DeFi Bulletin: 1inch launches governance token as Uniswap community makes its first decision

The decentralized finance (DeFi) sector continues to attract heightened attention from cryptocurrency investors and traders. ForkLog has gathered the most important events and news of the last three weeks in a digest.

Value of locked assets, market capitalization and DEX volumes

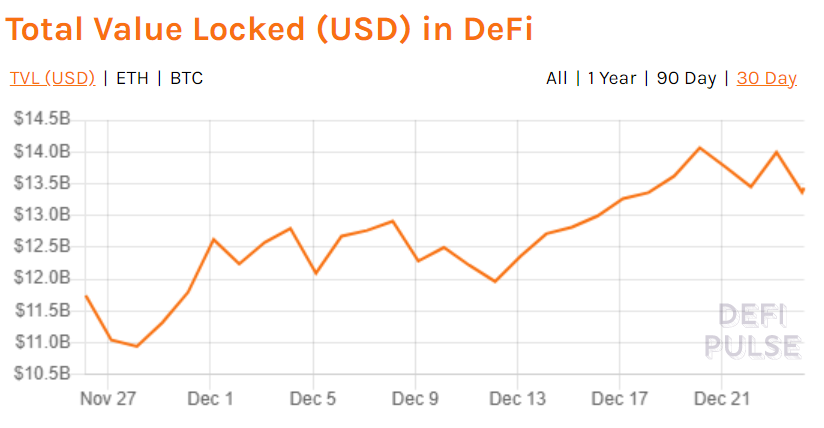

The total value locked in DeFi protocols on December 20 exceeded $14 billion, reaching an all-time high according to adjusted metrics from DeFi Pulse. As of December 24, the figure had fallen to $13.4 billion.

Data: DeFi Pulse.

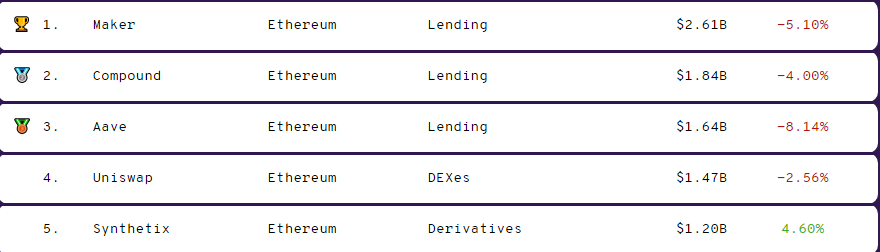

Maker retains leadership with $2.61 billion in locked assets — the dominance index stands at 19.54%. The top trio remains unchanged — Compound and Aave continue to lead.

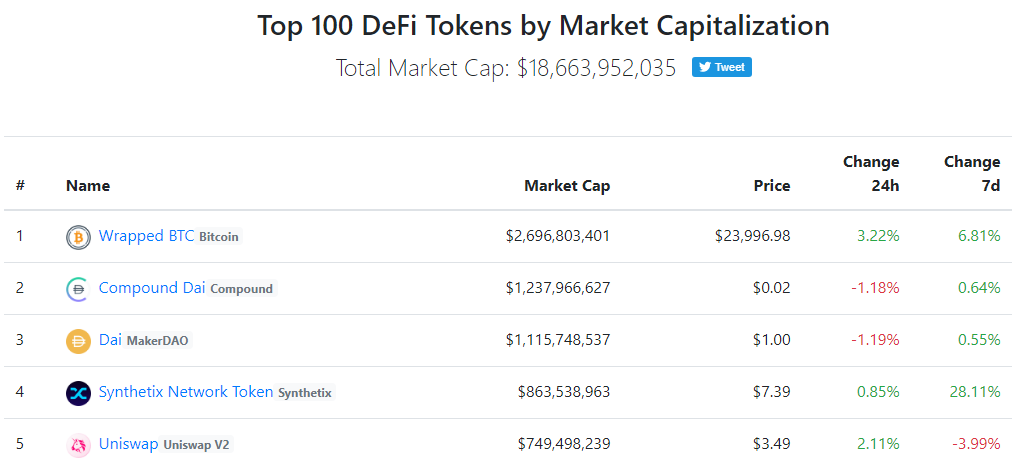

The market capitalization of DeFi tokens rose to $18.66 billion. Of the roughly $600 million increase in the metric over recent weeks, about $400 million was supplied by the sector’s top-market-cap asset — Wrapped BTC.

