Cryptocurrency Market Capitalisation Surpasses $4 Trillion for the First Time

Amid Bitcoin’s surge to new heights and a revival in the altcoin sector, the combined market value of digital assets has exceeded $4 trillion for the first time.

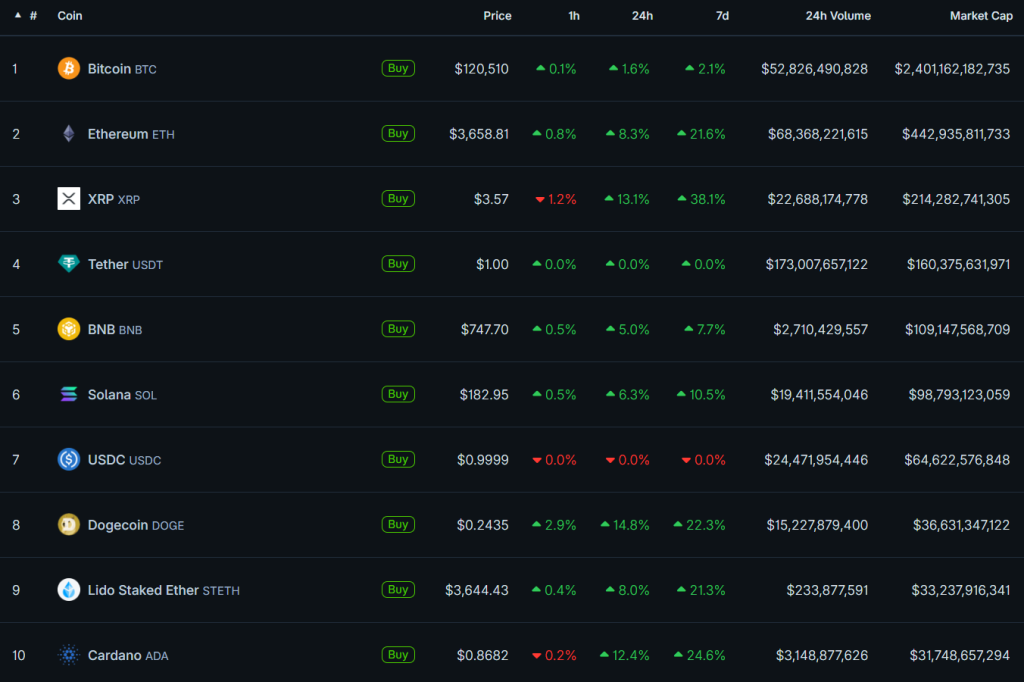

The current figure stands at $4.03 trillion, with a total trading volume over the past 24 hours reaching $277.4 billion, according to CoinGecko.

Bitcoin’s dominance index is at 59.5%, having slightly decreased recently, particularly amid Ethereum’s rise.

“Surpassing the $4 trillion mark is not just symbolic but a sign of a structural revaluation of cryptocurrencies in the global financial system,” stated Vincent Liu, Chief Investment Officer at Kronos Research.

He noted that the rise in the price of the first cryptocurrency, steady inflows into ETFs, and the gradual removal of regulatory uncertainty have contributed to the return of significant capital to the sector.

Over the past 24 hours, digital gold has risen by 1.6%, returning to price levels above $120,000. However, blue-chip altcoins have shown more convincing growth over 24 hours, ranging from 5% (BNB) to 14.8% (Dogecoin).

“Altcoins have shown confident growth — traders are shifting capital from Bitcoin to higher beta assets. This pattern is typical for the rally of the final phase of the cycle. However, this time it is supported by technological improvements and fundamental indicators,” said BTC Markets analyst Rachel Lucas.

She noted a higher level of ecosystem maturity in the current cycle. According to Lucas, growth is supported by the development of institutional infrastructure, regulated products, and the expansion of corporate participation.

“Bitcoin has started appearing on balance sheets, ETFs serve as a legitimate entry channel, and stablecoins are developing as a parallel payment system,” the expert explained.

In her view, the next “technical resistance level” is near the $4.5 trillion mark. However, there are risks of a decline in capitalisation if capital inflows into exchange-traded funds slow or the macroeconomic situation worsens.

Kronos’s Investment Director Liu noted that reaching the $4 trillion mark makes the digital asset market “more complex.” According to him, as liquidity grows and flows fragment between networks and platforms, “the role of infrastructure and execution quality increases.” Sustaining growth will require not only momentum but also “the resilience of systems with adaptive risk management mechanisms.”

Analysts at Glassnode warned of Bitcoin entering an “overheating zone.”

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!