An Unprecedented Experiment in Wealth Distribution on the Bitcoin Network

The ForkLog journal presents readers with a translation of the article “Bitcoin: An Unprecedented Experiment in Fair Distribution.” Its authors — Lucas Nuzzi, cofounder of Digital Asset Research, and the Coin Metrics team — found that despite institutional demand, the premier cryptocurrency is evenly distributed among a wide base of users.

- Researchers developed metrics to assess the uniformity of Bitcoin distribution across different address categories.

- It turned out that the supply of digital gold is relatively evenly distributed compared with other crypto assets.

- The near-uniform distribution of Bitcoin is aided by its emission mechanism and by miners who are forced to sell a significant portion of their mined output to cover costs.

Much has been written about fundamental differences between Bitcoin and other asset classes. The proximity of digital gold to traditional exchange-traded products like gold continues to attract new participants to the industry, among them institutions and retail investors.

But are there factors that make Bitcoin fundamentally different from other crypto assets?

As the first successful implementation of a digital currency, Bitcoin often serves as a kind of punching bag for technologists. In the view of many, it is a first-generation technology characterized by low throughput and limited functionality.

But be assured, Bitcoin’s uniqueness extends far beyond technology. This is an unprecedented experiment in wealth distribution.

The bull market is replete with textbook comparisons of Bitcoin to a congested Internet or email from the 1980s. Such comparisons are often components of carefully crafted marketing strategies promoted by advocates of new crypto assets. The latter purportedly succeed when Bitcoin fails. Tragically, newcomers focused solely on technical comparisons ultimately lose.

While technology undeniably plays a role in assessing the merits of any crypto asset, there is more to it. Technologists and many newcomers often overlook that crypto assets function as digital economic systems. In real economies, the technology governments, banks, and payment systems use to move money is not the decisive factor. Much more important are the efficiency of money circulation, monetary policy, and the distribution of wealth.

On-chain data represent a new paradigm of economic analysis, enabling us to identify inequitable distributions of wealth at the asset level. Blockchains, by their nature, provide a complete history of ownership structures, and that history speaks volumes.

Among various models of unfair supply distribution, [simple_tooltip content=’Providing privileges to relatives or friends, regardless of their professional qualities.’]nepotism[/simple_tooltip] inevitably leads to an incredibly centralised monetary base. With on-chain data we can identify ownership structures opposite to Bitcoin’s and quantify the degree of wealth centralisation in digital economies.

To give a full picture of the factors affecting fairness of distribution, we begin with a brief tour of Bitcoin’s early history. We then examine mining-based distribution and the impact of industrialisation in more detail. Finally, we will demonstrate two new metrics of supply distribution. This will help evaluate the wealth distribution of various assets relative to Bitcoin.

Genesis of the Magic Internet Money

The early history of Bitcoin confirms the innovation of a truly digital currency. The very first participants in transactions were probably inspired by a post by Satoshi Nakamoto on the P2P Foundation forum, where he first presented the system.

At that time only technically skilled individuals could run and continuously maintain a node of the network. Even fewer participants could properly use wallets, as this required some understanding of PGP encryption. It also required a lot of patience to deal with inevitable bugs in the first wallet (if one can call it that). There was not even an exchange rate against which early adherents could benchmark their bitcoins.

Along with the aforementioned technical difficulties, the results of early Bitcoin experiments were catastrophic — it is well known that an astronomical quantity of coins was irreversibly lost in that period. Transaction participants then regarded Bitcoin as a curious experiment with digital money in the Monopoly game.

