Dune Analytics: DEX trading volumes fall for two consecutive months

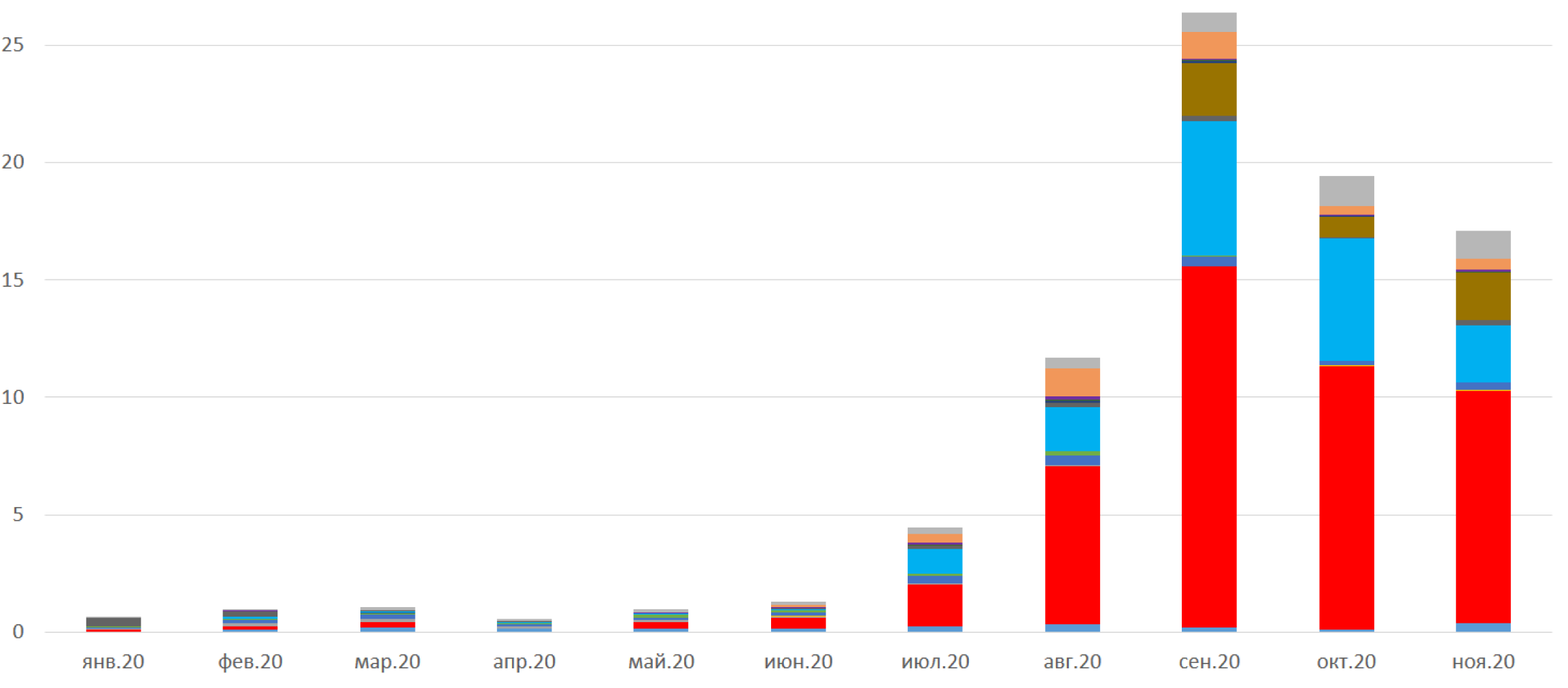

The aggregate trading volume on decentralized exchanges (DEXs) has declined for two consecutive months, according to data from Dune Analytics.

September’s DEX turnover exceeded $25 billion, before easing. By November the figure stood at $17.07 billion.

Data: Dune Analytics, analytical ForkLog report for November.

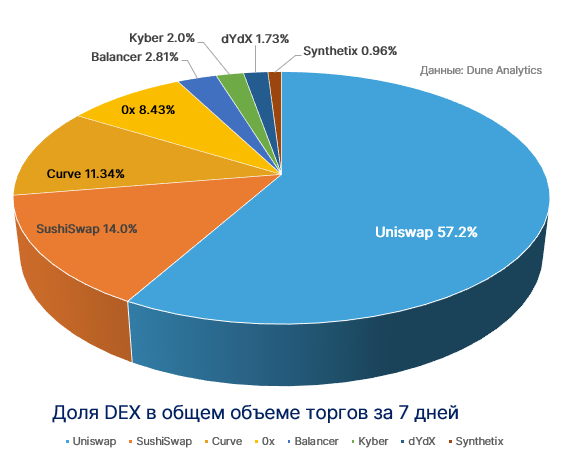

Uniswap remains the undisputed leader with a 57.2% market share (as of 7 Dec 2020). The second-largest by this metric is SushiSwap.

