What is Terra (LUNA)?

What is Terra?

How to receive the Terra 2.0 (LUNA) airdrop?

Terra is a blockchain platform designed for issuing algorithmic stablecoins: Terra USD, Terra KRW, Terra SDT and others. These assets are pegged to their respective fiat currencies and are backed by the native cryptocurrency Terra (LUNA).

To mint stablecoins, LUNA is burned in an amount equal to the value issued. To remove stablecoins from circulation, they are swapped into another asset via LUNA. Arbitrageurs help keep prices anchored.

The Terra network uses a Delegated Proof-of-Stake consensus algorithm. Users can stake LUNA via the decentralised application Terra Station. Validators produce blocks and determine the exchange rate of the stablecoins to LUNA by voting through the oracle module.

Who created Terra and when?

Daniel Shin founded the project in 2018; the platform is developed by Terraform Labs.

Shin is the president and founder of TicketMonster.

The Terra mainnet launched in April 2019. At the same time the developers released the core tools: the wallet Terra Station and the block explorer Terra Finder. In late 2020 they launched Terra USD (UST) and other stablecoins.

In August 2018 the project raised $32m from investors. The funding round included Binance, Polychain Capital, FBG Capital, Hashed, 1kx, Kenetic Capital and Arrington XRP Capital.

In January 2021 Terraform Labs raised another $25m from Galaxy Digital, Coinbase Ventures and Pantera Capital. Over 2021 the company received $150m from Arrington XRP Capital, BlockTower Capital and others.

To develop the ecosystem, a group of e-commerce industry participants created the Terra Alliance.

Which tokens run on Terra?

Terra hosts stablecoins pegged to national currencies and to Special Drawing Rights (SDR): the US dollar, the South Korean won, the euro, the Mongolian tugrik, SDRs and other units.

UST has the largest market capitalisation. In South Korea, Terra KRW (KRT) is popular. Terra SDT (SDT) is pegged to a basket comprising the US dollar, euro, Chinese yuan, Japanese yen and British pound.

LUNA is the network’s native coin, backing the stablecoins and absorbing their price volatility. The maximum supply is 1bn. LUNA also serves as a governance token, allowing holders to vote on community proposals.

How do Terra’s stablecoins work?

The project’s core task is to issue stablecoins. Swaps between Terra stablecoins are fee-free at a unified rate but incur a Tobin tax.

They are minted and burned via Terra Station. LUNA intermediates swaps between stablecoins and other cryptocurrencies. The exchange rate of the stablecoins to the native token is set by validators.

To mint stablecoins in Terra Station, users must send LUNA equal to the required value. Previously, only part of the LUNA was burned and the remainder went to the community treasury. After the Columbus-5 upgrade, minting stablecoins requires a full LUNA burn.

When stablecoins are removed from circulation, they are swapped for LUNA, which can then be exchanged for other assets. For example, suppose validators set LUNA’s price at $50. Burning 100 UST would yield 2 LUNA, which the user can then trade for other cryptocurrencies. The 100 UST are burned.

Changes in demand for the stablecoins can push their prices up or down. The platform relies on a market mechanism of arbitrage to keep prices in line.

Terra Station lets users swap stablecoins for LUNA at the relevant fiat exchange rate. Arbitrageurs profit from price differences across markets, bringing rates back into line.

When demand for Terra USD rises, its price may climb above $1. In such cases price regulation occurs in two steps:

- Arbitrageurs mint Terra USD by burning LUNA. To create 1 UST, users spend $1 worth of LUNA.

- They then swap the stablecoins for LUNA at a market price above $1 and pocket the difference.

Arbitrageurs repeat these actions in cycles. The supply of UST increases, pushing its price back to target.

When the market is flooded with sell orders for Terra USD, supply often exceeds demand, pushing UST below $1. Arbitrageurs then mint LUNA by burning Terra USD. They buy UST on the market at a discount and repeat the process, restoring the balance between supply and demand.

