WBTC, renBTC and HBTC — What Bitcoin on Ethereum Is and Why It Matters

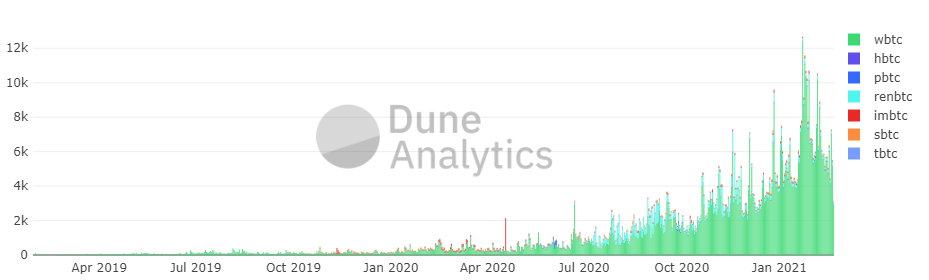

The tokenised Bitcoin segment is growing rapidly. Projects like WBTC and renBTC have long since secured listings on major exchanges and have become familiar to many users.

That was not always the case. The first mentions of ‘wrapped in Ethereum’ bitcoins appeared about two years ago. Back then some members of the community voiced confusion, calling them ‘just another useless shitcoin’.

During the bear market, at the turn of 2018-2019, few people knew about decentralized finance (DeFi). Only a year later did neologisms like yield farming and liquidity mining appear.

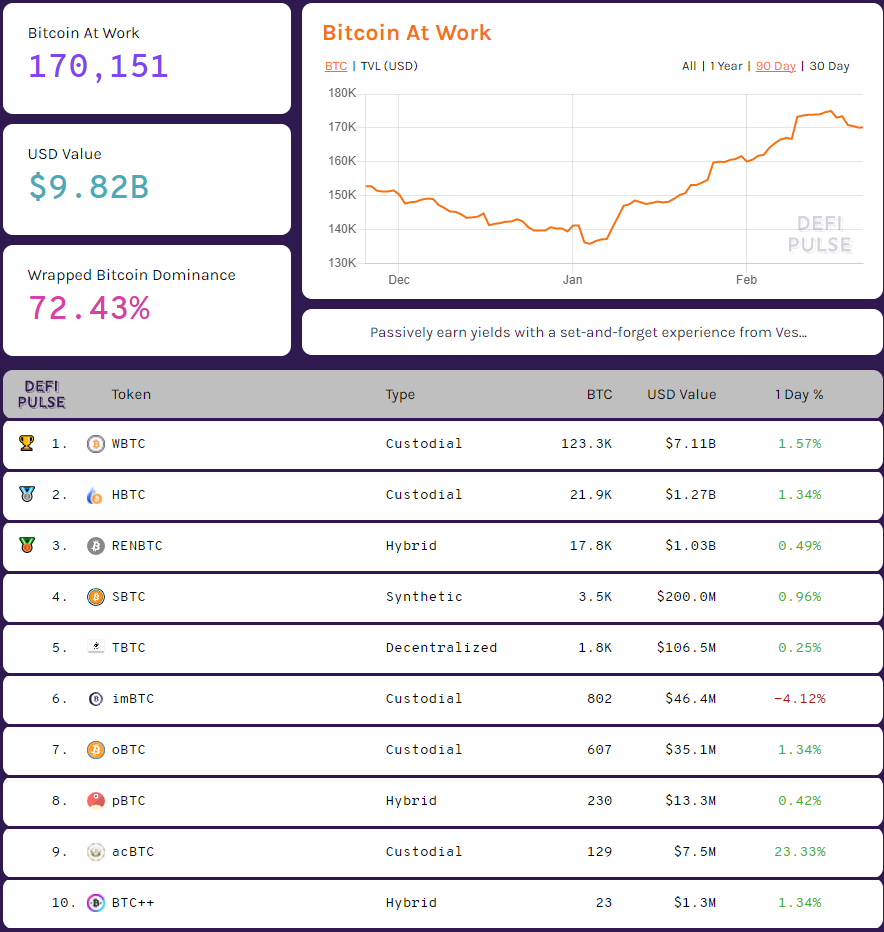

Unexpectedly for many skeptics, over a year and a half the capitalization of the first ‘Bitcoin on Ethereum’ — WBTC — grew from virtually zero to more than $7 billion. Various implementations of such assets emerged, forming a whole market segment with growing competition.

