Coin Metrics: Fundamentals Point to Bitcoin Rally Continuing

A rise in Bitcoin’s fundamental on-chain metrics after the market crash in March this year supports expectations of the largest-ever rally. The findings are outlined in a new report from analytics firm Coin Metrics.

“Bitcoin is known for its volatility and has undergone many wild price swings in its history. But this time something has changed. The cryptocurrency rose according to metrics we have not observed in previous growth phases,” the analysts write.

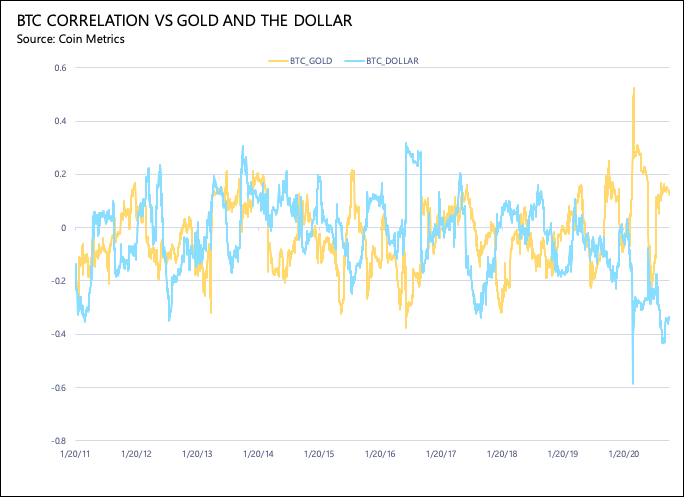

Researchers note a change in Bitcoin’s correlation with gold and the US dollar. This manifested on March 12, when Bitcoin fell along with other markets amid the panic triggered by the COVID-19 pandemic. Coin Metrics notes that this correlation with gold remains near record highs, while with the dollar it is not far from historical lows.

Bitcoin’s correlation with gold (orange) and the US dollar (blue). Source: Coin Metrics.

Also mentioned are recent investments in Bitcoin as a reserve asset by companies such as MicroStrategy and Square. In Coin Metrics’ view, this reinforces the thesis that the leading cryptocurrency is increasingly seen as digital gold.

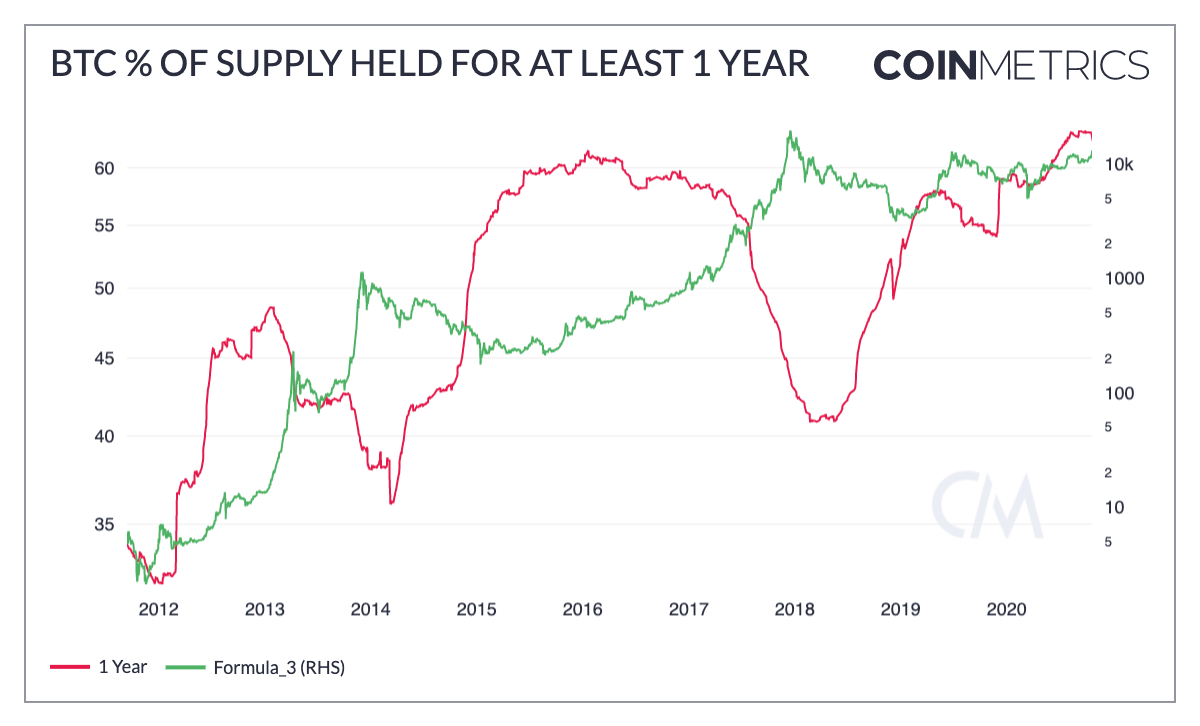

Experts noted a rise in the long-term holding trend for Bitcoin, reinforcing its perception as a store of value alongside gold.