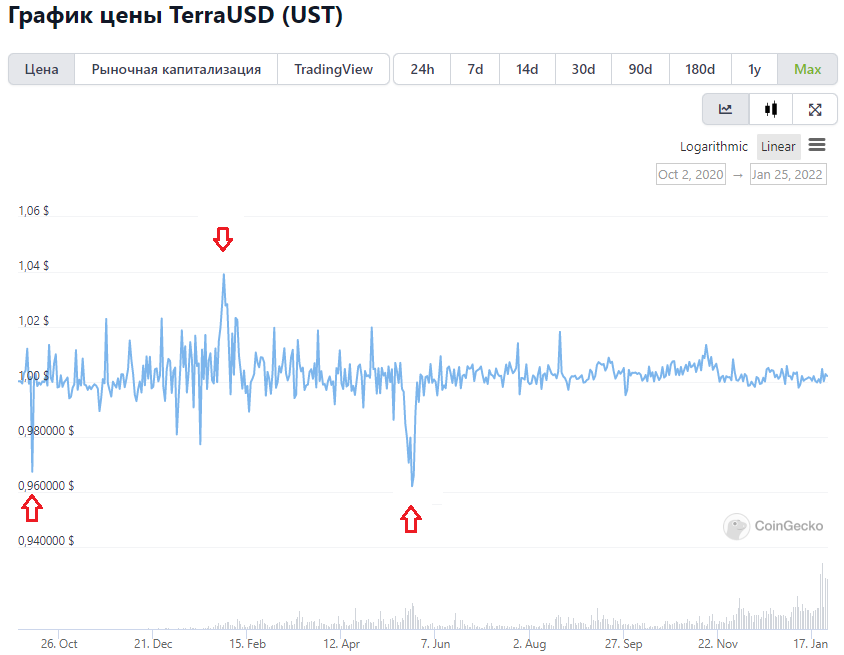

High arbitrage profits act as a lever to support the value of the stablecoins. UST has deviated materially from parity only three times, and arbitrageurs quickly corrected it.

What are Terra’s distinctive features?

Terra is built with Cosmos SDK and uses a Delegated Proof-of-Stake algorithm. Users delegate coins to validators, and the chance of proposing a block is proportional to the stake.

Validators’ price votes for LUNA undergo statistical processing. The algorithm computes the mean and the standard deviation of the rate. Rewards are then distributed to validators in proportion to their staked funds.

Payouts are made if a validator’s submitted rate is within one standard deviation of the mean. If a validator votes incorrectly, the platform applies slashing, reducing the amount counted for rewards.

The platform aims to provide validators with stable, predictable income. Validators earn gas fees on every transaction and spreads on swaps between stablecoins and LUNA.

Previously there were stabilisation fees on stablecoin transfers. When aggregate transaction value fell, fees rose, and when activity increased they fell to a minimum. Validator income thus remained steady in both quiet and active markets. Stabilisation fees were abolished in January 2022.