Data from Dune Analytics as of 7 Dec 2020.

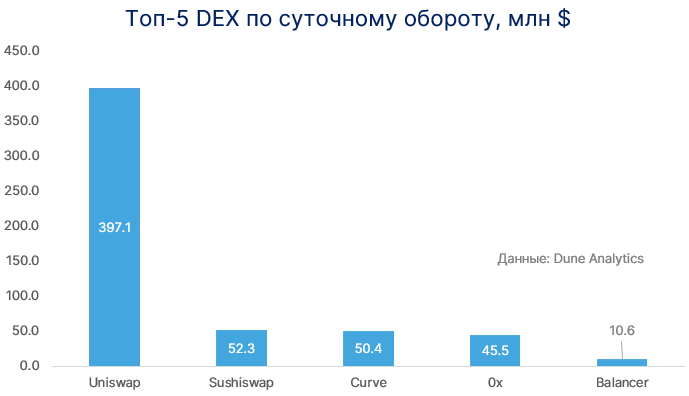

The diagram below shows the top five DEX by daily trading volume.

Data from Dune Analytics as of 7 Dec 2020.

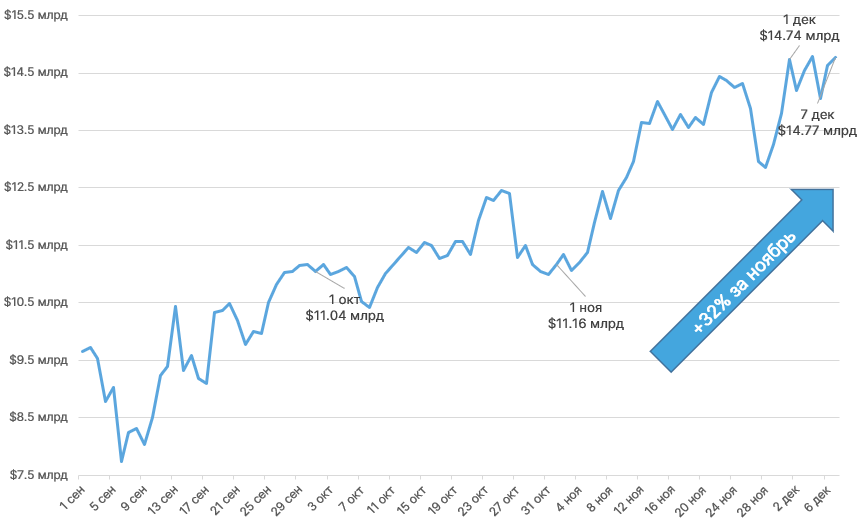

Despite the activity on DEXes easing, the broader DeFi market is gradually expanding, as evidenced by the dynamics of the value locked in DeFi smart contracts (TVL).

Data: DeFi Pulse, analytical ForkLog report for November.

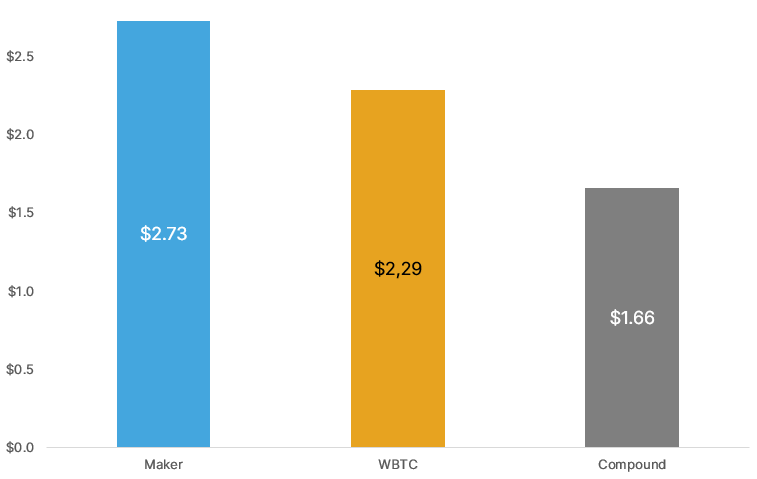

The issuer of the stablecoin DAI and the Maker lending service lead TVL. They are followed by the tokenised-Bitcoin platform WBTC and the Compound project.

Data: DeFi Pulse.

Uniswap, with a TVL of $1.33 billion, sits in fifth place on the DeFi Pulse rating.

Earlier ForkLog reported that most non-custodial exchanges face security issues.

More information on DEX and the DeFi sector in ForkLog’s November report.

Subscribe to ForkLog news on Telegram: ForkLog FEED — all the news, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!