Expert predicts a large-scale bitcoin sell-off

Corporate purchases of the first cryptocurrency have slowed. Some metrics point to growing sell-off risks, noted Capriole investment fund founder Charles Edwards.

Bitcoin Treasury Companies are getting squeezed.

Are Tradfi capital markets reaching exhaustion?

🧵

— Charles Edwards (@caprioleio) August 22, 2025

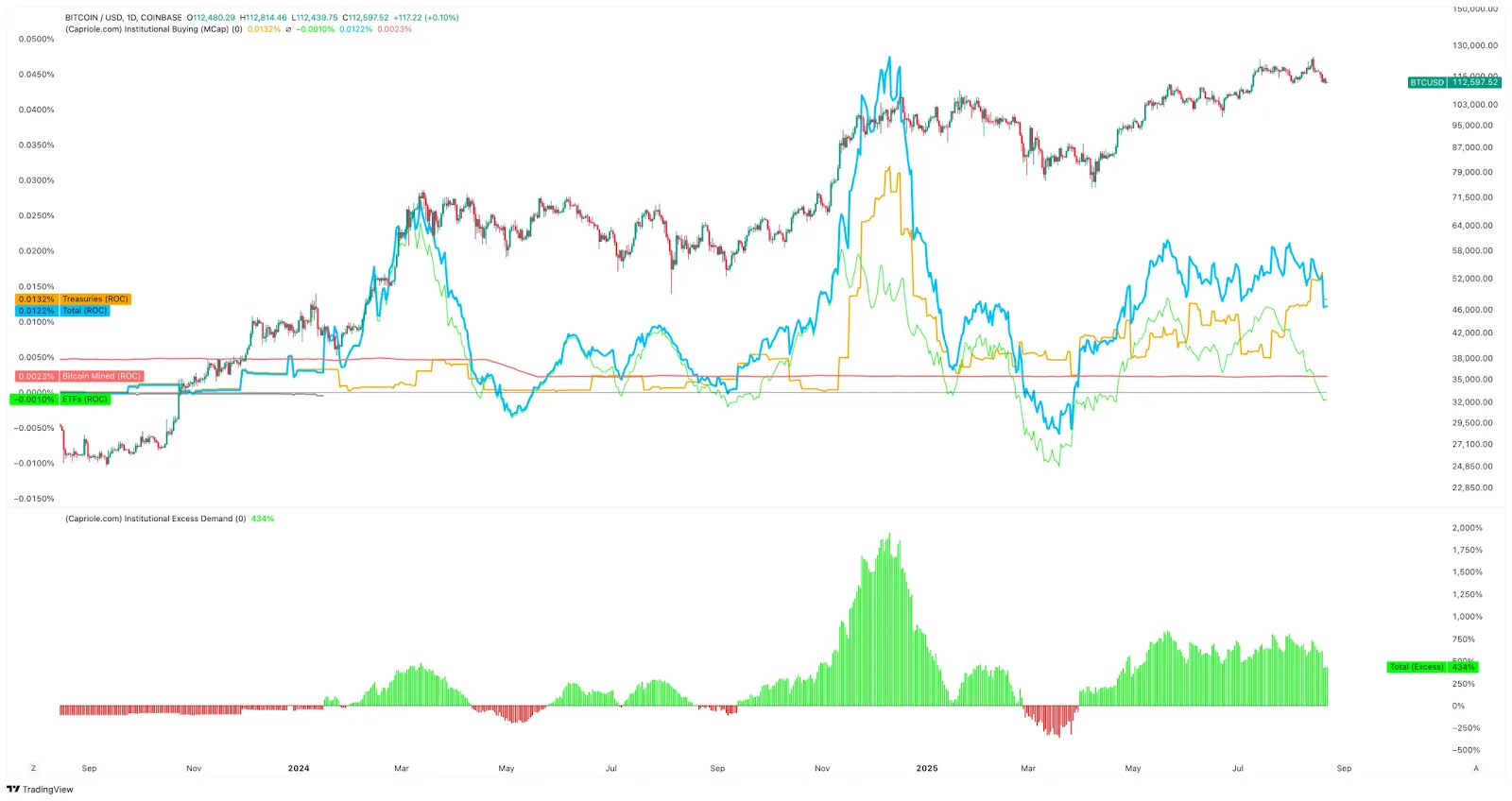

Institutional investors are still buying 400% of bitcoin’s daily supply. However, this measure has fallen from peaks of 600% and is at its lowest since March, when bitcoin traded at $85,000.

The average number of companies buying the first cryptocurrency each day is shrinking. Edwards allows this could be a temporary lull or a sign of market saturation. A positive signal remains: 93% of firms are buying rather than selling digital gold, indicating resilient interest.