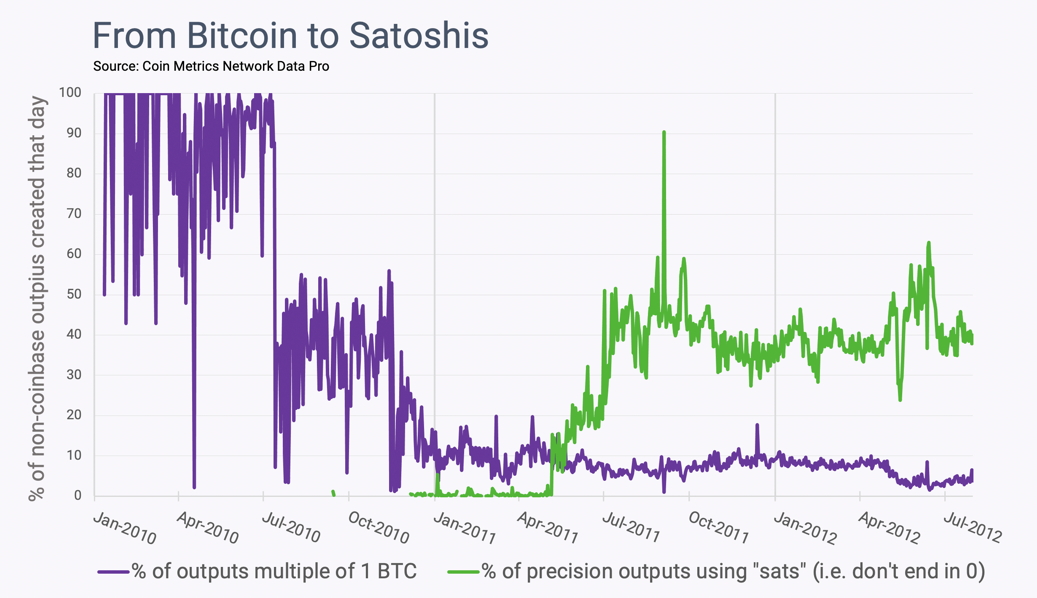

Probably no time series illustrates the unserious character of early Bitcoin as well as the graph below. It shows that up to about 2011, transaction participants sent each other whole bitcoins (the purple line), not fractional satoshis.

This shows the substantial difference between digital gold and all subsequent crypto assets, whose initial users accepted value from day one rather than experimenting idly. This ultimately led to unprecedented levels of circulation for the supply of the first cryptocurrency.

