Corporate Crypto Treasuries Divide the Community

The trend of establishing digital asset treasuries (DAT) has sparked debate among market participants, reports The Block.

The concept of corporate reserves in cryptocurrency emerged in 2020 when Michael Saylor decided to transform his company, Strategy, into the largest public holder of Bitcoin.

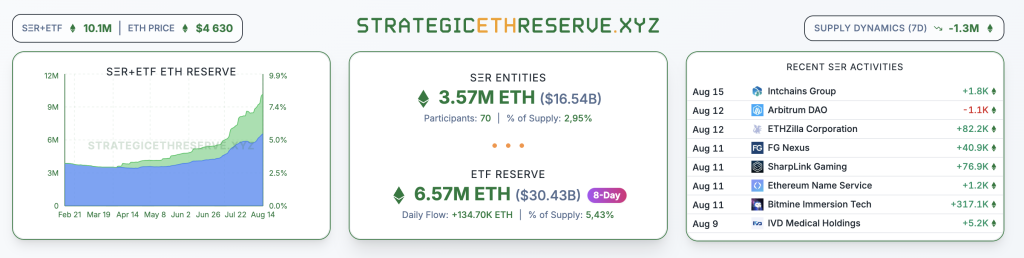

Following the rise of digital gold, its market value soared, attracting the attention of other firms. By 2024, the DAT wave had spread to other assets — Ethereum and Solana.

Proponents argue that such structures “enhance ecosystem visibility” and create long-term value.

“Companies managing crypto treasuries drive token prices up, attracting users, developers, and fostering the emergence of dapps. All this can significantly enhance the visibility of the coin’s ecosystem, especially among traditional investors and institutional players,” noted Upexi’s chief strategist Brian Rudick.

However, critics, including The Block’s director of research, Steven Zheng, point to the risks of conflicts of interest. According to him, many DATs are formed with insider involvement, who may purchase tokens at a discount before public announcements.

Controversial Deals

A company associated with Donald Trump’s family, World Liberty Financial, raised $1.5 billion to create a treasury for the WLFI token, which is not traded on exchanges.

Project co-founder Zak Witkoff stated that the coins were acquired through ALT5 at a 64% discount from the “assumed market price” ($0.2 versus $0.56). Eric Trump joined ALT5’s board, strengthening ties between the project and the administration.

A similar story occurred with TON Strategy (formerly Verb Technology), which announced raising $558 million to purchase Toncoin.

The deal involved companies Kingsway Capital, Ribbit Capital, and Vy Capital, who are also early investors in TON. Kingsway’s CEO, Manuel Stotz, also serves as the president of the TON Foundation and executive chairman of the newly created DAT — TON Strategy.

According to an investor presentation filed with the SEC, TON Strategy will be able to buy Toncoin at a 40% discount thanks to “connections in the TON ecosystem.”

Some experts say such closed-loop deals are not new to the industry.

“Information considered a grey area in the crypto industry may well be deemed insider information in the stock world,” said an anonymous source to The Block.

Critics of DAT have also highlighted deals involving other well-known industry figures. For instance, the family office of Binance founder Changpeng Zhao invested $500 million in transforming CEA Industries into a BNB treasury. Previously, he reported that 98% of his crypto assets are in this token.

In June, after a $100 million deal, SRM Entertainment renamed itself Tron Inc. Justin Sun became its advisor. The firm positions itself as the largest corporate holder of TRX.

In July, biotechnology company Sonnet BioTherapeutics rebranded, changed its name to Hyperliquid Strategies, and began accumulating the HYPE token.

Before the DAT announcement, the company’s shares were at $1. However, two weeks before the public announcement, Sonnet sold convertible bonds worth $2 million to unnamed accredited investors. After this, the stock prices began to rise rapidly, gaining over 300%, and eventually reached $10.

Ultimately, the firm acquired 12.6 million tokens for $583 million with the support of Paradigm. It later emerged that 98% of Sonnet’s shares are owned by Rorschach I LLC, an entity affiliated with Paradigm.

Expert Opinions

Komodo’s CTO Kadan Stadelmann described all the examples as “the very circular economy that gives crypto skeptics fodder for years to come.”

“When a treasury company takes money from venture funds or a development fund to buy tokens that those same funds already own, it’s not asset management — it’s creating liquidity for an exit. It’s self-dealing disguised as capital deployment,” he noted.

Alluvial’s CEO Mara Schmidt took a more optimistic stance. She said the drive of crypto projects to create public companies represents an opportunity to raise accountability levels.

“Public companies are required to adhere to strict disclosure requirements and maintain transparent policies regarding conflicts of interest. When such organizations participate in crypto treasuries, they bring a level of accountability that can raise standards for the entire ecosystem,” she emphasized.

Ethereum founder Vitalik Buterin supported corporate treasuries in the second-largest cryptocurrency by market capitalization but warned of risks. He noted that excessive use of leverage by companies could turn this into a “dangerous game.”

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!