Kraken: Holding Bitcoin in the $13,000–$15,000 zone could push it to fresh records

Kraken analysts see solid grounds for continuing Bitcoin’s rally toward an all-time high, driven by the FOMO effect and the actions of so-called ‘whales’, while noting signs of a divergence between the price of the leading cryptocurrency and traditional financial assets.

Download the latest volatility report from Kraken Intelligence ‘Surprise, Surprise, Higher Highs.’

In this report we cover:

↕️ Decreasing month-to-month volatility for #Bitcoin

📈 Macro trends

🚀 Parabola soon?Read it here ⏩ https://t.co/3eNUKPKIgP pic.twitter.com/1PbW1UzLEm

— Kraken Exchange (@krakenfx) November 9, 2020

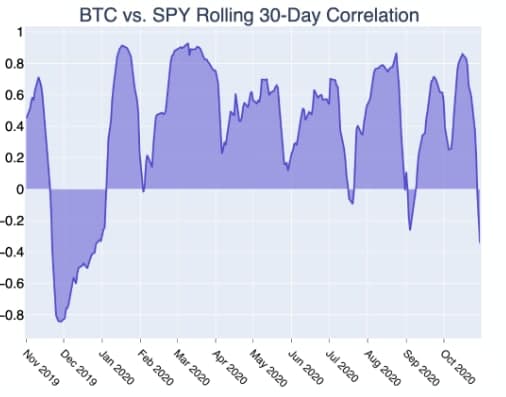

According to the new Kraken report, the rally to a 33-month high near $14,080 in October was accompanied by a drop in the 30-day correlation with the S&P 500 to a new year-to-date low (-0.34).

Earlier, the indicator reached a seven-week high (0.86).

Positive correlation prevailed throughout 2020.

Source: Kraken Research.

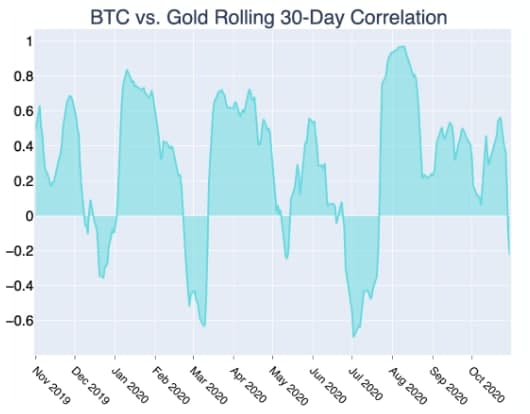

A similar divergence formed in Bitcoin’s relationship with the stock-market fear index VIX and gold. In the latter case, the measure fell to July 20 lows. Over the previous three months, the correlation was positive.

Source: Kraken Research.

The longer Bitcoin continues to show ‘opposition’ to traditional financial assets and withstand uncertainty, the stronger its appeal and status as an alternative investment, the report says.

Despite a strong October, annualised volatility for the month fell to a 19-month low (35.5%). Analysts expect a more volatile November — the historical median is 85%, and the median price gain is 14%.

Source: Kraken Research.

Experts counted that around 70,000 bitcoins were realized by holders of addresses with more than 100 coins. But purchases by those with balances below this threshold had a much larger effect.

Kraken researchers believe that maintaining the price in the $13,000–$15,000 range will generate additional demand that will carry into 2021.

Analysts draw a parallel with March 2020, when under similar conditions of accumulating Bitcoin-kite positions a FOMO effect emerged.

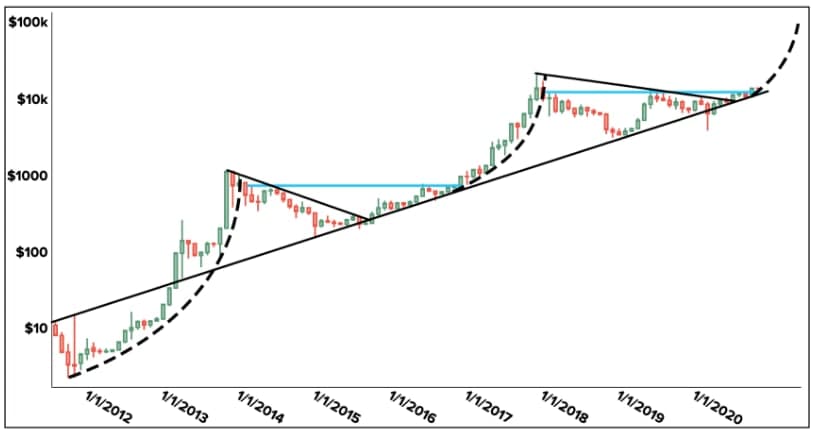

The October close at $13,809 (per Kraken data) proved to be higher than the previous significant high. This could signal the end of the three-year downtrend and the start of a bullish market.

Bitcoin has traded above $10,000 for a record 97 days in a row. This could point to conditions for a parabolic rise toward an all-time high near $20,000 and above, though researchers do not rule out a correction and a retest of $11,000.

Source: Kraken Research.

Earlier, analyst PlanB confirmed that his forecast for Bitcoin to reach $100,000–$288,000 by December 2021 remains valid.

The Winklevoss twins, founders of the cryptocurrency exchange Gemini, are placing higher bets: based on their own analysis they expect Bitcoin to reach $500,000.

Subscribe to ForkLog news on Telegram: ForkLog FEED — all the latest news, ForkLog — the most important updates and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!