Tether Mints a Record $2 Billion of USDT in One Week

The issuer of the largest stablecoin by market cap, Tether, has increased the supply of USDT by $2 billion over the past week. The total number of coins in circulation reached 24.4 billion.

According to the Tether website, $14.34 billion was issued on the Ethereum blockchain, $9 billion on Tron, with the remainder on Omni, EOS, Algorand, the Liquid sidechain and the Simple Ledger Protocol on Bitcoin Cash.

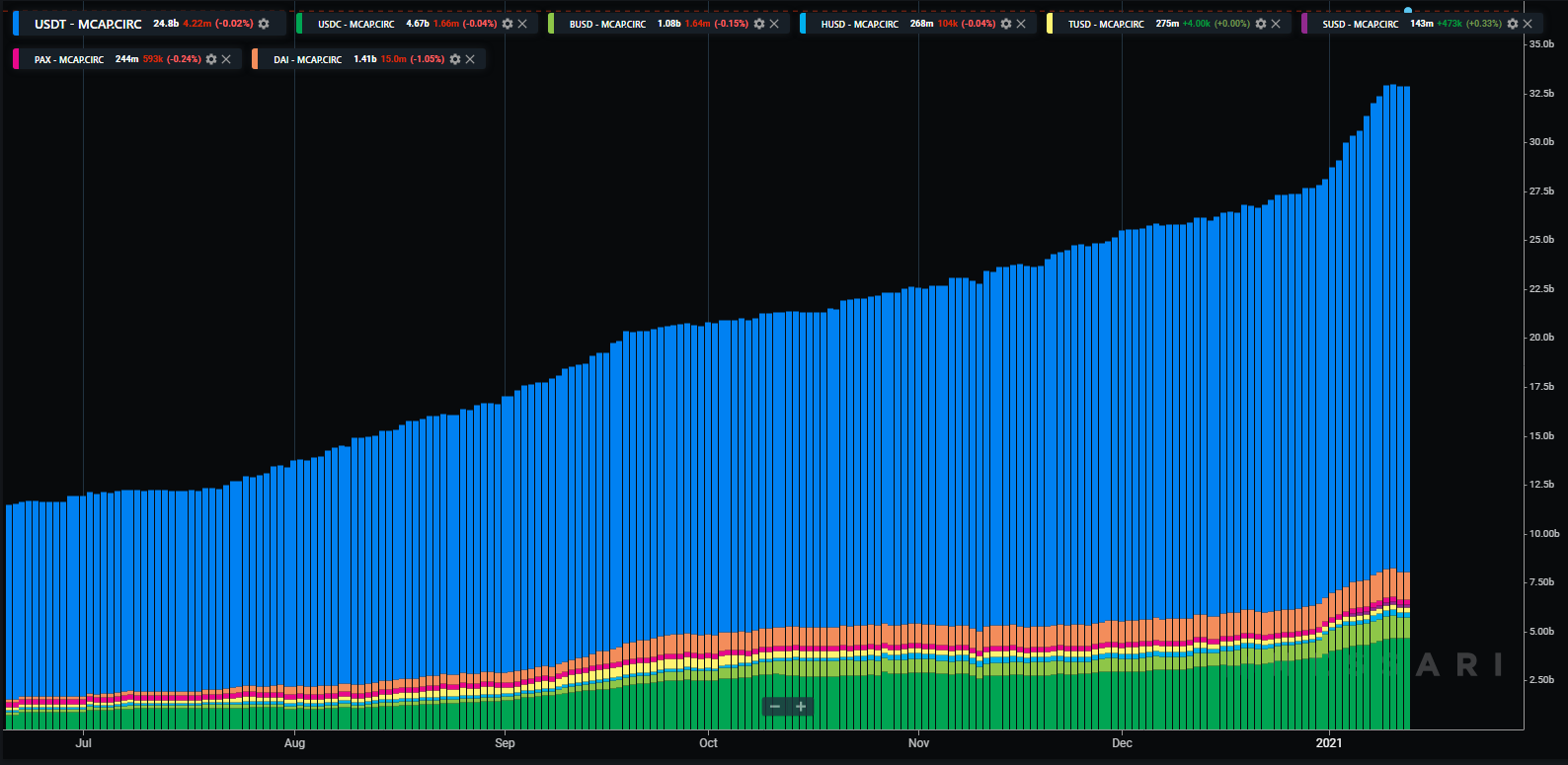

According to Messari, the total market capitalization of all stablecoins rose to $32.9 billion. The next-largest stablecoins after Tether, USDC and DAI, were $4.67 billion and $1.41 billion respectively.

Data: Messari.

The Alameda Research trader Sam Trabucco explained the sharp rise in Tether’s issuance as a result of its high liquidity, which facilitates access to the cryptocurrency market.

“Some people do not trust local banks or currencies. The growth is also driven by aggressive conversion of Bitcoin into USDT and back, which moves the stablecoin’s price away from its pegged currency in either direction,” he added.

Technical Director Paolo Ardoino pointed to the rise in USDT’s capitalization as a reason, citing purchases by big investors like MicroStrategy and Ruffer Investment. To this end, they use OTC platforms, expanding the supply of the stablecoin.

“Among Tether’s clients are all major over-the-counter platforms and high-frequency trading firms. When taking buy orders for the first cryptocurrency, they convert client funds into USDT and distribute buying pressure across all available liquidity sources, boosting demand for the stablecoin,” he explained.

Trabucco confirmed Ardoino’s words, noting “increased activity” on OTC platforms in recent days. As an additional factor, he mentioned the emergence of new uses for USDT as collateral in various derivative products.

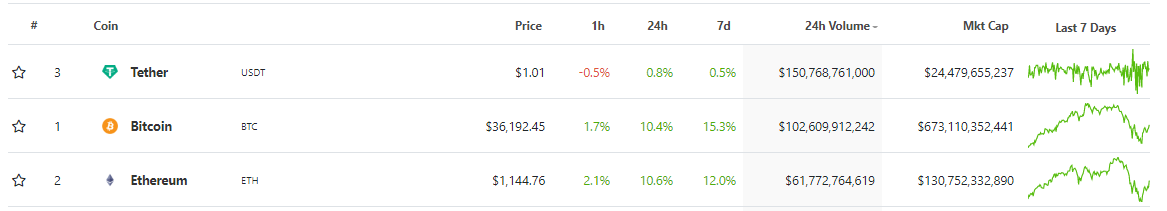

According to CoinGecko, over the last 24 hours the turnover of the largest stablecoin exceeded that of the leading cryptocurrency by about 1.5x — $150.8 billion versus $102.7 billion.

Data: CoinGecko.

In 2019, as part of the New York Attorney General’s lawsuit against Tether, the company’s chief legal officer stated that USDT was backed by fiat reserves only 74%.

Recently, Paolo Ardoino noted full backing of USDT, adherence to all KYC/AML measures and improved transparency in 2021.

— tether is backed

— working towards increased transparency in 2021, stay tuned!

— strong KYC/AML

— weekend purchases explained

— after 15th Jan, business as usualAnd much more. Hopefully we can a round 2 soon to cover missing topics. https://t.co/YMzxWV3McU

— Paolo Ardoino (@paoloardoino) January 10, 2021

Earlier, The Block analyst Larry Chermak described the rise in Tether’s popularity as one of four factors in the cryptocurrency market’s maturing over the last three years.

Follow ForkLog news on Facebook!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!