‘Mysterious’ whale bought $1bn of ETH in a week

Over the past seven days an anonymous address acquired 221,166 ETH worth about $1bn, according to analysts at Lookonchain.

This mysterious institution accumulated another 49,533 $ETH($212M) today.

Over the past week, they have accumulated 221,166 $ETH($946.6M) from #FalconX, #GalaxyDigital, and #BitGo.https://t.co/k99BomKVq5 pic.twitter.com/u3j2LJ9M1H

— Lookonchain (@lookonchain) August 11, 2025

Over the past 24 hours, the unidentified institution bought $212m of ether via Galaxy Digital, FalconX and BitGo, the experts said. The funds were distributed across six wallets. The largest holds $181m; the smallest, $128m.

Lookonchain first flagged the “mysterious” whale on August 6. It began with a purchase of 101,131 ETH for $361m.

A whale/institution created 4 wallets and accumulated 101,131 $ETH($361M) from #FalconX, #GalaxyDigital, and #BitGo in the past 2 days.https://t.co/SwPaOz5m2lhttps://t.co/JJHddaGoCZhttps://t.co/srILlPbVfnhttps://t.co/9vPk825Php pic.twitter.com/tphf1eDpoh

— Lookonchain (@lookonchain) August 6, 2025

Members of the crypto community suggested the buyer is another company adding the second-largest cryptocurrency to its reserves. According to user 0xstealy, the transactions could involve Sharplink or Bitmain — the largest public holders of Ethereum.

Ethereum’s rise

Over the past day ETH has risen 1.6%, according to CoinGecko. At the time of writing the asset trades at $4,278.

On August 11 Ethereum’s market capitalization briefly topped $522bn, overtaking Mastercard. According to CompaniesMarketCap, the latter stands at $519bn.

Market participants are optimistic about the coin’s prospects. The CryptoQuant analyst known as CryptoOnchain said the price is currently testing a key resistance zone at $4,020–4,060 that has historically decided whether trends reverse or continue.

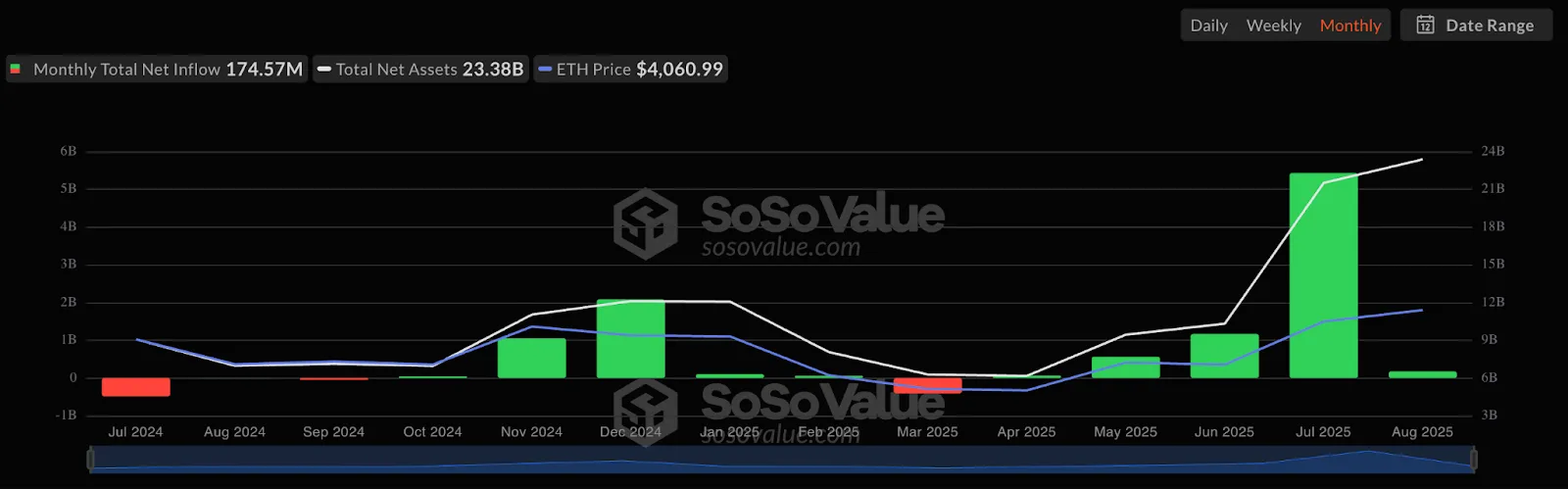

Medium-term factors such as institutional demand and network development remain supportive. In the previous session, ETH ETFs took in $726.6m. Total coins held by funds rose to 5m, valued at $20.3bn.

Ark Invest bought 30,755 ETH for $108.57m, while Fundamental Global allocated $200m to crypto purchases.

The analyst stressed that interest from big investors and ETF inflows “will limit deep declines and support the uptrend”. A break above $4,450–4,550 would open the way to new highs, he added.

Meanwhile, the popular trader known as Rekt Fencer said ETH’s rise to $15,000 is “programmed”.

ETH to $15,000 is programmed:

— Companies bought $10B ETH in 3 months

— The U.S. President bought $500M of ETH

— Billions in ETF inflows

— Pro-crypto laws passed

— ETH Staking ETF is comingLike if you agree, RT if you’re bullish pic.twitter.com/zMciZ9CKZH

— Rekt Fencer (@rektfencer) August 11, 2025

He cited the following factors that he believes are supporting the altcoin’s price:

- purchases of $10bn worth of ETH over three months by large companies;

- demand for Ethereum from World Liberty Financial (WLFI), backed by U.S. President Donald Trump;

- billions in ETF inflows;

- passage of laws aimed at regulating the crypto market;

- a potential launch of staking functionality in exchange-traded funds.

Fundstrat co-founder Tom Lee forecast ETH at $30,000. He argues the second-largest cryptocurrency is going through what bitcoin did in 2017, when its price rose 120-fold on the “digital gold” narrative. He highlighted the following drivers:

- adoption of stablecoins by U.S. regulators;

- the SEC’s stance on moving financial operations to blockchain;

- work by major institutions such as JPMorgan and Robinhood on Ethereum.

Earlier, Ethereum co-founder Vitalik Buterin supported the trend toward corporate ETH treasuries but warned of risks.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!