On October 25, the share of coins not moved for more than a year reached 62.5%, not far from all-time highs. Previously, such a pattern occurred each time Bitcoin formed price lows.

Share of Bitcoins not moved for more than a year. Source: Coin Metrics.

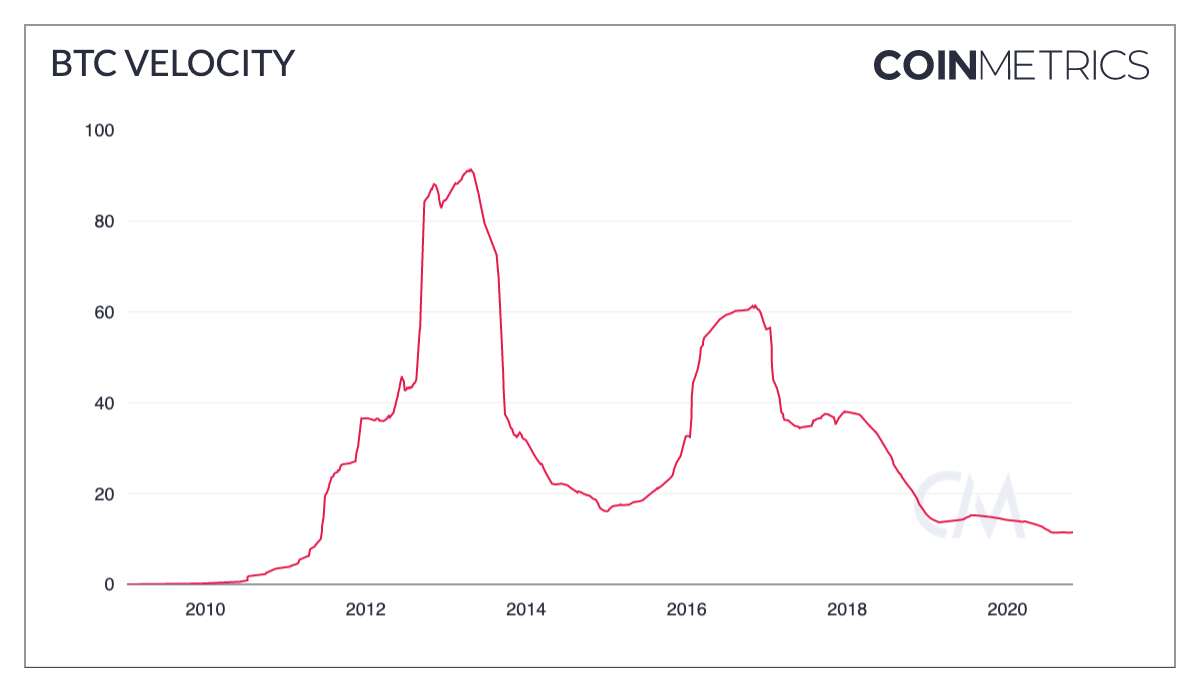

Coin Metrics also notes a drop in the velocity of coins to multidecade lows since 2011. This metric supports the hypothesis that Bitcoin is seen more as a store of value than as a means of exchange.

Bitcoin velocity dynamics. Source: Coin Metrics.

