Glassnode experts identify signs that Bitcoin’s correction is ending

Glassnode analysts, based on two on-chain metrics, forecast the end of the correction and the formation of a new bullish impulse for Bitcoin.

Glassnode analysts, based on two on-chain metrics, forecast the end of the correction and the formation of a new bullish price impulse for Bitcoin.

Despite briefly dropping below $30k over the past week, on-chain fundamentals for $BTC remain strong, indicating room for further growth.

Meanwhile, the rest of the crypto market is growing even faster than #Bitcoin.

Read more in The Week On-Chain 👇https://t.co/i6d9W4tTKy

— glassnode (@glassnode) January 25, 2021

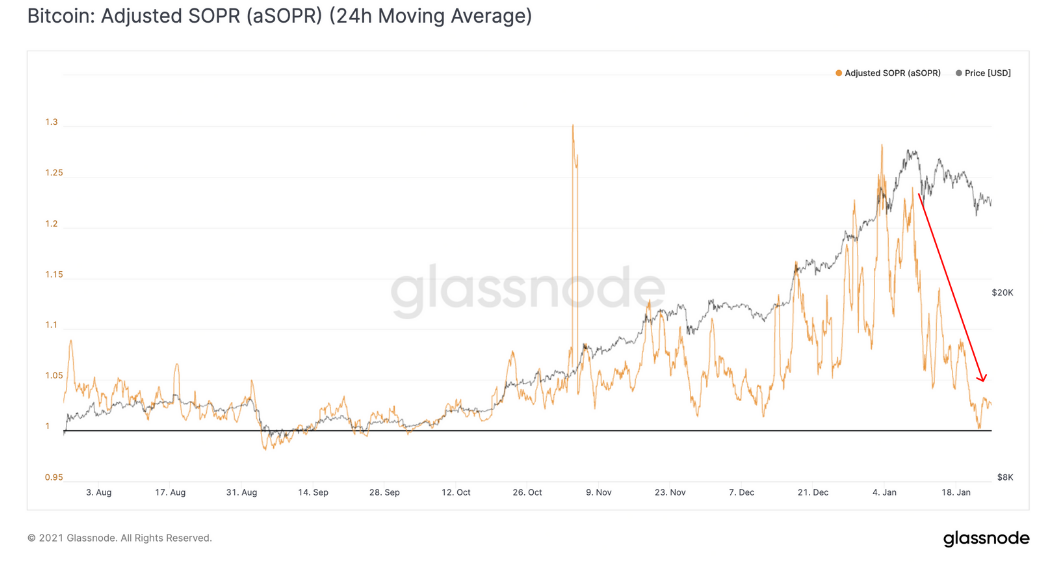

One such signal was the return of the adjusted Spent Output Profit Ratio (aSOPR, Adjusted Spent Output Profit Ratio) to neutral levels.

The SOPR metric is calculated as the ratio of the dollar-denominated [simple_tooltip content=’учитывается цена каждого биткоина на момент последней ончейн-транзакции‘] realised value to the cost at the time of creation of the output, and can be used to identify extremes. According to the description on Glassnode’s site, the adjusted measure excludes from calculations all outputs with a “life” duration of less than an hour.

“The 24-hour moving average of aSOPR has returned to unity after rising for several months. In other words, the average investor can no longer sell coins at a profit. A move below the neutral level would indicate selling at a loss, which is unlikely given the current phase of the market,” the researchers wrote.

Data: Glassnode.

For the most part, SOPR oscillates around unity. Along the Bitcoin rally that began in October, the metric pushed into a range above 1.25. In a bull market, values rarely dip below the neutral level, as investors are not inclined to sell at a loss.

According to Whalemap, the current SOPR readings favour optimists relative to previous bull cycles.

This is how HODLer SOPR looks for previous cycles. We are nowhere near those values now pic.twitter.com/cg9QypMmsl

— whalemap (@whale_map) January 25, 2021

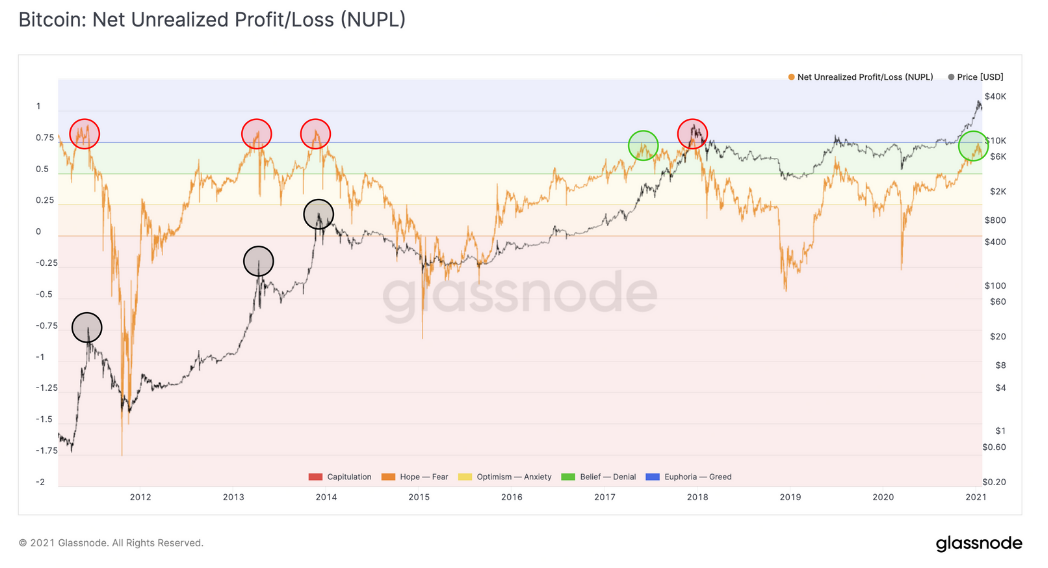

Another tracked Glassnode metric — the difference between unrealized profits and losses based on the latest coin movement (NUPL, Net Unrealized Profit/Loss) — has approached the boundary between the “belief” and “euphoria” zones.

Historically, an uptick in NUPL has preceded the formation of a global top (periods on the chart are marked with red circles). In mid-2017 the reversal occurred after Bitcoin’s price rose another 900%. In January the indicator did not cross into this critical zone, which does not rule out a renewed rally.

Data: Glassnode.

Earlier in December, Glassnode’s chief technology officer Raphael Schulze-Kraft suggested that the price of Bitcoin could exceed $200,000.

In January, CryptoQuant’s CEO Ki Young Ju stated that institutions will not allow the price of the leading cryptocurrency to fall below $28,000, as many have invested near that level.

Follow ForkLog’s news on Twitter!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!