demand has reinforced Bitcoin’s special status in the digital asset segment, with increasing sentiment that “there is no second best.”

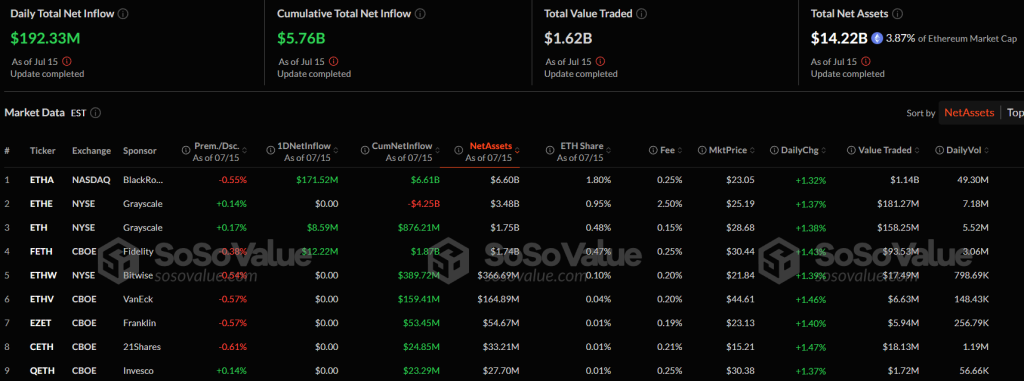

Ethereum ETFs

Spot exchange-traded funds based on Ethereum have recorded eight days of net inflows. In the past 24 hours alone, the AUM of these structures increased by $192.33 million.

The cumulative net inflow since the launch of Ethereum ETFs in July last year has reached $5.76 billion. The total AUM stands at $14.22 billion (3.87% of Ethereum’s market capitalization).

At the time of writing, the second-largest cryptocurrency by market capitalization is trading around $3,158, with a 5.8% increase in the last 24 hours, according to CoinGecko.

Meanwhile, corporations currently outpace ETFs in demand for digital gold.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!