We take a closer look at why tokenised Bitcoins are needed and what their prospects are.

- Since the start of 2020, the market supply of Wrapped Bitcoin (WBTC) has grown more than 200-fold.

- In the DeFi boom, other projects — tBTC, renBTC and HBTC — appeared. Competition in the segment has intensified.

- All ‘Bitcoin on Ethereum’ assets are pegged to the price of digital gold at 1:1, but the approaches to issuing and collateralising assets differ substantially.

The Rise of Bitcoin on Ethereum

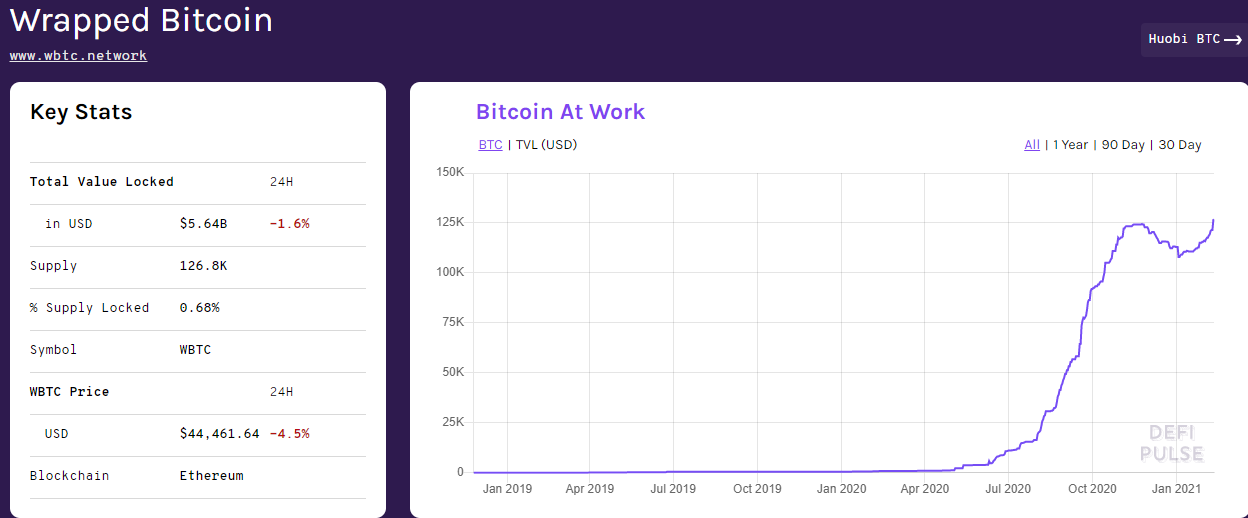

WBTC, launched in early 2019, demonstrated exponential growth in the second half of 2020 amid the DeFi boom.

The WBTC project benefits from the [simple_tooltip content=’Advantages enjoyed by the pioneer in the new market segment. They can be expressed in market share, profits, number of users, volumes, etc.’]advantages of the pioneer[/simple_tooltip] — its share in the segment stands at 72.43% (as of 21.02.2021).

For the later projects — HBTC and renBTC — the overall market value has already surpassed $1 billion.

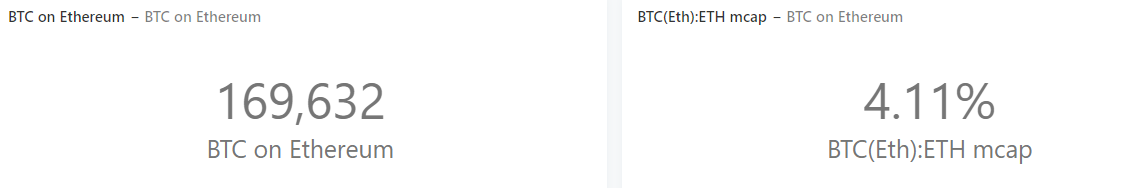

According to Dune Analytics, a total of 169,632 tokenised bitcoins are in circulation (as of 21.02.2021). This equates to 4.11% of Ethereum’s market capitalization and 0.91% of Bitcoin’s total market value.