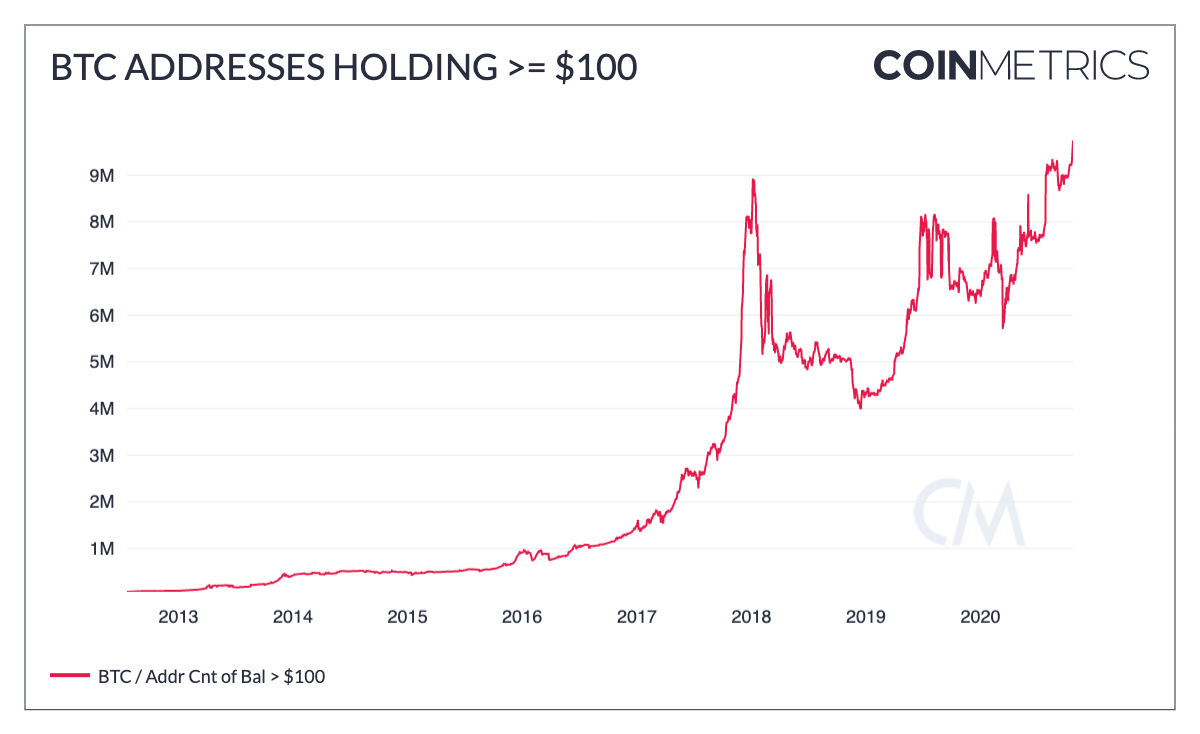

Analysts estimate that to date the number of addresses holding more than $100 has reached a new record (9.74 million). This positive momentum signals long-term adoption of the leading cryptocurrency.

Share of Bitcoin addresses holding more than 100 BTC. Source: Coin Metrics.

