Opinion: The U.S. stock market awaits a crash reminiscent of the dot-com bust

The U.S. stock index, the S&P 500, hit a new high, while the trailing twelve-month profits of its components fell to their lowest since 2009. According to analyst Michaël van de Poppe, such a disconnect between stock prices and the real economy signals the groundwork for a bear market.

This pattern was previously characteristic of the dot-com bubble and in the run‑up to the Great Depression of the 1930s.

This chart shows the big discrepancy between the real economy and the current values of the stock market.

A crisis is inevitable.

It literally is going to occur in the next years and it’s going to be as heavy as the 1930s.

The last time we had such a gap; 2000 tech bubble. pic.twitter.com/USpIKfb5jt

— Michaël van de Poppe (@CryptoMichNL) December 29, 2020

The expert says the two curves will converge sooner or later.

They will go back to reality indeed.

— Michaël van de Poppe (@CryptoMichNL) December 29, 2020

One explanation for the ‘dislocation’ between the S&P 500’s dynamics and the real economy is the policy of quantitative easing, implemented by the Fed and other leading central banks around the world.

Since August, and to the present day, the Federal Reserve has been purchasing assets worth $120 billion a month. At the December meeting, members of the rate‑setting committee confirmed that the quantitative easing programme would continue until full employment is achieved and inflation returns to 2%. In August, Federal Reserve Chair Jerome Powell stated that the central bank was prepared to allow inflation to rise above the 2% target.

COVID-19, the Fed’s printing press and uncertainty: why now is the time to pay attention to Bitcoin

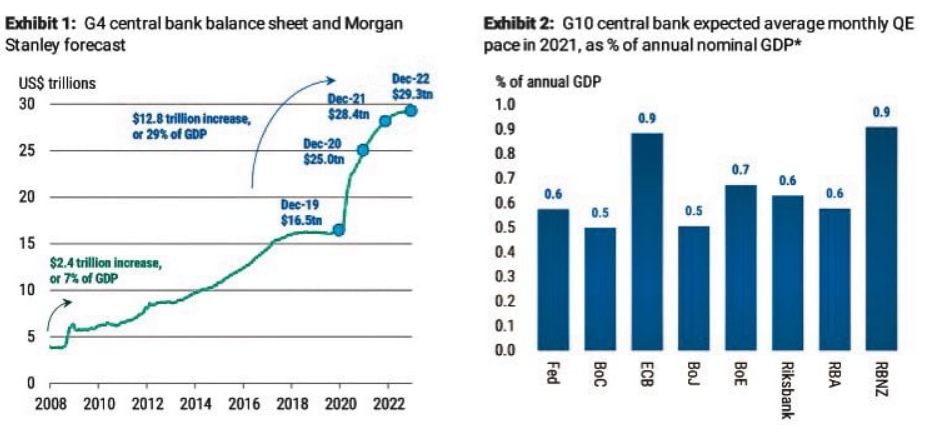

In a new Morgan Stanley report, by December 2022, the balance sheets of the Federal Reserve, the European Central Bank, the Bank of England and the Bank of Japan are forecast to grow by $12.8 trillion, or 29% of their nominal GDP. In another illustration, analysts note that the Fed is far from being the “champion” — relative to nominal GDP the ECB and the Bank of New Zealand are printing money faster.

Data: Morgan Stanley.

The ultra-accommodative policy distorts pricing on financial markets and nudges investors to take on more risk in their positions. According to FINRA, the size of margin positions at the end of November reached a record $722.1 billion.

In crypto circles, central bank policy is associated with the meme «Money printer go BRRR». It hints at the Fed’s aggressive money printing during the coronavirus crisis. The meme laid the groundwork for Grayscale Investments’ August‑launched advertising campaign.

Earlier, the MicroStrategy CEO, who has invested over $1 billion in cryptocurrency, explained that moving funds into Bitcoin was a reaction to rising devaluation risks.

Subscribe to ForkLog’s news on Telegram: ForkLog FEED — the full news stream, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!