Against the backdrop of rapid growth in the segment, the number of trades involving ethBTC on DEXes is steadily increasing.

Let us briefly review the main features of the most popular ethBTCs.

Synthetic, Centralised and Moving Toward Decentralisation

There are three main models of the ‘Bitcoin on Ethereum’ tokens:

- centralised — WBTC and HBTC, where custodians are BitGo and Huobi respectively;

- systems governed by smart contracts — tBTC;

- synthetic — sBTC from the decentralised derivatives platform Synthetix.

Wrapped Bitcoin (WBTC) is an ERC-20 token backed 1:1 by Bitcoin.

The project was launched with Kyber Network, Ren (formerly Republic Protocol) and BitGo. WBTC has a number of partners, including Compound, Maker, Blockfolio, Uniswap, CoinGecko, Aave and 0x.

These companies are certified merchants — they can issue WBTC for verified users and burn tokens.

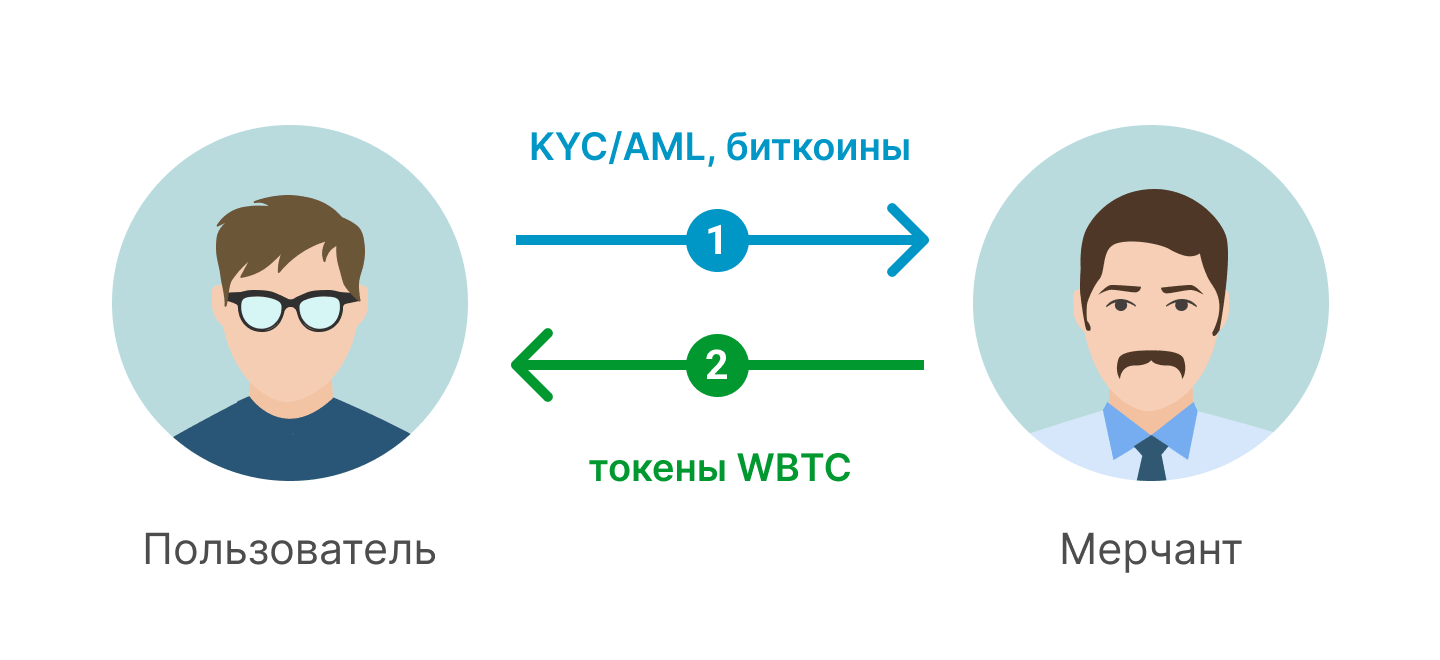

“To obtain WBTC, the user requests tokens from a merchant. The merchant verifies the user’s identity in accordance with KYC/AML procedures. After that, an exchange is performed, during which bitcoins are sent to the seller and WBTC is sent to the user from the merchant”, — states the Wrapped Bitcoin project site.

