US Treasury Rules Out Budget-Funded Bitcoin Reserve

The US government has no plans to purchase additional bitcoin to form a strategic reserve (SBR). This was stated by US Treasury Secretary Scott Bessent in an interview with Fox Business.

According to him, the Trump administration’s strategy regarding cryptocurrencies is based on three principles:

- refraining from new bitcoin purchases at the government’s expense;

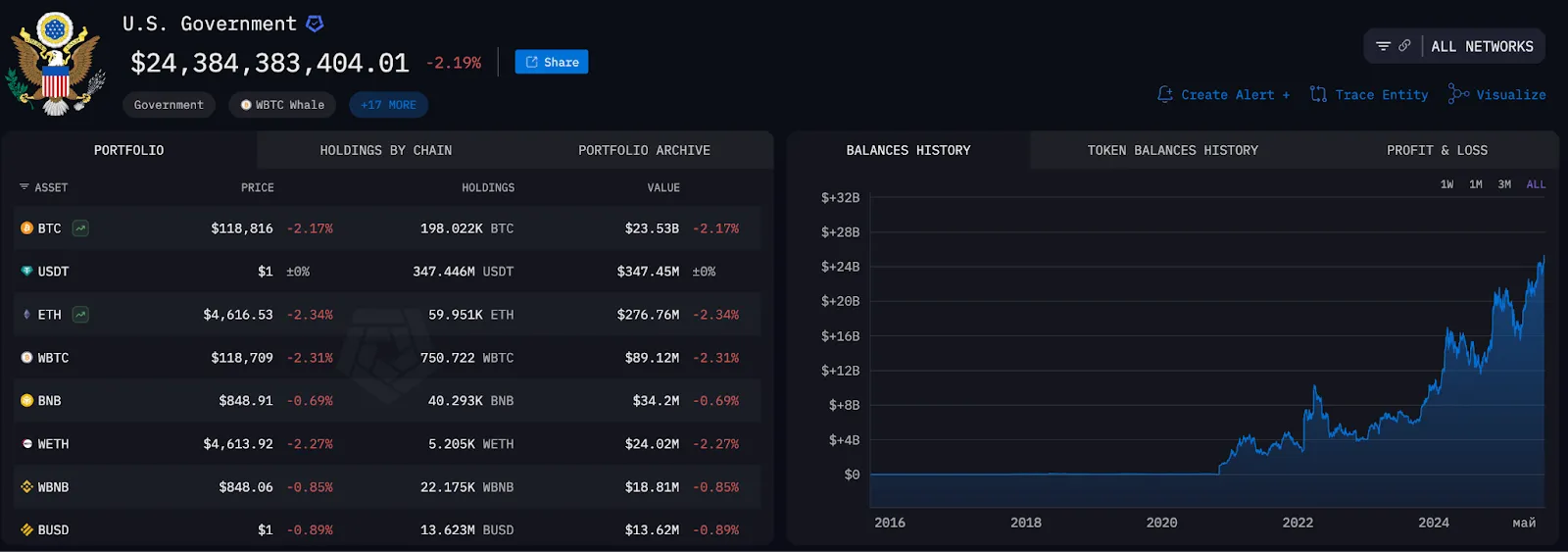

- retaining the already accumulated 198,022 BTC;

- replenishing the reserve exclusively through funds seized in criminal and civil proceedings.

“We are not going to sell these assets. At current prices, our bitcoin reserve is valued at $15-20 billion,” Bessent stated.

He later clarified that the Treasury is exploring budget-neutral ways to acquire digital gold to expand the SBR.

Bitcoin that has been finally forfeited to the federal government will be the foundation of the Strategic Bitcoin Reserve that President Trump established in his March Executive Order.

In addition, Treasury is committed to exploring budget-neutral pathways to acquire more…

— Treasury Secretary Scott Bessent (@SecScottBessent) August 14, 2025

Trump signed the first cryptocurrency-related executive order a few days after his inauguration. This led to the creation of a working group on digital asset markets, headed by special advisor on AI and cryptocurrencies, David Sacks.

The group was tasked with developing a federal regulatory framework for the crypto market and assessing the feasibility of creating a strategic bitcoin reserve.

On March 6, the US president signed another order, which provided for the formation of a reserve from confiscated assets and the development of mechanisms to replenish it without taxpayer expense. Trump also directed the establishment of a separate fund for other digital assets.

The White House working group had 180 days to prepare a detailed report on industry regulation and the SBR. Recommendations were presented at the end of July. There were few additional details about the proposed reserve.

Market Reaction

Bessent’s statements coincided with the release of producer price index (PPI) data, which showed a 3.3% year-on-year increase. This was the highest level since February and triggered sell-offs in the crypto market.

In the past 24 hours, the price of bitcoin has decreased by 1.9%, according to CoinGecko. At the time of writing, the asset is trading at $119,210.

Ethereum fell by 2%, dropping to $4,640.

The total cryptocurrency market capitalization fell by 2.6% to $4.1 trillion.

On August 14, Timothy Misir, head of research at BRN, warned of impending volatility. According to him, the risks are associated with record leverage in altcoins.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!