Opinion: the S2F model does not work; Bitcoin resembles a technology company’s stock

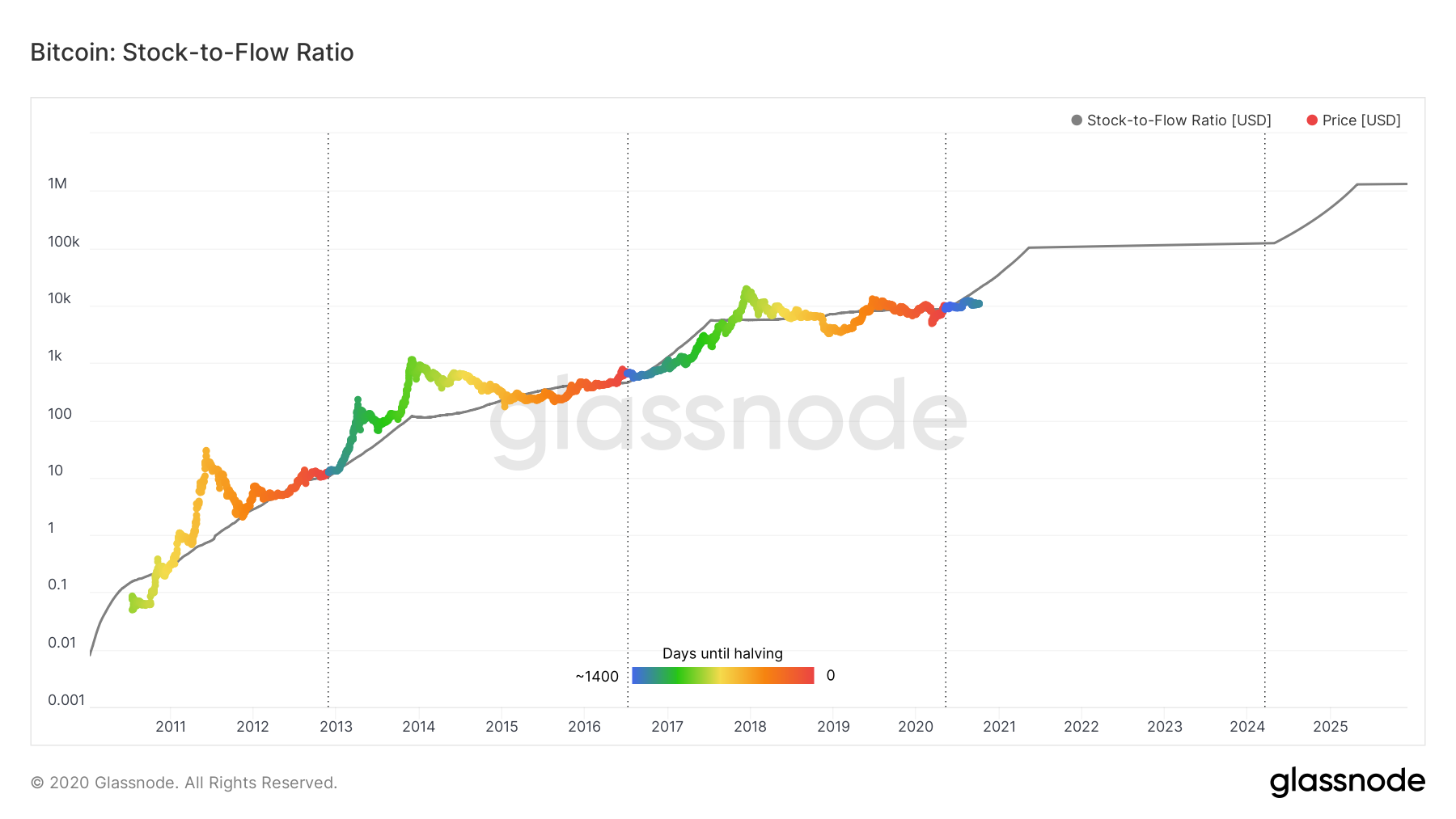

The popular Stock-to-Flow (S2F) model is not applicable for valuing the first cryptocurrency. Since Bitcoin’s supply, unlike precious metals, is fixed, its price is determined by demand. These conclusions are contained in a report by ByteTree’s head of analytics, Charlie Morris.

Our new comprehensive report explores the various factors that drive the value of #Bitcoin; the first chapter examines the key macro drivers for Bitcoin in 2020. Get access to the full report here, hosted by @Bitstamp: https://t.co/fIxYG9uC7e pic.twitter.com/nMgZePb4Va

— ByteTree (@ByteTree) October 6, 2020

— cryptonews.com (@cryptonews) October 9, 2020

According to the S2F model, by 16 August 2021 the price of Bitcoin will reach $100 000.

Bitcoin miners’ revenues relative to market capitalization and transaction value. Source: ByteTree.

After the third halving of Bitcoin, the price lagged behind the model’s forecast for several months.

Bitcoin’s market value dynamics and the projected price according to the S2F model. Source: Glassnode.

In June, the S2F model was criticised by Ethereum co-founder Vitalik Buterin.

ForkLog previously published a piece on crypto-asset valuation models.

Subscribe to ForkLog’s channel on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!