To swap BTC for WBTC, merchants initiate the token issuance by providing a Ethereum address to a custodian contract. The merchant then sends bitcoins to the custodian (BitGo). The custodian issues WBTC and sends them to the merchant.

As a result, the original bitcoins stay with the custodian, and the total supply of WBTC increases in line with the amount of BTC supplied by users.

If BTC needs to be withdrawn, the merchant initiates the corresponding procedure and burns WBTC, sending them to a special contract. The custodian approves the burn and releases the bitcoins to the merchant.

“The amount to be burned is deducted from the seller’s balance, and the WBTC supply is reduced”, — explains the project site.

DeFi users can acquire WBTC on various exchanges, including Uniswap. They can also use the wbtc.cafe service built on RenVM, which enables BTC-to-WBTC conversion in a few clicks.

Everyone can verify WBTC collateralisation with the base asset using the Proof of Assets tool on the project site. There is also an option to see who among the merchants burned or issued coins into the market.

The project dominates its segment. With a market cap of $7.1 billion, WBTC sits on the 14th place in CoinGecko’s ranking (as of 21.02.2021).

The next by market cap after WBTC is the HBTC token from Huobi exchange. Its issuance occurred relatively recently — in February 2020. By now, the total market value of this asset has exceeded $1.2 billion.

“Launched by Huobi Global and deployed on the Ethereum network, Huobi BTC (HBTC) is intended to support the growth of the decentralised market by introducing Bitcoin, the largest and most liquid asset, into the DeFi ecosystem”, says Huobi Global.

The project ranks 62nd on CoinGecko.

renBTC is technically more complex and less centralised than the competitors discussed above.

It uses the open RenVM protocol, which enables asset swaps across chains with the help of the RenBridge tool. In addition to Bitcoin, the protocol supports Bitcoin Cash, Zcash and other coins.

RenVM rests on a network of decentralised nodes (Darknodes) and the Byzantine Fault Tolerance algorithm. The system also employs the Shamir’s Secret Sharing, Trusted Computing and ECDSA.

A video below illustrates the BTC-to-renBTC exchange process.

The common thread across WBTC, HBTC and renBTC is that they are all pegged to Bitcoin’s price and backed 1:1 by it. Custody is provided by the RenVM protocol. RenVM launched in May 2020.

Currently, renBTC is the third-most popular tokenised Bitcoin. A total of 17,837 RENBTC have been issued (as of 21.02.2021).

The renBTC team will become part of the venture firm and market maker Alameda Research on the crypto market. It is planned that the project will add Solana support to the cross‑chain RenVM protocol.

tBTC. Despite a rocky start and vulnerabilities disclosed in spring 2020, the Keep Network developers managed to reboot the project. The total market value of tBTC has surpassed $100 million.

As with renBTC, there is no central custodian controlling assets locked in the protocol for tBTC. However, the approaches to issuing BTC-backed tokens differ markedly.

Bitcoin holders can issue tBTC using the decentralised Keep Network signer network. Signers are chosen randomly, with a new group involved for each issued tBTC.

“To guarantee users compensation in case of fraud, signers provide a collateral of 150% of the BTC deposited in ETH. tBTC tracks misbehaviour by signers, punishes them and fully reimburses the user for their tBTC, and excludes the signer from the signer pool”, — stated on the project site.

By locking Ethereum as collateral, signers receive a reward at redemption time.

sBTC represents a completely different approach to issuing ‘Bitcoin on Ethereum’. The token is not backed by digital gold — it is a synthetic asset backed by the native SNX token of the Synthetix platform. A total of almost 3500 sBTC have been issued (as of 21.02.2021).

