yEarn.Finance readies storage upgrade as liquidity declines

The developers of yEarn.Finance announced a storage upgrade for yVaults aimed at increasing its flexibility and security.

The project team notes that the current version of yVaults has allowed yEarn.Finance to scale to its present level.

The push to optimise the storage was prompted by maintenance difficulties and the absence of features affecting security and the risk/return balance.

The forthcoming update will enable yVaults to optimise the development cycle for new strategies via a standard API, broaden their available options, and make storage usage simpler and safer.

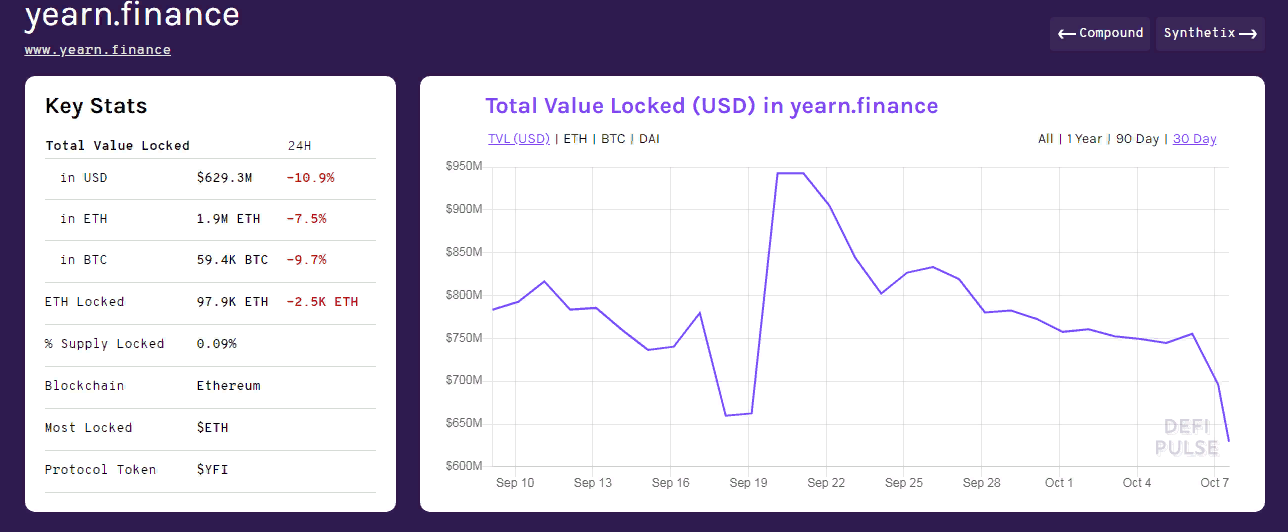

The announcement came amid ongoing withdrawals of frozen YFI tokens from DeFi protocols: over the past 30 days liquidity has fallen by about 25% to $629 million. In the last 24 hours, this figure declined by more than 10%.

Data: DeFi Pulse.

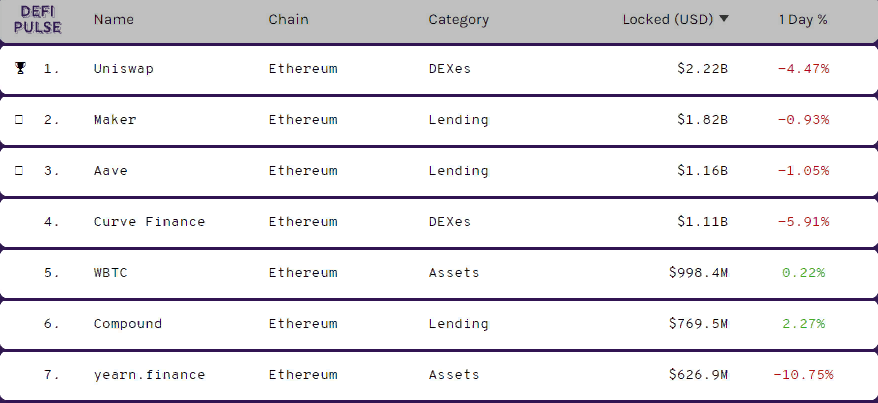

As of writing, yEarn.Finance ranked seventh by frozen-funds volume. Uniswap remains first with $2.22bn, and Maker with $1.82bn. In third place is Aave with $1.16bn. Curve Finance is fourth at $1.11bn, fifth is WBTC at $998.4m, and sixth is Compound at $769.5m.

Data: DeFi Pulse.

Since 12 September, when the YFI token reached its all-time high of $43,678, its price, according to CoinGecko, has fallen by 64.9% to $15,260.

In September, the developers of yEarn.Finance announced the launch of the StableCredit protocol. It is planned to include tokenised debt-stablecoins, lending, and automated market making.

Subscribe to ForkLog’s channel on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!