SushiSwap liquidity falls after tenfold reward cut

The DeFi platform SushiSwap completed distribution of rewards amounting to 1000 SUSHI among liquidity providers who supported the project before the launch of the automated market maker. After the planned reduction of rewards to 100 SUSHI per block at block 10850000 of the Ethereum network, users began withdrawing assets from the protocol.

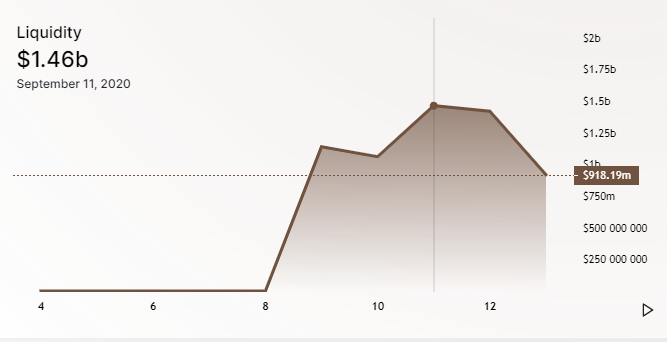

In two days, the protocol’s liquidity volume fell by 37% — from $1.46 billion to $918 million.

Data: sushiswap.vision.

SushiSwap — of the leading in the DEX segment of the Uniswap platform. The liquidity of the latter rose by 38.16% in the last 24 hours, до $747 млн.

Several days ago Uniswap lost more than 70% of its liquidity due to asset migration to SushiSwap.

As of writing, the SUSHI token trades at $2.30, according to CoinGecko. Over the last 24 hours, the asset’s market value fell by 6.1%.

Earlier, the protocol administrator nicknamed “Chef Nomi” dumped the price of SUSHI, selling half of the developers’ fund worth $27 million in protocol tokens. Users suspected an exit scam.

After some time, “Chef Nomi” returned the funds to the developers’ fund, apologising to the community.

Subscribe to ForkLog news on Facebook!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!