Opinion: Institutions absorb bitcoin-whale selling as price edges toward $20,000

Grayscale Investments bought 7,188 BTC into its Bitcoin Trust in a single day. During November, 55,015 BTC were purchased, nearly twice the amount mined by miners in the period (27,881 BTC).

.@Grayscale Bitcoin Trust bought near 2 times total #BTC mined during Nov 2020. $BTC #BTC pic.twitter.com/GFJTwPR9Mk

— Coin98 Analytics (@Coin98Analytics) December 3, 2020

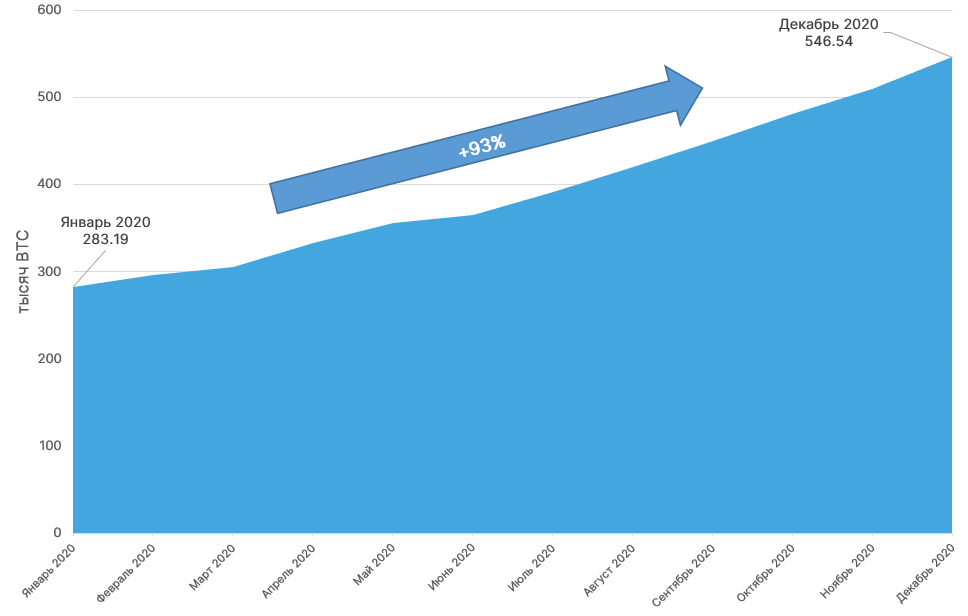

From January to date, Grayscale Bitcoin Trust’s assets rose from 283.19 thousand BTC to 546.54 thousand BTC. For comparison, at the end of November the figure stood at 509.58 thousand coins.

Data: Grayscale, ForkLog.

On December 3, the total value of crypto assets under management by Grayscale Investments reached $12.6 billion. In the Grayscale Bitcoin Trust (GBTC), assets exceeded $10.6 billion.

12/03/20 UPDATE: Net Assets Under Management, Holdings per Share, and Market Price per Share for our Investment Products.

Total AUM: $12.6 billion$BTC $BCH $ETH $ETC $ZEN $LTC $XLM $XRP $ZEC pic.twitter.com/zse0K5NbZY

— Grayscale (@Grayscale) December 3, 2020

Beyond institutional buyers, PayPal users and Square’s Cash App could push Bitcoin to new highs. Pantera Capital analysts at the end of November estimated PayPal purchases at about 40%, and those of Cash App at about 70% of the volume of newly minted bitcoins.

Ki Young Ju, head of the CryptoQuant analytics service, noted inflows of bitcoins to exchange wallets. The downward trend observed over the previous months has been broken.

According to the analyst, a similar pattern was seen in July. Then the price attempted to hold above $10,000 but ultimately moved sideways for a month.

4/ All exchanges reserve is no more going downward trend. This much uptick also happened on July 28 when the price was breaking 11k. The price got corrected after going sideways for a month. pic.twitter.com/g57gaSoGU5

— Ki Young Ju 주기영 (@ki_young_ju) December 3, 2020

An analyst believes that a return of bitcoin whales to selling will push back breaking the $20,000 psychological level until year-end.

5/ I’m long-term bullish, but I think it’ll go sideways for a few days or get corrected. I think we can’t break 20k in the short-run. I expect it’ll break 20k at the end of this year. (I’m not a PA trader tho)

In conclusion, OG whales stopped HODLing and I’m short-term bearish.

— Ki Young Ju 주기영 (@ki_young_ju) December 3, 2020

Shortly before the November 30 all-time high update, Ki Young Ju reported that there was a signal of a possible dump by large holders of the first cryptocurrency.

Such a scenario was not ruled out, JPMorgan’s chief strategist Nikolaos Panigirtzoglou, who saw a threat in the actions of quantitative-investing crypto funds.

Subscribe to ForkLog news on Telegram: ForkLog FEED — full news feed, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!