DeFi Bulletin: Uniswap launches governance token and overtakes Coinbase in monthly trading volume

The decentralized finance (DeFi) sector continues to grow at a rapid pace. We have gathered the most important news from the last three weeks into one piece.

Value of Locked Assets, Market Capitalization and Trading Volumes on DEXes

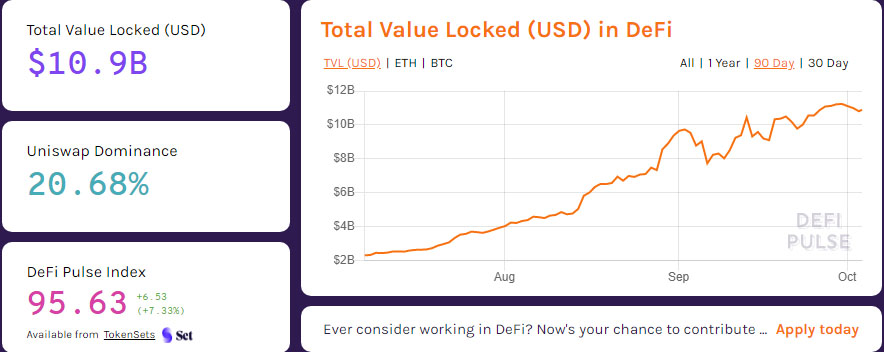

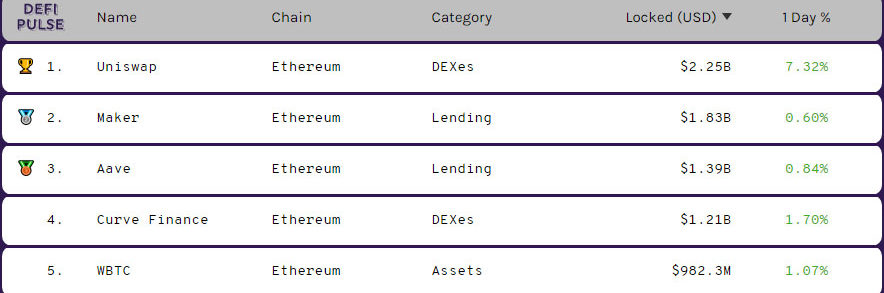

Total value locked in DeFi protocols after a sharp rise over the summer and a period of volatility in the first half of September has hovered over the past two weeks in the range of $10-$11 billion (DeFi Pulse).

Source: DeFi Pulse.

Source: DeFi Pulse.

As of writing, the figure stood at $10.9 billion, with Uniswap’s dominance index at 20.68%. The value of assets locked on the leading DEX is $2.25 billion.

Three other protocols have a value above $1 billion — Maker, Aave and Curve Finance.

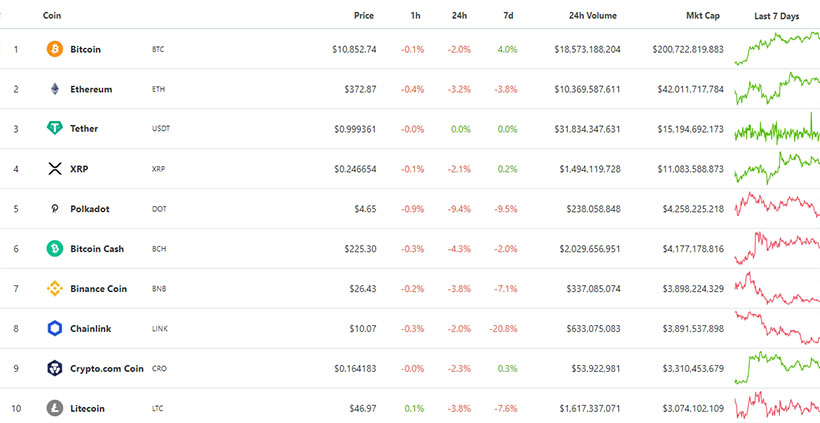

The total DeFi token market capitalization exceeds $13.2 billion (CoinGecko). 26.8% of the market share goes to Chainlink (LINK), even though the coin has fallen 14.2% in the last seven days.

In the “green zone” during this period only governance tokens of Aave and Maker.

Trading on DEXes continued to grow exponentially in recent months. The figure has surged from July and by the end of September reached $23.5 billion. This is 103% higher than in the previous month.

