Analysts Identify Bitcoin Support Levels to Sustain Bullish Trend

Digital gold risks falling to $100,000 if it fails to hold the $110,000 level.

On August 26th, the price of the leading cryptocurrency dropped to $109,000, triggering a wave of liquidations amounting to $900 million in a single day. Analysts have warned of further market decline risks, reports The Block.

“The week began with a significant correction of major assets,” noted Sean Dawson, head of research at the on-chain options exchange Derive.xyz.

The expert added that Bitcoin’s daily volatility surged from 15% to 38%, while Ethereum’s increased from 41% to 70%.

According to him, the key reason was the publication of the producer price index, which exceeded forecasts. Traders are panicking, hedging risks ahead of the release of key data: the US GDP report on August 28th and the labour market data in early September.

The derivatives market confirms the pessimistic sentiment. The 25-delta skew for the two largest cryptocurrencies by market capitalization has turned negative, with market participants actively buying put options.

Dawson suggested that by the end of September, Bitcoin might test the $100,000 mark, while Ethereum could reach $4,000.

According to Glassnode, open interest in digital gold futures decreased by 2.6%. Meanwhile, funding payments for longs increased by 29% — from $2.8 million to $3.6 million, exceeding historical averages. This is a dangerous combination: if the price growth slows, a chain reaction of position closures could begin, analysts emphasized.

Simultaneously, on-chain activity shows a contradictory trend. The number of daily active addresses has fallen, while transaction volume has increased. This indicates that the market is driven by short-term speculators rather than organic demand.

Timothy Misir, head of research at BRN, described the correction as a “leverage flush amid market weakening.” According to him, the daily liquidation volume could approach $1 billion. He highlighted the following key Bitcoin levels:

- $110,000 — the average price at which short-term investors bought the cryptocurrency. If digital gold holds this level, stability might return;

- $103,700 and $100,800 — the next important marks. If the rate falls below these, it could seriously disrupt the current bullish trend and trigger a new wave of sales.

Good News

Despite the panic, major companies and institutional investors see the correction as an opportunity and are beginning to buy Bitcoin at a reduced price. On August 25th, Strategy purchased 3,081 BTC for $357 million.

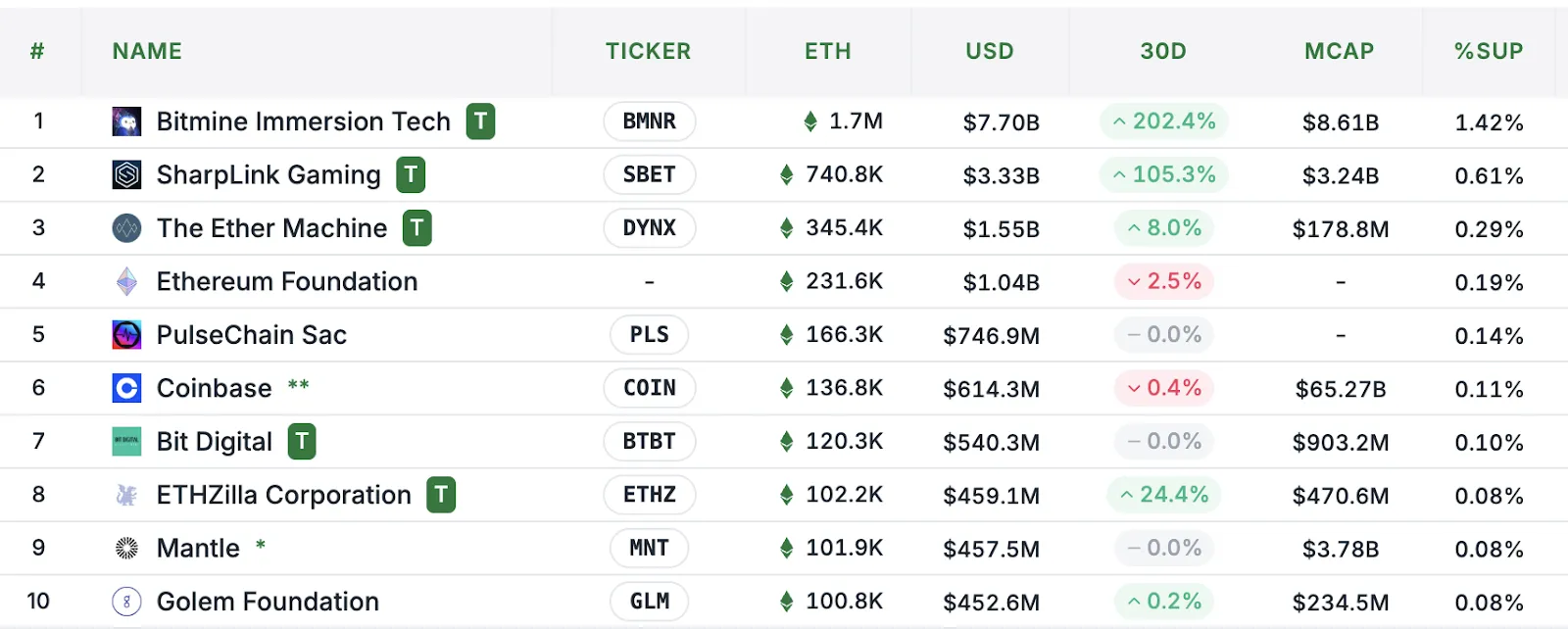

BitMine Immersion increased its Ethereum reserve by 190,500 ETH worth $2.2 billion. At the time of writing, the firm holds 1.7 million ETH valued at $7.7 billion at the current rate.