Despite the peg to Bitcoin, the market prices of sBTC, wBTC, renBTC and tBTC usually diverge slightly. This reflects varying demand.

Why Tokenised Bitcoin Matters

The Bitcoin network, operating since 2009, is the most secure, characterised by antifragility and genuine decentralisation. Yet Bitcoin’s use cases are not that wide — primarily payments, store of value as digital gold, and trading on centralised exchanges. DeFi opens opportunities well beyond the typical Bitcoin use cases.

To earn by lending BTC, users can use centralised services like BlockFi. Interacting with such platforms implies KYC procedures, which decentralisation and permissionless advocates may find burdensome.

These drawbacks of the first cryptocurrency helped drive the emergence and growth of ethBTC. The main use case for ‘Bitcoin on Ethereum’ assets is decentralised applications that enable:

- access to affordable loans without KYC or bureaucratic fuss;

- the ability to place funds at attractive interest rates;

- spot and margin trading of tokens and derivatives on non-custodial exchanges;

- asset insurance.

Bitcoin’s market capitalization is more than four times that of Ethereum. Digital gold can be productively deployed in DeFi.

The scarce nature of Bitcoin and the steadfast trajectory of price growth make digital gold a valuable collateral in DeFi applications. Wrapped Bitcoin coins can be used in lending services like Aave, Maker or Compound. Users can also provide liquidity to the WBTC/ETH pool on Uniswap and then earn passive income from trading fees.

You can earn even without deviating from Buy & Hold. If a loan is repaid, WBTC or renBTC engaged in lending applications can be unlocked and swapped back to BTC at any time.

Problems and Risks

Despite what would seem to be a wide range of possibilities compared with classic Bitcoin, WBTC is not without drawbacks. The main one is that custody of the asset is handled by a centralized custodian.

In this context, one can draw a parallel with the USDC stablecoin, backed by the US dollar. WBTC and USDC bring Bitcoin and the dollar into DeFi, but both are centralized assets.

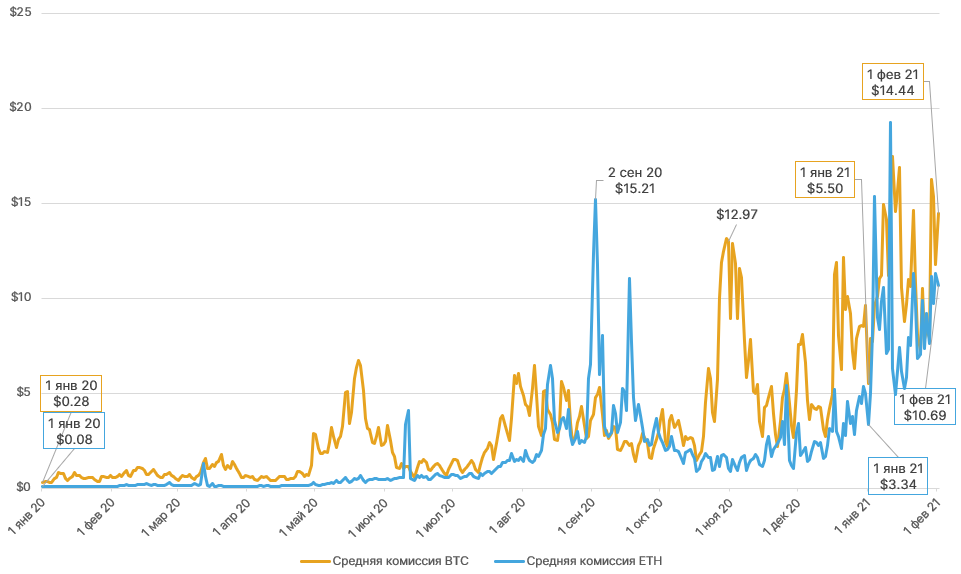

For Ethereum, scalability is a pressing issue, manifested in extremely high gas costs. In the second half of the previous year, the average fee for a simple ETH transfer repeatedly exceeded the corresponding metric for Bitcoin.