Source: The Block.

Uniswap’s share of total DEX trading volume stood at 65%.

DeFi Usage Guide: ForkLog Conference Wrap-up

On September 29, ForkLog Live hosted an online conference, “DeFi: A Practical Guide.” Nine speakers discussed the trends and challenges in the decentralized finance market, and debated the prospects for regulatory oversight.

A concise summary of their talks can be found in the ForkLog article:

DeFi: A Practical Guide: Final Overview of ForkLog Conference

Billionaire Alexander Lebedev announces creation of a large “anti-bankster” DeFi project

Russian businessman and banker Alexander Lebedev announced the creation of a large DeFi project intended to address the chronic problems of the traditional financial system.

Lebedev, previously on Forbes’ list, argues that the technologies underlying DeFi, despite the current hype and a rush for easy money, can fundamentally reshape the financial system in the long term.

For ForkLog, project architect Sergey Mendelyev, founder of the Garantex exchange, described its main features. According to him, the plan is to provide users with access to the following resources:

- decentralized exchanges (DEX);

- lending;

- asset management (by analogy with yEarn Finance);

- the creation of derivative assets within a single infrastructure, a kind of DeFi-bank.

A governance token for the project is also planned.

Uniswap launches governance token UNI

On September 17, the leading decentralized exchange Uniswap released the governance token UNI.

Within hours of the launch, the listings were announced by several leading crypto exchanges, including Binance and Coinbase Pro. On Bitfinex, UNI trading started on September 20.

The total UNI supply will be 1 billion; 60% is allocated to the community — to be distributed over four years.

The team, current and future employees, will receive 21.51% under the vesting program. Another 17.80% was allocated to investors, and 0.069% to project advisors.

After four years, an inflation mechanism will kick in — annual inflation will run at 2%.

Several days after the airdrop began, Glassnode expressed concerns about Uniswap’s decentralization of governance. They pointed out that the governance tokens are not locked in a smart contract and reside on ordinary Ethereum addresses.

They also noted that the project team has not disclosed vesting details, and tokens are distributed across 43 addresses. Glassnode concluded that, for this reason, in the early stages of governance the Uniswap team and investors will wield disproportionately large power.

Analysts explained this as Uniswap’s attempt to guard against possible attacks by centralized exchanges.

Months before the UNI launch, Uniswap lost 70% of its liquidity due to its migration to the competing SushiSwap protocol, which attracted liquidity providers with the distribution of the SUSHI governance token. But after the end of the bonus period with higher block rewards, the reverse flow began and SushiSwap liquidity fell tenfold.

The SushiSwap administrator became the holder of 138,000 UNI as a result of the token distribution. He said that their estimated value at the time (roughly $522,600) was equivalent to funding the work of the development team for several months.

Read more about the ambiguous fork of Uniswap with the culinary-name in the ForkLog article:

The runaway “chef,” the DeFi fever and the whale gambit: how SushiSwap attracted $1B in two weeks

UNI’s price surged from $2.97 to a high of $7.82 within a day after the launch (CoinGecko). As of writing, the token trades around $3.90.

Market capitalization of the Uniswap token stands at $702 million, placing it 31st in the crypto ranking.

Launching UNI led to unexpected consequences, sparking interest in tokens with a similar ticker. One of them — Unicorn Token — rose more than 60,000 times in price before collapsing back to its initial levels.

As September ended, Uniswap’s monthly turnover surpassed Coinbase’s, the largest U.S. crypto exchange.

Trade volume in September 2020:

— @UniswapProtocol $15.4 billion.

— @coinbase $13.6 billion. pic.twitter.com/CdK5HoaCwu— Mika Honkasalo (@mhonkasalo) October 3, 2020

To understand how the DEX managed to challenge centralized platforms, ForkLog explains in the article:

Just add the token: how Uniswap became the first DEX to beat Coinbase

Hacker Drains $15 Million From Incomplete Eminence DeFi Project

From the new DeFi project by the founder of yEarn Finance, the attacker extracted $15 million, taking advantage of a testnet environment deployed for the ecosystem.

Eminence is described by its developers as an “economy for a multi-game universe.”

The night before the incident, Cronje and the team had completed the project concept and deployed interim Ethereum contracts for further testing. They also published art teasers for the project.

According to Cronje, Eminence had at least three weeks to go before launch.