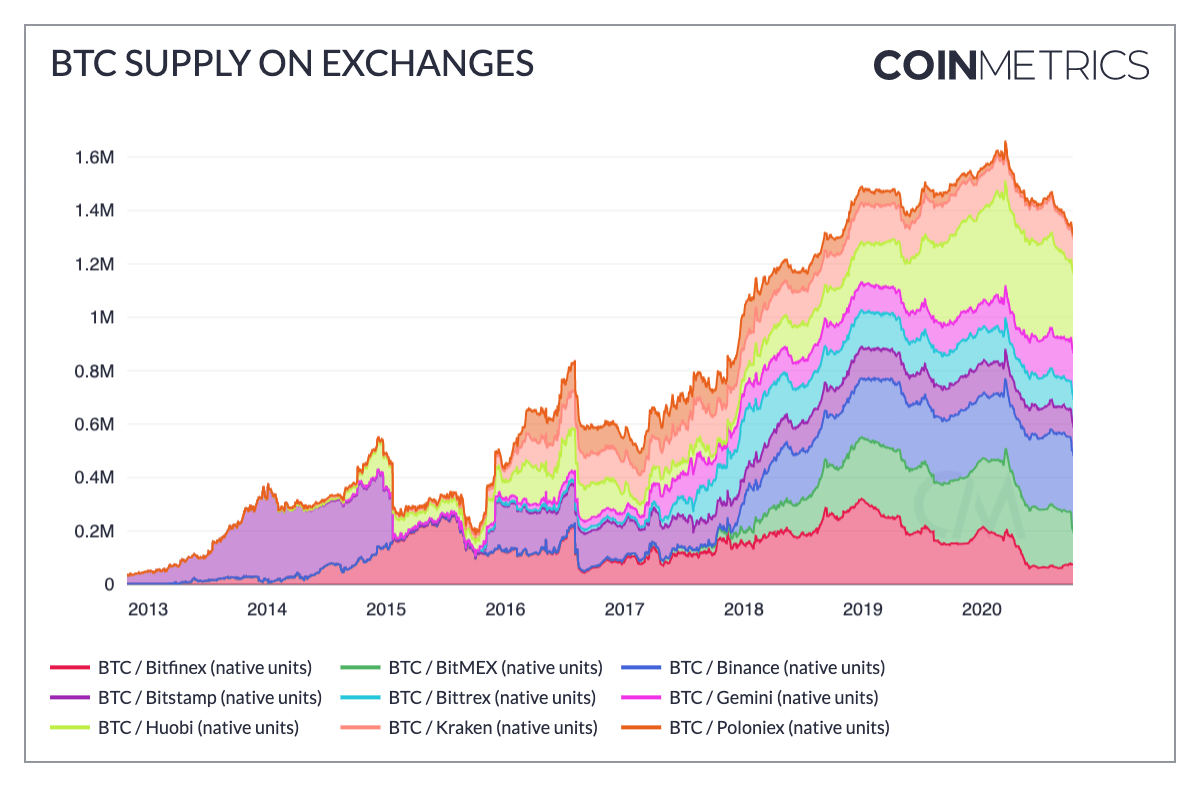

Another metric researchers flagged is the continued outflow of Bitcoin from centralized exchanges. Partly this reflects users’ preference for self-custody given the long-term outlook.

Dynamics of Bitcoins on centralized exchange wallets. Source: Coin Metrics.

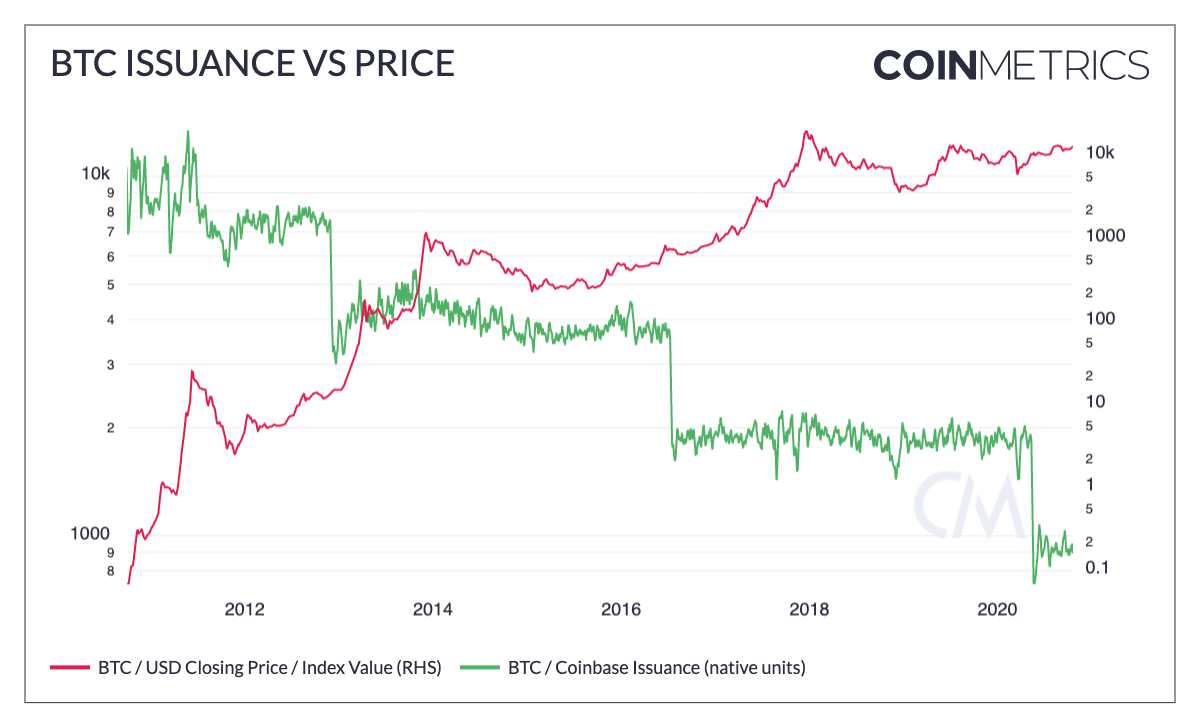

In conclusion, Coin Metrics analysts noted the May halving. The chart below shows changes in Bitcoin’s issuance and price.

Bitcoin price and issuance dynamics. Source: Coin Metrics.

“Historically, Bitcoin’s price reached a local peak within a year and a half after the halving. The trend toward holding coins is strengthening, and after the reward to miners was halved, only six months have passed. All signs point to Bitcoin being ready for takeoff,” the report’s authors conclude.

Earlier, the number of Bitcoin addresses holding 1,000 BTC or more выросло to a new all-time high.

Earlier, the Winklevoss brothers, founders of the cryptocurrency exchange Gemini, confirmed their previous forecast that Bitcoin’s price would reach $500,000. They also insist that Bitcoin is the only long-term inflation hedge.

Follow ForkLog news on VK!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!