Data: DeFi Market Cap.

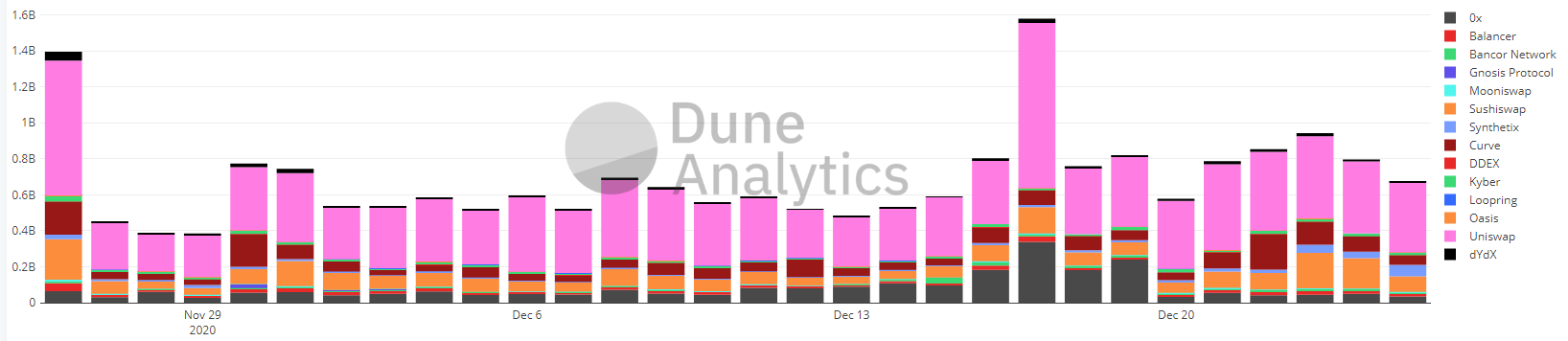

Trading volume on decentralized exchanges (DEX) over the last 30 days amounted to $20 billion. Compared with the previous analogous period, the figure rose 19%.

Uniswap remains the undisputed leader, the aggregate trading volume on which has surpassed a record of $50 billion since its inception.

Daily trading volume on Uniswap. Data: DuneAnalytics.

DeFi project 1inch released the eponymous governance token

The liquidity aggregator from decentralized exchanges 1inch released the token of “instant governance” 1INCH.

It is used solely within the ecosystem and allows the community to vote on protocol settings, ForkLog representatives said.

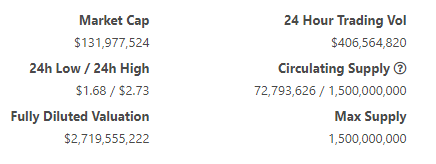

The total issuance is 1.5 billion 1INCH. Initially, 6% will be in circulation. 30% of the tokens are allocated to the community, 14.5% to the development fund. They will be distributed over four years.

The tokens will be issued to participants of two liquidity mining programs and wallets that interacted with the aggregator before 00:00 UTC on December 24 and met one of the conditions:

- at least one trade before September 15;

- trades totaling at least $20;

- at least four trades.

Tokens can be claimed on the 1inch site by connecting your wallet via WalletConnect or another option.

According to Dune Analytics at the time of writing, more than 67,172,592 1INCH have been distributed among 26,174 wallets. This amounts to 75% of the planned airdrop volume.

The token trades around $1.6, although at its peak it reached $2.73, according to CoinGecko.

Data: CoinGecko.

Launch of DeFi project by banker Alexander Lebedev

The developers launched the DeFi project InDeFiEco, which positions itself as an “independent decentralized financial ecosystem”. Earlier, it attracted investment from Russian entrepreneur and banker Alexander Lebedev.

According to the white paper, the project will offer traditional financial institution services through the mechanics of cryptocurrency projects and decentralized finance. The ecosystem will include the following products:

- cryptocurrency-backed loans;

- crypto deposits with fixed interest rates;

- yield farming;

- insurance;

- stablecoins;

- derivatives.

InDeFiEco operates on the Ethereum blockchain. At its core is a governance smart contract that defines the rules of interaction among participants. It will also ensure borrowers’ compliance with a given jurisdiction while fully observing AML/KYC procedures, the documentation states.

Only IDF token holders will be able to influence the governance model. The IDF issuance will be 10 million. 70% will be distributed among ecosystem participants, the remaining 30% will be shared by the founders, the project team and the reserve fund.