During the night he was woken up by a message that users had put $15 million into the contracts, which the attacker fully withdrew. The hacker returned $8 million to Cronje by sending it to the deployment account on yEarn Finance.

Cronje noted that neither the contracts nor the ecosystem were final. Their deployment, he said, was ordinary practice of “testing in production.”

Aave launches decentralized governance system on the mainnet

The lending DeFi protocol Aave launched a governance system on the mainnet via community voting. The first Improvement Proposal (AIP) was the migration to the new governance token.

Previously governance took place on the Kovan and Ropsten testnets. LEND token holders could participate in pilot votes.

One of them concerned migrating to the new governance token AAVE. The proposal received the majority of votes.

On September 25, an official five-day voting period for AIP1 on the mainnet began.

As a result, migration to the new governance token was supported by 100% of votes.

The voting period for AIP1 to migrate from $LEND ➡️ $AAVE has ended, with an overwhelming ‘YAE’

You can track the countdown to the migration start here: https://t.co/noc4D7wzmG

We will release instructions for migration and staking on Friday, and we are here to help you! https://t.co/xizn3JcPB6 pic.twitter.com/gwrsu3V6lX

— Aave (@AaveAave) October 1, 2020

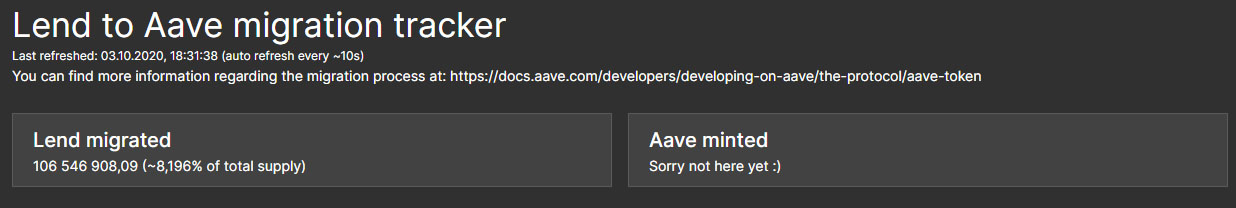

The migration began on Friday, September 2. At the time of writing, more than 106 million LEND — about 8.2% of the total supply — had migrated.

Source: Aavewatch.

Class action against Maker referred to arbitration

The United States District Court for the Northern District of California granted the Maker Ecosystem Growth Foundation’s motion to transfer a class-action suit against the company to arbitration proceedings.

In April, investors accused Maker Foundation, Maker Ecosystem Growth Foundation and Dai Foundation of willfully distorting the risks of owning CDPs (collateralized debt positions). The plaintiff, Peter Johnson, sought a total of $28 million from the defendants.

On March 12, attackers exploited the Auction Keeper vulnerability amid Ethereum’s price collapse and pulled more than $8 million from MakerDAO.

The motion was a response to the investor’s suit. Representatives say he violated the terms of the user agreement he accepted when joining the service in 2018.

Before the court ruling, Maker (MKR) holders voted against compensating the collateral owners in MakerDAO who were liquidated during the March market crash.

Binance users confirm willingness to risk DeFi assets

The cryptocurrency exchange Binance unveiled an “innovation zone” for trading DeFi tokens. Access will be granted to only a subset of platform users.

Binance positions the new service as a safe space to trade DeFi assets with high volatility. To enter the “innovation zone,” users will be asked two questions:

- Are you prepared to lose 50% of your capital or more?

- Are you prepared to take responsibility for those losses?

«We hope to filter out those who should not trade projects in the ‘Innovation Zone’ from more advanced traders with proper risk management and the appropriate mindset,» Zhao said.

ForkLog also wrote:

- Messari: DeFi projects Uniswap, Curve and Balancer captured 90% of the DEX market.

- DeFi platform bZx lost $8 million due to another attack.

- Poisoned tomato: the DeFi protocol tomatos.finance turned out to be a scam.

- DeFi project LV Finance was suspected of an exit scam.

- Crypto.com integrated price data from Chainlink into its DeFi wallet

- The joke token MEME rose to $1,800.

To help navigate the growing DeFi sector and the multitude of projects that continually appear, ForkLog explains in the article:

DEX, DAOs and tokenized Bitcoins: how not to get lost in the DeFi thickets

Subscribe to ForkLog’s news on Telegram: ForkLog Feed — all the news, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!

Материалы по теме