Trader Outlines Condition for Bitcoin to Reach $50,000

A practicing trader and founder of the Crypto Mentors project, Nikita Semov, explains the current market situation.

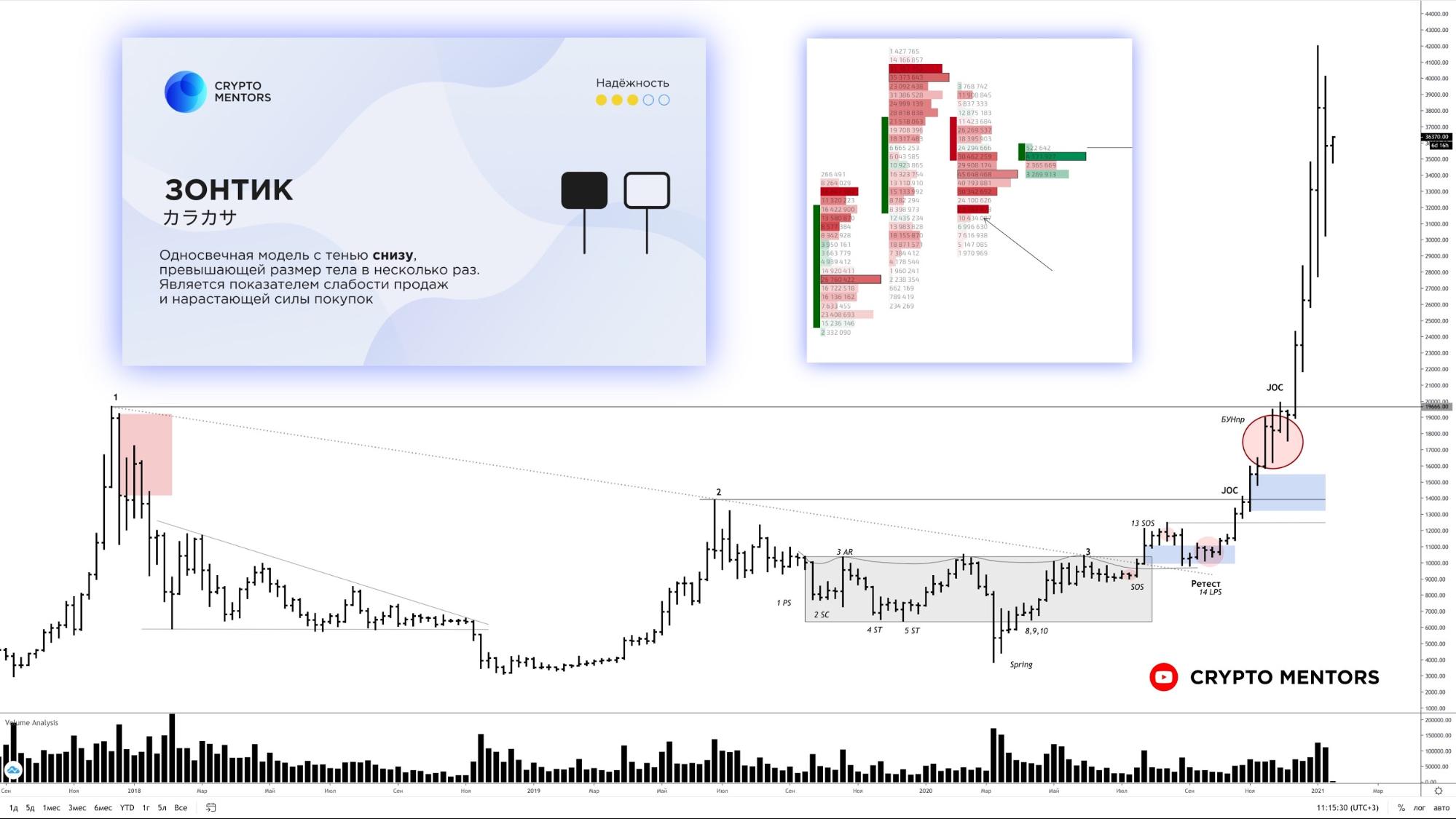

Bar-by-bar analysis of the weekly time frame

History on the markets always repeats itself. This formation has existed before, and we wrote about it, accurately predicting the bar’s direction (note the red circle).

Bar-by-bar analysis. The seller’s spread according to the VSA method is small relative to buyers. This indicator signals weakness in selling. On moderate-volume in the matrix, they could not push the price significantly lower.

The bar structure is testing, with a large buyer in the tail. The expectation from such bars is always for a buying bar on the next move. We conclude that the week will close higher. The delta clearly shows support from a limit buyer (ineffectiveness of market selling is evident).

Japanese candlesticks. A single-candle ‘umbrella’ pattern has formed, indicating buyers’ strength in the moment. We expect a bullish candle this week.

Bar-by-bar analysis of the daily time frame

The bar-by-bar analysis of Bitcoin on the daily chart over the past week is telling: there is no evidence of confident selling. Most likely, the bears’ initiative has been exhausted, the correction is in place, and a resumed buying is expected in the near term.

We do not recommend opening shorts, as such a short position would be against the buying volume located in the tail of bar A1.

Analyzing through the lens of clusters reveals the opportunity to unfold the chart and view it from within. This market view is, so to speak, a ‘grail’ — a trader using it can gauge metrics others cannot. At the lows, a massive limit buyer is absorbing all dips, so the long side is preferred in the medium term.

Price Action and VSA

The price contracted into a triangular volatility range, and after contraction, as is known, an expansion follows. Comparing points [1] and [2], we see buying activity from the lower trend triangle with increased volume and momentum.

We expect the true breakout from this pattern to follow the direction of the trend. Volumes are distributed toward the lows; this again confirms the plan of large capital to buy Bitcoin below $33,000. A firm hold above $40,500 would provide an excellent entry point for a long with potential to move toward $50,000.

Horizontal volumes and deltas analysis

From the current standpoint of horizontal volumes, the upward structure remains supported. This is evident from the defense of key buying points.

Despite the tepid reaction from the POC of the latest accumulation, the only thing holding us from above, as noted in previous analytics, is the $40,500 level; yet even here the reaction is not particularly robust, which led to a narrowing of the range.

Nevertheless, a detailed view of the clusters yields a clearer answer to what is happening. At $40,000 there were no signs of fixing or resting volumes. Meanwhile, the main mass of point volumes has moved upward and remains defended.

From the delta perspective we observe a completely organic alternation of control. Most importantly, there is no aggressive selling at the moment. The cumulative delta has been negative for the third month running, which can only mean one thing — an incredibly strong limit-order player who is willing to buy Bitcoin even at seemingly high levels.

Subscribe to the Forklog channel on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!