“Negative growth”

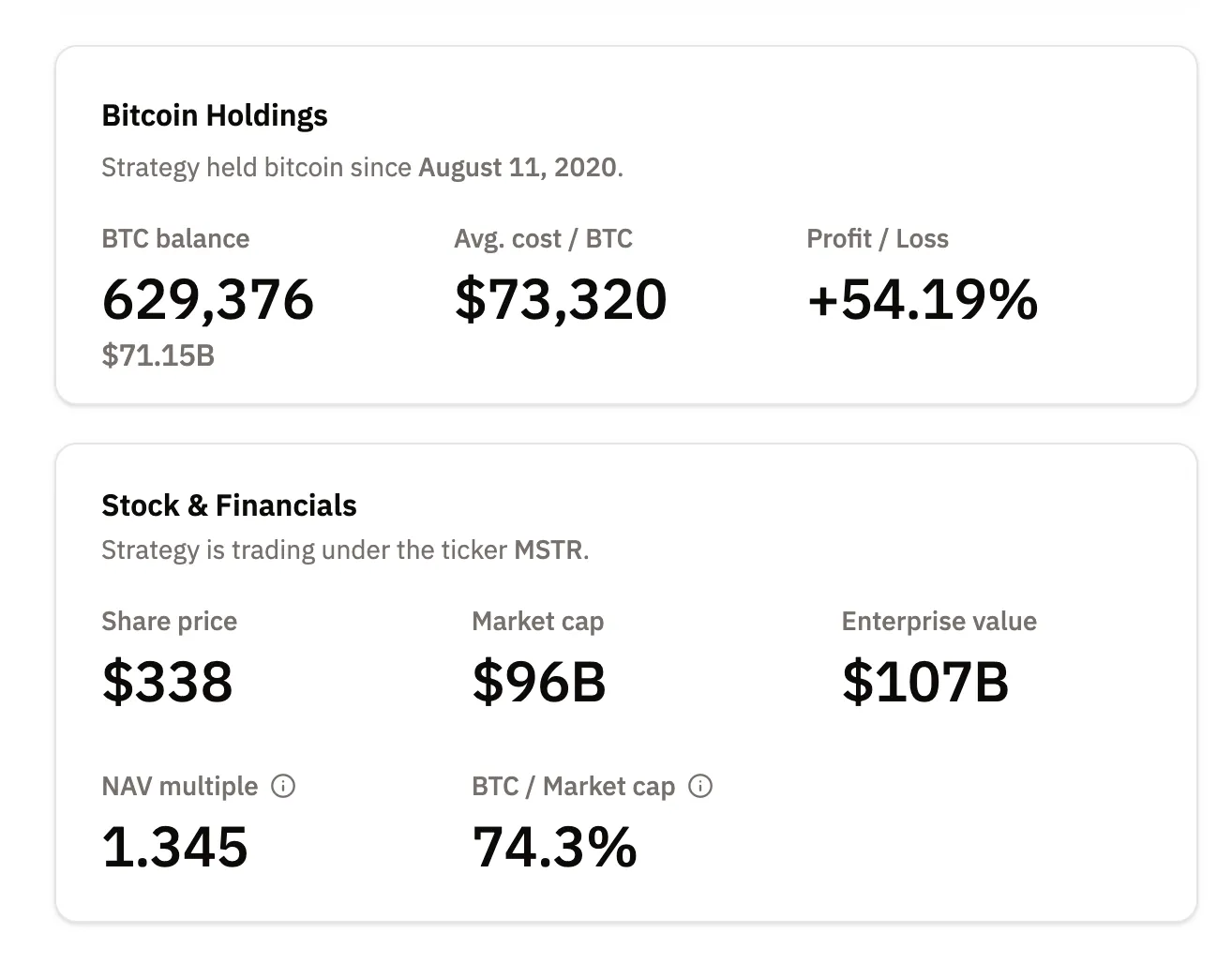

The share of companies with mNAV below 1 has reached a record 27%. This means their market capitalisation has fallen below the value of their bitcoin reserves.

Issuing stock to buy cryptocurrency is becoming unattractive for stakeholders. In such circumstances, it is more advantageous for companies not to add to their bitcoin positions but to sell bitcoin instead to buy back their own cheap shares.

A prolonged decline in mNAV could intensify pressure on companies and increase the risk of a fall in the flagship cryptocurrency’s price.