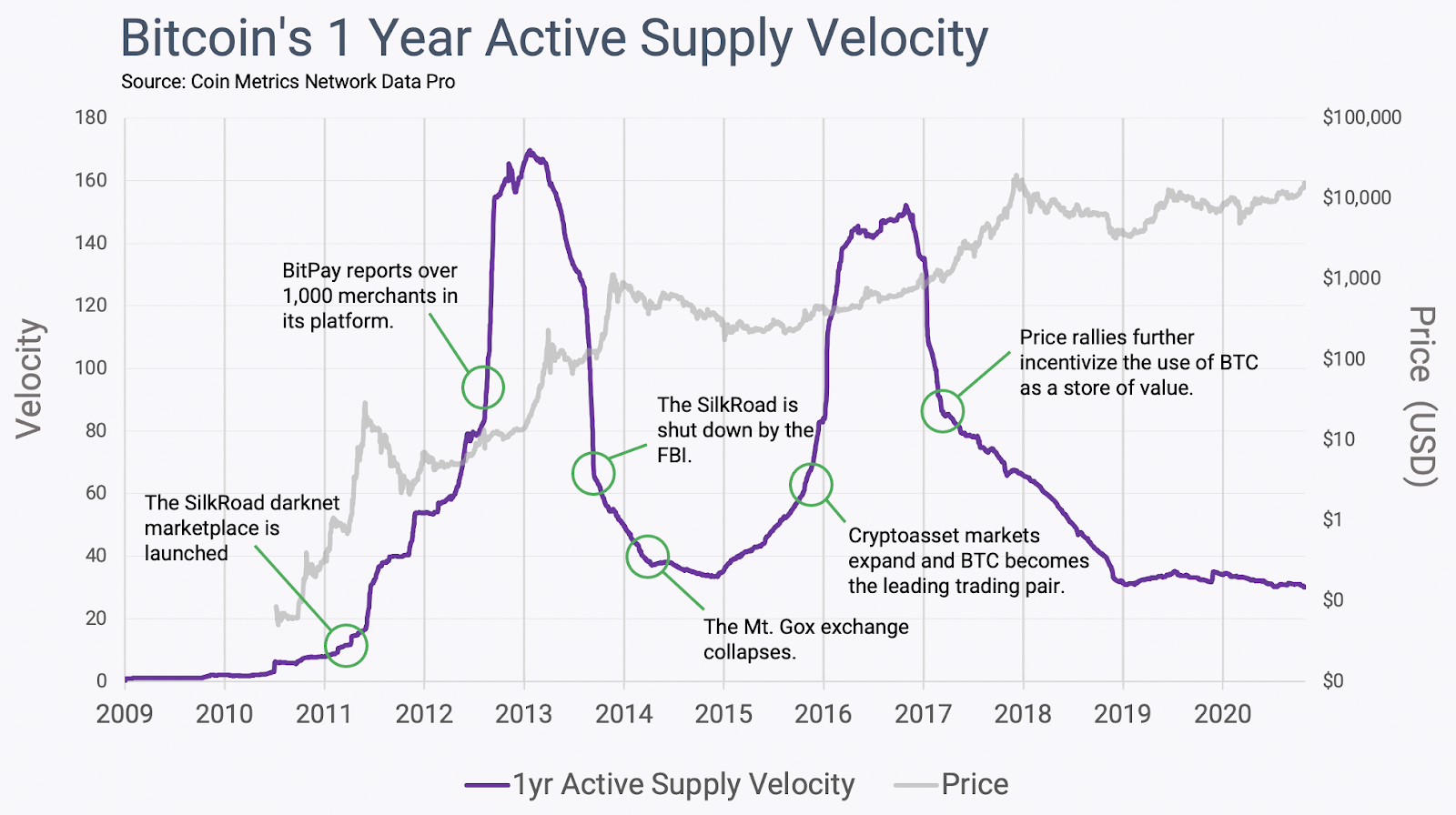

A direct method of assessing circulation is to measure the average number of coin transfers. The metric is usually computed by dividing the circulating supply by the total money stock.

The key element of unprecedented distribution is clearly traceable periods of high supply velocity that occur cyclically. They reflect early adopters giving way to newer market participants. Previously relentless price rallies were the main driver of Bitcoin’s supply velocity.

Fair Distribution by Design

As noted, the technology underlying crypto assets is certainly not the sole determinant of their intrinsic value. Yet it is a factor that matters—heavily influencing supply distribution.

Bitcoin resolved the long-standing distributed consensus problem, known as the “The Byzantine Generals’ Problem”. It concerns achieving consensus about the validity of a statement among parties that do not trust one another. Indeed, it is remarkable that Satoshi managed not only to solve the problem of distributed consensus but to implement it via mining—a activity that, by its nature, contributes to monetary decentralisation.