Following the latest trading session, spot Bitcoin ETFs attracted $219 million after a weekly outflow of $1.1 billion, according to SoSoValue. Meanwhile, ETH-based exchange-traded funds received $444 million.

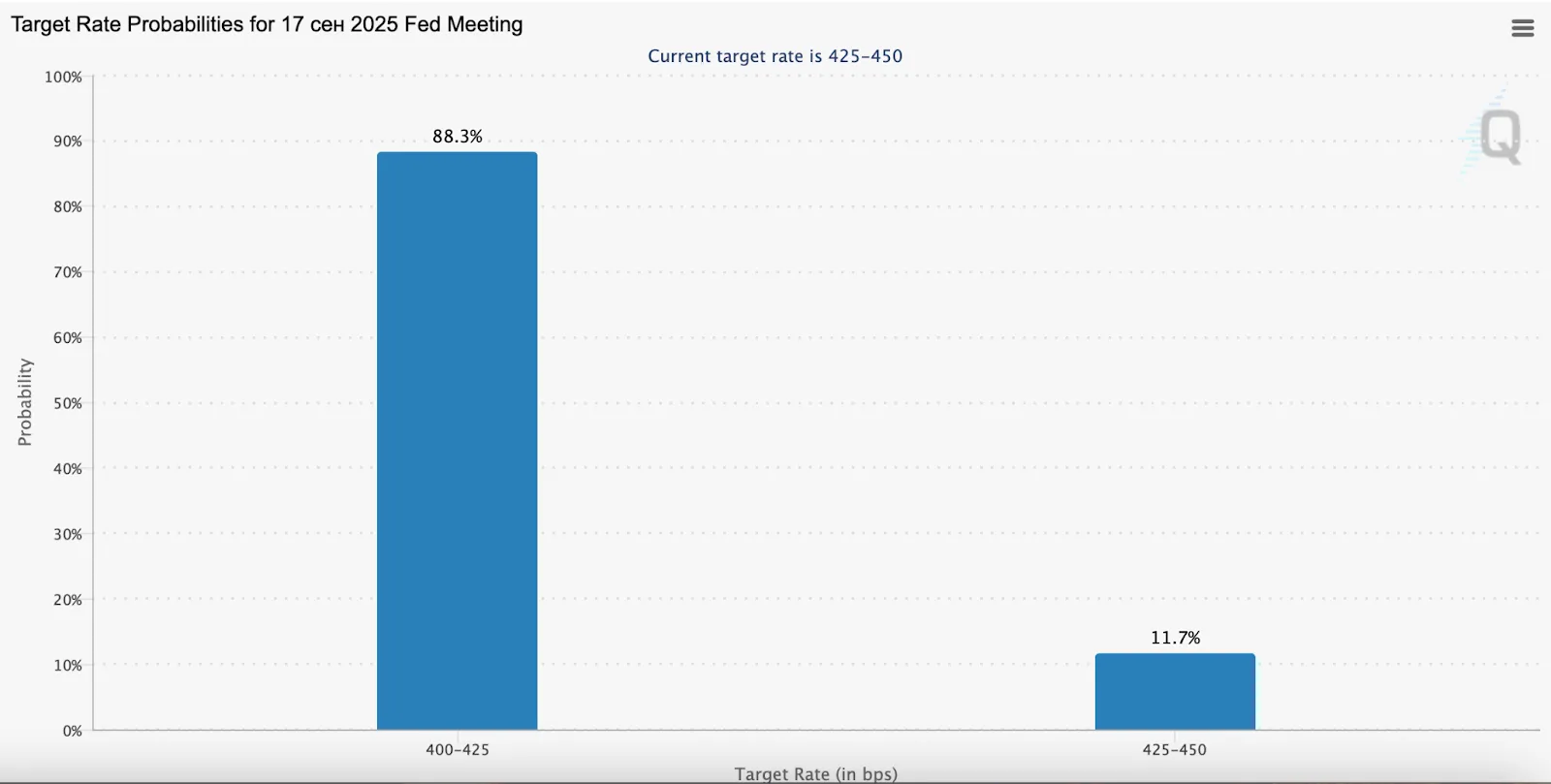

However, the market remains under pressure due to uncertainty surrounding US monetary policy. Last week, during the Jackson Hole symposium, Federal Reserve Chairman Fed Jerome Powell adopted a “dovish” stance.

At the time of writing, 88.3% of market participants expect a rate cut at the next FOMC meeting, scheduled for September 17th.

Previously, the surge in discussions about the Fed rate indicated potential risks for the crypto market.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!