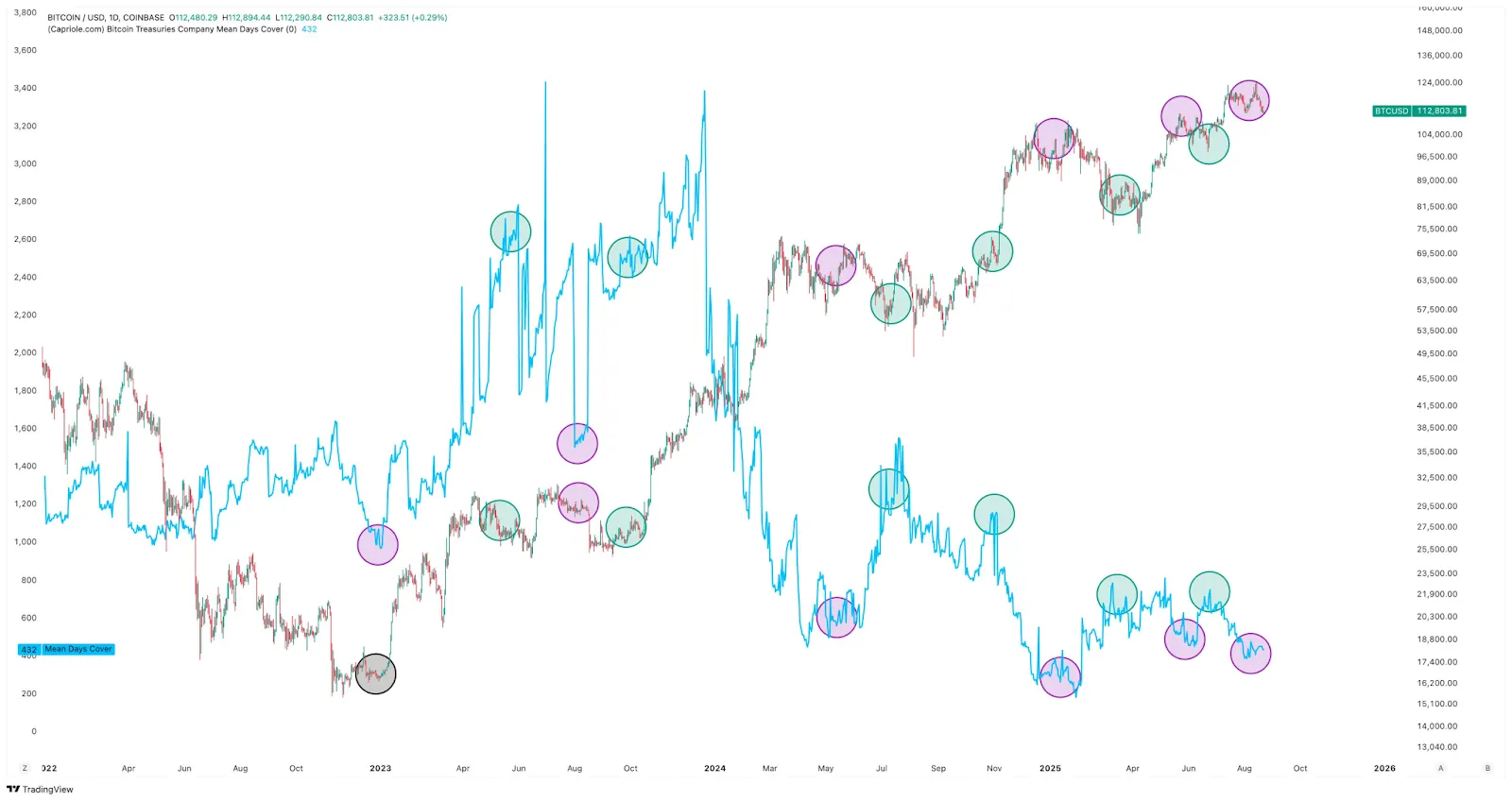

The expert also drew attention to the Mean Days Cover (MDC) metric, which functions as a sentiment indicator. It shows how long a firm would need to justify its market capitalisation at the current pace of crypto-asset purchases.

Edwards explained that a low reading indicates efficiency but often coincides with bitcoin price peaks.

A high reading, by contrast, usually appears at the market bottom or at the start of a growth phase. It signals investor confidence: they buy the company’s shares, providing it with additional resources for new allocations to digital gold.

At the time of writing, MDC is at low levels. This points to pessimism among market participants.

Outlook

Edwards stressed it is too early to draw firm conclusions. However, the combination of falling mNAV and MDC alongside slowing corporate purchases points to potential risks.

If conditions deteriorate, companies may start selling bitcoin, increasing pressure on the price. At the same time, the volume of purchases remains significant, and the market could rebound quickly if institutional interest returns.

“The longer mNAV stays low, the greater the pressure on companies to sell their bitcoins, which could exacerbate any decline in the cryptocurrency’s price — this is a risk scenario to prepare for. For now, the overall picture remains acceptable,” the expert concluded.

Over the past 24 hours the price of digital gold has fallen by 0.6%, and by 5% over the week, according to CoinGecko. At the time of writing the asset is trading at $113,076.

Strategy and the bitcoin price

Strategy is the largest corporate holder of digital gold. The company holds 629,376 BTC worth $71.1 billion. Market participants closely follow the actions of Michael Saylor’s firm, believing they influence bitcoin’s price.

However, on the Coin Stories podcast by Natalie Brunell, Strategy executive Shirish Jajodia denied any impact on the first cryptocurrency’s price. According to him, the company structures deals so “as not to move the price of bitcoin”. One method is the use of OTC platforms.

As noted by Cointelegraph, the asset’s reaction to Strategy’s purchases is mixed. For example, from 18 to 24 November 2024 the company acquired 55,000 BTC for $5.4 billion at an average price of $97,862, which preceded a rise in the cryptocurrency to $106,000 by 17 December.

However, after buying 21,021 BTC for $2.46 billion on 29 July, the price fell by 4% to $113,320.

Strategy head Saylor has repeatedly said that his goal is the maximum accumulation of bitcoin regardless of its price. In December last year he said that the company “will continue to buy “at the highs” forever”.

On 21 August, Glassnode analysts warned that the first cryptocurrency’s price was approaching a peak.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!