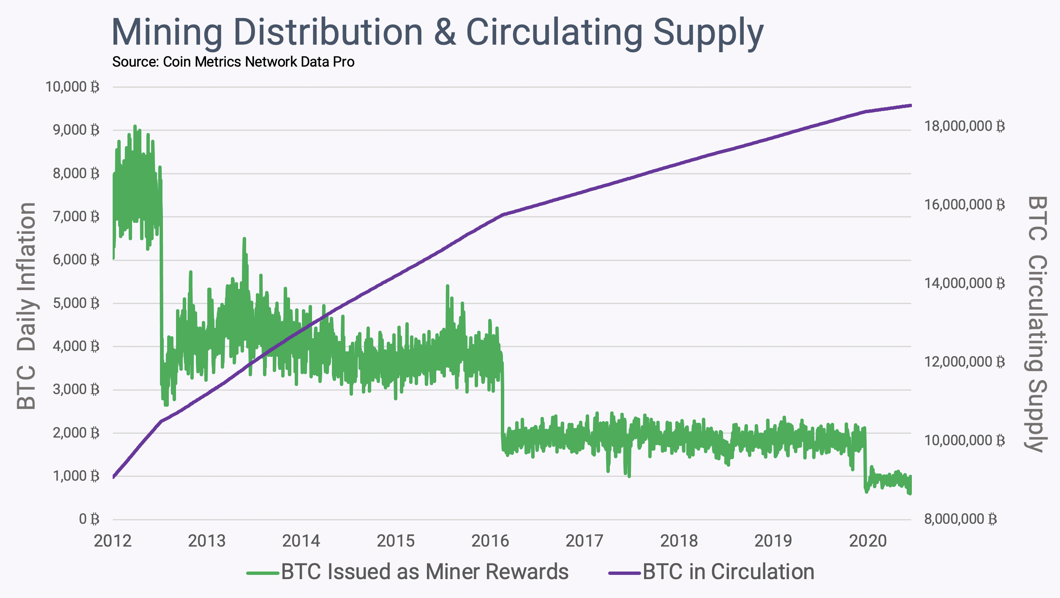

By design, Bitcoin mining is an activity that nudges market forces toward fair distribution. To be profitable, miners must plan for the long term, since their activity is associated with ongoing operating costs.

Mining rewards swing widely, because Bitcoin is marked by high volatility. This encourages miners to manage their assets more carefully, periodically selling a portion to cover costs, including electricity and equipment upgrades to stay competitive. This ultimately increases the velocity of supply.

Beyond the efficient validation of Bitcoin transactions, this activity strengthens the network, increasing the cost of a potential attack. In its essence, Bitcoin’s monetary policy promotes competition, as the inflation rate declines with each halving.

Despite ongoing industrialisation and concentration of capacity, the sheer scale of miner operations leaves little room for speculation, helping to move new coins from hand to hand.

Crypto assets and unfair wealth distribution

We have surveyed the fundamental factors shaping Bitcoin’s supply distribution. Now we can assess how these factors differentiate the first crypto asset from other assets. The economic literature offers a wide array of metrics for measuring inequality of wealth and money supply.

Regrettably, the crypto industry does not yet possess such a broad metric toolkit. In an effort to change this, we have developed a set of metrics for quantifying wealth-distribution inequality across multiple crypto assets.

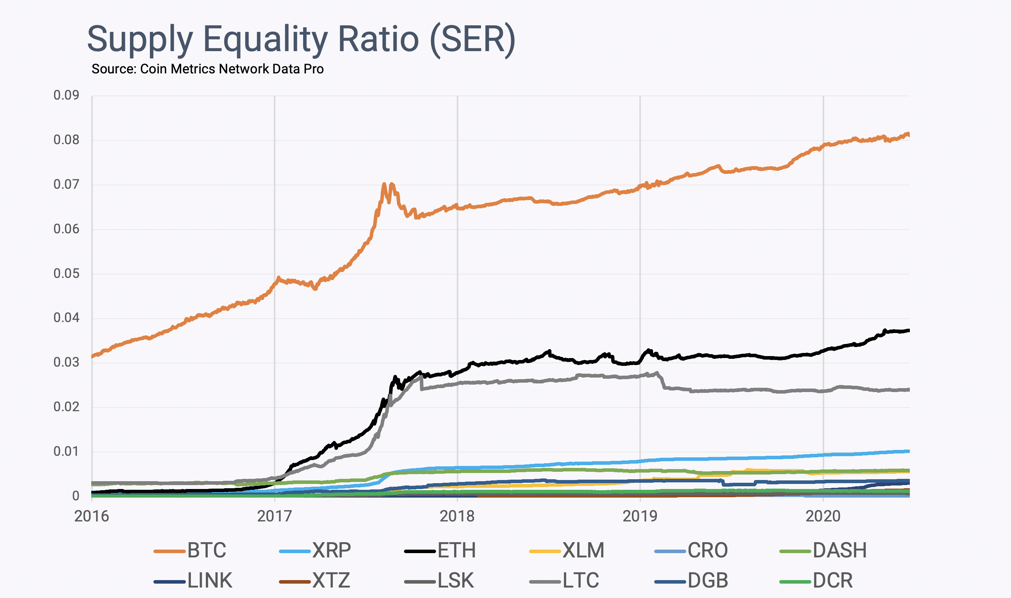

The first is the Supply Equality Ratio (SER). It is similar to the 20:20 Ratio, a traditional measure of wealth distribution inequality that contrasts the average income of the top 20% with that of the bottom 20%.