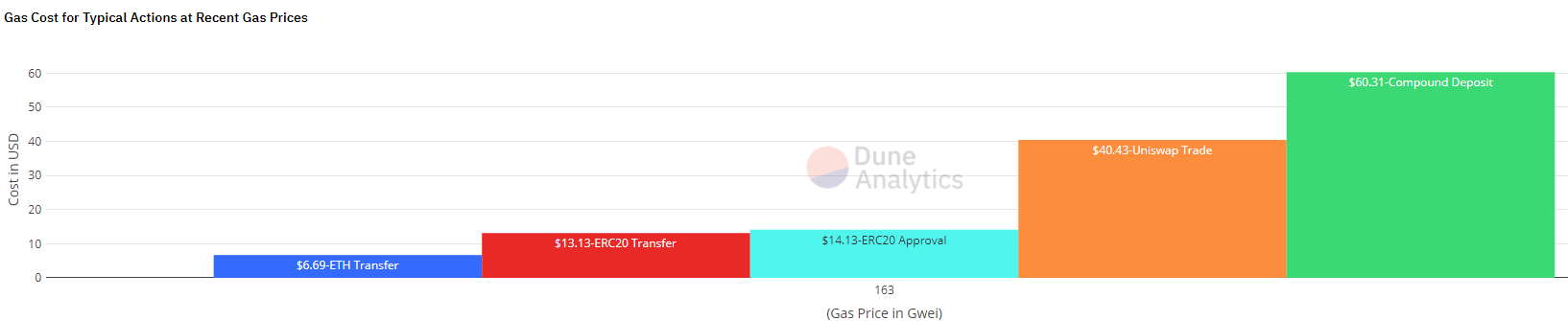

The diagram below shows the gas costs for typical operations on the Ethereum network:

- transfer of native ETH;

- transfer of ERC-20 tokens;

- approval of an ERC-20 token for DeFi operations;

- token swap on a non-custodial exchange like Uniswap;

- deposit on Compound.

Obviously, for everyday users dealing with small sums and those testing DeFi apps, these fees can be intimidating.

With sharding and the Proof-of-Stake (PoS) consensus, the new version of Ethereum is expected to address high transaction costs. However, until the zero-phase, the rollout of sharding and the merge of the PoW blockchain with the new PoS system remains a distant prospect.

For now, Ethereum proponents are counting on widespread Layer 2 solutions such as Optimism and ZK-Rollups, which reduce load on the main network.

Many users are eagerly awaiting the launch of the third version of the largest non-custodial exchange Uniswap. It is expected that the upgrade will significantly improve platform efficiency, reduce slippage and increase transaction speed. Likely in late Q1, the Optimism solution will launch, dramatically scaling the largest DEX.

Using DeFi apps, one should not forget about risks — software bugs and probable exit-scams. In recent months there have also been more frequent hacker attacks using flash loans.

Be especially cautious with newly launched apps, where the annual percentage yield (APY) is measured in hundreds of percent. Such coins are likely illiquid, and the projects probably did not attract funding from reputable investors or undergo audits.

High yields typically imply higher risk. Therefore, investors should not convert all their Bitcoin into tokenised versions for DeFi interactions.

Conclusions

As the supply of WBTC and other tokens grows, demand for such assets appears to be rising. The combination of Ethereum’s capabilities and the advantages of Bitcoin creates a strong value proposition.

Until Ethereum’s scaling problem is solved and gas costs remain high, further growth in the market share of competing tokens can be expected. Similar assets in various implementations will appear on other networks, including the rapidly growing Binance Smart Chain (BSC) and Huobi Eco Chain (Heco). The total value locked (TVL) of applications on these networks has reached $11.9 billion and $2.69 billion respectively (as of 21.02.2021).

BSC and Heco clearly lag Ethereum in decentralisation, but confirmations are processed in seconds at much lower transaction costs. This makes alternative DeFi ecosystems popular among many retail investors.

Against the backdrop of continued DeFi growth, one can expect tokenised Bitcoin to further increase in market value, given there are numerous use cases. The evident success of WBTC and similar assets could also spur the popularity of tokenised versions of altcoins.

Sign up for ForkLog news on Telegram: ForkLog FEED — the full news stream, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!