Hacker breached founder’s personal address of a DeFi protocol for $8 million

On December 14, an unknown malicious actor withdrew more than $8 million in native NXM tokens from the personal wallet of Nexus Mutual founder Hugh Karp.

Nexus Mutual explained that the hacker was able to install a compromised version of the MetaMask application on Karp’s personal computer, which tricked him into approving the transaction.

As a result, 370,000 NXM (around $8.22 million at the time of writing) were transferred in a single transfer to an address controlled by the attacker. He is a member of the mutual insurance society and completed KYC 11 days ago.

The Nexus Mutual team assured that the protocol itself was not harmed and user funds are safe. It continues the investigation and has not yet identified the hacker.

Hugh Karp reached out to the attacker via Twitter, calling the hack “a very nice trick.” He emphasized that cashing out such an amount of NXM would be problematic, and offered a $300,000 bounty and the end of the investigation in exchange for the return of the funds.

To the attacker. Very nice trick, definitely next level stuff.

You’ll have trouble cashing out that much NXM.

If you return the NXM in full, we will drop all investigations and I will grant you a $300k bounty.

— Hugh Karp 🐢 (@HughKarp) December 14, 2020

Analyst from The Block Igor Igamberdiev found that the hacker used the renBTC protocol to withdraw 137 BTC to two addresses.

«Twelve hours have passed, but it seems the hacker will not return anything. Instead, he used renBTC to move funds to two addresses,» he wrote.

Igamberdiev also noted that one of the addresses is linked to the Huobi exchange, as is the attacker’s Ethereum address.

On December 16, the hacker demanded a ransom of 4,500 ETH (around $2.6 million at the time). He left a comment via a transaction and added three addresses that hold assets worth more than $10 million.

Karp replied that one of the addresses belongs to the Nexus Foundation, and that he does not own that amount of cryptocurrency.

Uniswap community first reached quorum in the platform’s third vote in history

On Thursday, December 24, the third vote on the Uniswap decentralized exchange system concluded, in which the proposed changes were approved for the first time.

Community members weighed in on the ecosystem development grants program using UNI tokens. More than 60 million tokens were voted for the initiative, 9,300 against.

In the initial stage, funding targets small projects, including hackathons. In the future, grants are planned to be awarded to more substantial initiatives.

The program’s maximum quarterly budget is $750,000. In a subsequent vote in six months, the community will decide on its extension.

The Uniswap community’s votes on the two previous proposals failed to achieve the required number of votes.

DeFi project Warp Finance lost $7.7 million as a result of an attack

The decentralized Warp Finance platform suffered an attack using a flash loan eight days after launch. The team estimated losses at $7.7 million in USDC and DAI stablecoins.

Warp Finance launched on December 9. The protocol enables creating capital markets for liquidity provider tokens. The warp.finance smart contracts have undergone the Hacken audit.

Security expert Emiliano Bonassi noted that the attacker used a sophisticated lending scheme involving Uniswap and the DeFi platform dYdX.

DeFi project Compound to launch cross-chain protocol

The lending DeFi project Compound presented a whitepaper detailing Compound Chain — a new protocol designed to enable interoperability of assets from different blockchains.

«A distributed registry capable of moving value and liquidity between peer-to-peer ledgers,» the document states.

Within Compound Chain, users will be able to deposit and borrow assets from various systems, whether Polkadot or Tezos. The native token CASH will be used to pay fees in the new system.

Governance of Compound Chain will be conducted by the community via COMP tokens on Ethereum.

A testnet launch for the new project is planned for early 2021.

DistX token collapsed after creators emptied liquidity pool

The DistX platform for conducting token sales saw its capitalization fall from $1.5 million to less than $15,000 within a day after the project closed and withdrawal of its creators’ funds from the Uniswap liquidity pool.

Market participants saw this as another example of the so-called rug pull. The term denotes the practice of inflating the value of a token in a liquidity pool with a subsequent sharp withdrawal of funds, leaving other providers with devalued assets.

The creators promised token holders not only access to participate in token sales, but also 2% of the volume of each issue if a threshold is reached.

At launch in August, DISTX rose to $0.25.

As of December 26, DISTX is valued at less than $0.0005, with a capitalization barely above $15,000 (CoinGecko).

ForkLog also wrote:

- The DeFi project Opium Protocol will launch an insurance and staking service.

- Polychain Capital led a private token sale for a “cryptographically transparent” DeFi project.

Subscribe to Forklog’s channel on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!