Rather than income, SER examines the supply across addresses on a given network. It contrasts the “poorest” addresses (the sum of coins on addresses holding less than 0.00001% of the total supply) with the wealthiest (coins held by the top 1% of addresses).

A high SER indicates a high degree of supply inequality. As expected, Bitcoin has the highest figure among popular crypto assets, followed by Ethereum and Litecoin.

This is notable, since digital gold is the principal crypto asset in demand among large financial institutions. The trend raises the denominator of SER, exerting downward pressure on the ratio.

A steady rise in the metric demonstrates that despite institutional adoption, Bitcoin remains driven by the broad masses. The number of relatively small addresses holding less than 1.85 BTC continues to grow, offsetting the tendency for coins to accumulate at the largest addresses.

SER offers a fresh lens on supply distribution, a metric not readily applicable to most traditional assets. However, it is important to note that a single person can own multiple crypto addresses. As such, supply distribution does not map directly to the savings of individual investors.

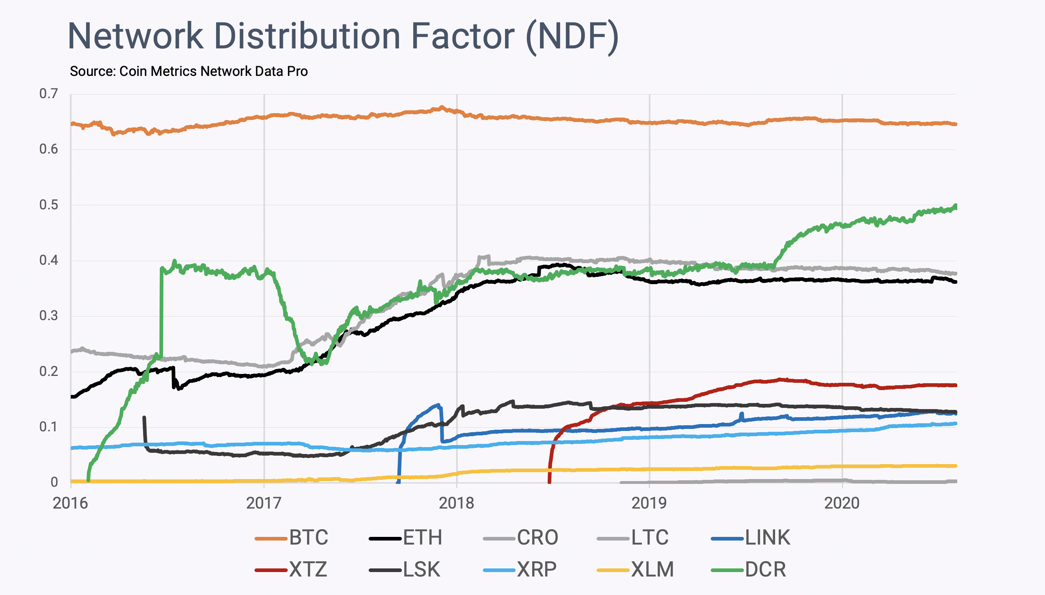

Supply distribution can also be assessed via the Network Distribution Factor (NDF). The metric encompasses a broader economic cohort. To calculate it, one computes the total number of coins on addresses containing more than 0.01% of the total supply, then divides by the total supply of coins.

Again, Bitcoin has the highest NDF. Decred, Litecoin and Ethereum follow.

We have only touched on the questions surrounding dispersion metrics for monetary mass. Nevertheless, SER and NDF offer a glimpse into Bitcoin’s unique supply distribution. In the future, we hope to continue research in this area using more sophisticated heuristic approaches.

***

The vibrant history of Bitcoin as the first successful crypto asset was accompanied by a high velocity of its supply during the 2010s. The mechanism of fair emission of the first cryptocurrency fosters even distribution of coins, as miners have a natural incentive to reallocate new supply.

The combination of these factors has made Bitcoin the most evenly distributed crypto asset, as confirmed by SER and NDF metrics.

Subscribe to ForkLog news on Telegram: ForkLog FEED — the full news stream, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!