JPMorgan: Institutions increasingly view Bitcoin as an alternative to gold

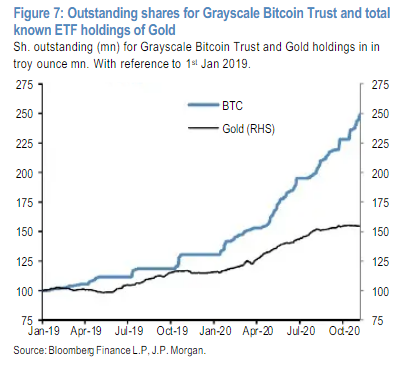

The Grayscale Bitcoin Trust is outpacing gold-backed exchange-traded funds (ETFs) in capital inflows, driven by rising demand from institutional investors. This follows from a report by JPMorgan analysts.

“Earlier we noted the significant potential of Bitcoin for long-term growth if it competes more intensively with gold as an ‘alternative’ currency. The market capitalization of the first cryptocurrency would have to grow tenfold to match private-sector investments in gold through ETFs or bars and coins,” the JPMorgan experts emphasised.

Dynamics of GBTC growth and assets in “gold” ETFs. Source: JPMorgan.

Analyst Willy Woo agrees with the experts’ assessment of Bitcoin’s positive momentum.

Who has been buying this rally? It’s smart money… High Net Worth Individuals. You can see the average transaction value between investors taking a big jump upwards. OTC desks are seeing this too.

Bitcoin is still in it’s stealth phase of its bull run. pic.twitter.com/3q41pmNVP9

— Willy Woo (@woonomic) November 9, 2020

Who’s behind this rally? It’s smart money… High-net-worth individuals. The average transaction value between investors has jumped significantly. OTC desks are also aware of this trend. Bitcoin is still in the stealth phase of its bull run,” he explains.

Woo suggests looking at another chart that gives a bullish signal. It shows a jump in the orange line, which indicates the speed of new investor inflows. The last time such momentum was seen was in late 2017.

Best of all we are not just seeing smart money flow in, it’s NEW smart money.

Orange line is the rate of new investors coming in per hour previously unseen before on the blockchain.

It’s seriously bullish.

Another killer chart by @glassnode. pic.twitter.com/ZXk95ksx3b

— Willy Woo (@woonomic) November 9, 2020

Analysts at JPMorgan do not rule out profit-taking after the rally in recent weeks.

According to our methodology, trend-following speculators intensified the latest rally and pushed Bitcoin into overbought territory. This could lead to a weakening of flows in the near term. To move into the extreme-value zone that would amplify this signal, the price of the first cryptocurrency would need to rise another 5-6%,” they add.

JPM-Flows-Liquidity-2020-11-06 by ForkLog on Scribd

Earlier JPMorgan strategist Nikolaos Panigirtzoglou noted that investors are seeking alternative assets and are allocating substantial cash to gold and Bitcoin. This is driven by uncertainty due to the coronavirus pandemic.

In March, the bank’s analysts acknowledged that Bitcoin’s March crash was its first serious stress test, which it handled quite successfully.

According to the latest Cointelegraph poll, 61% of institutional investors have already invested in cryptocurrencies or plan to do so.

Follow ForkLog on Facebook!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!