SEC approves Coinbase’s direct listing application.

On Thursday, February 25, the U.S. Securities and Exchange Commission (SEC) approved Coinbase’s application for [simple_tooltip content=’the process by which a company goes public, in which no new shares are issued, but existing shares held by shareholders are sold’]direct listing of shares[/simple_tooltip].

Company filed an S-1 with the SEC in December 2020. After its approval, the information became public. As the listing venue for its market debut, Coinbase selected Nasdaq.

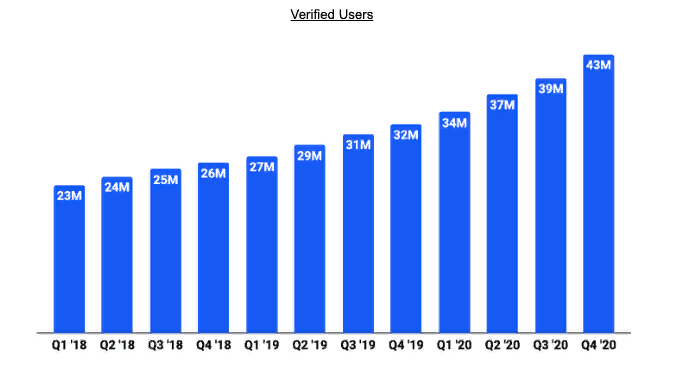

According to the document, the exchange’s net income for 2020 was $1.1 billion versus $482.9 million in 2019. The platform has about 43 million users, with 2.8 million transactions per month.

Data: Coinbase Form S-1.

Trading volume on Coinbase since its founding in 2012 has surpassed $456 billion. The platform holds assets of $90 million. The platform’s operating expenses for 2020 amounted to $868.5 million, compared with $579.5 million a year earlier.

Analyst The Block’s Larry Cermak noted that the company held $130.1 million in Bitcoin, $23.8 million in Ethereum and $34 million in other assets.

• As of end of 2020, Coinbase had cash and cash equivalents of $1.1 billion

• $48.9 million of USDC

• Held the following crypto: $130.1M of Bitcoin, $23.8M of Ethereum and $34.0M of other— Larry Cermak (@lawmaster) February 25, 2021

Earlier, Coinbase announced that it has held Bitcoin and other cryptocurrencies on its balance sheet since 2012. The exchange plans to support investments in digital assets.

As financial advisors, Coinbase has engaged Goldman Sachs, JPMorgan, Allen & Co and Citigroup. Market makers are Goldman Sachs, JPMorgan and Citi.

Obviously direct listing on Nasdaq

Market makers: Goldman Sachs, JP Morgan, and Citi

Advisors: Goldman, JPM, Allen & Company and Citi

— Larry Cermak (@lawmaster) February 25, 2021

Earlier on February 17, the price of Coinbase stock futures on FTX rose to $369. This suggested a potential valuation of $92.2 billion after the company went public.

On February 20, traders valued this figure at $100.3 billion.

Follow ForkLog news on Twitter!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!