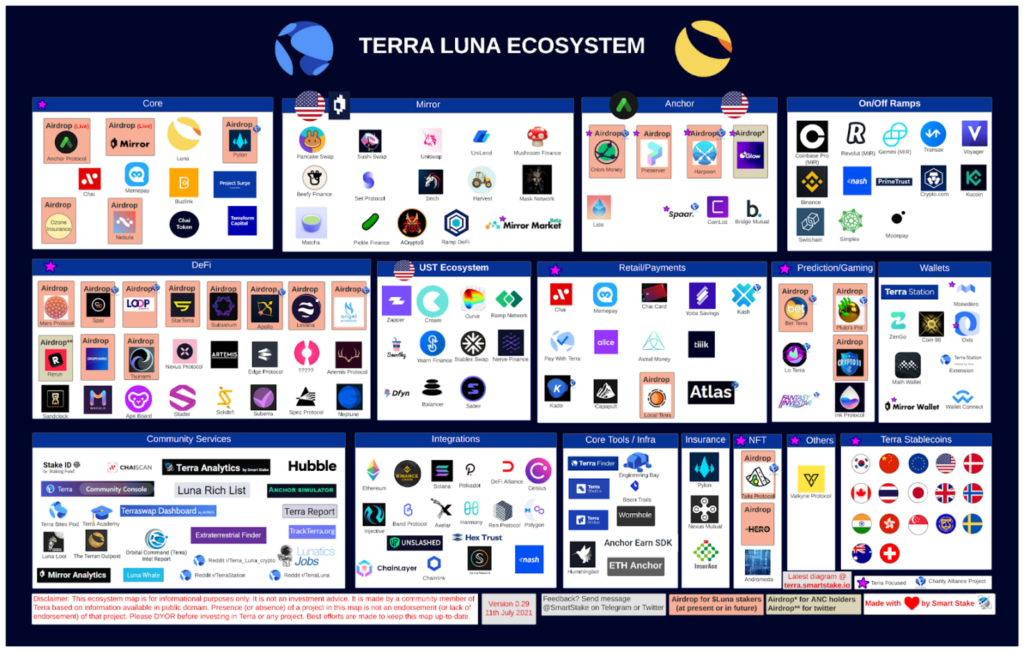

Which projects sit in the Terra ecosystem?

Terra’s ecosystem grew rapidly after UST’s launch in late 2020.

Terra Station enables interaction with the network. Versions exist for Windows, iOS, Linux, macOS and Android, as well as a browser extension.

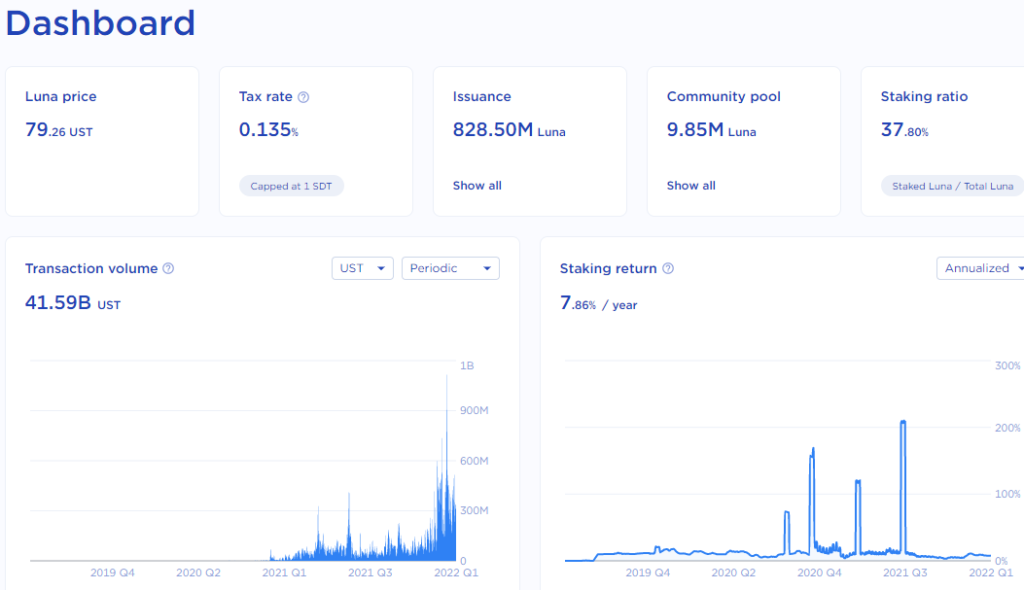

The app displays token issuance, transaction volumes, staking yields and other metrics. It lets users send and receive LUNA, stablecoins and other assets. The wallet supports staking by delegating to a chosen validator, and token swaps.

Cross-chain transfers of tokens are handled via Terra Bridge. The bridge moves assets between Terra, Ethereum, Binance Smart Chain, Harmony and Osmosis.

The ecosystem includes the DeFi project Mirror Protocol, built for issuing and trading synthetic assets. Anchor Protocol is also popular, allowing deposits in Terra stablecoins. The protocol’s hallmark is low volatility of deposit yields.

How is Terra developing?

According to DeFi Llama, Terra’s TVL exceeded $16bn (as of 25 January 2022). By this measure the ecosystem trails only Ethereum. Anchor Protocol accounts for the largest share of TVL.

Cross-chain solutions for moving stablecoins have boosted Terra’s popularity. In December 2021 the decentralised app Multichain (formerly AnySwap) added support for the network. At the time of writing the bridge supports UST and LUNA.

A launchpad StarTerra has appeared in the ecosystem, focused on GameFi and NFT applications.

To support the ecosystem, a non-profit organisation, Luna Foundation Guard (LFG), was created in Singapore. It builds reserves to help maintain Terra stablecoins’ pegs and funds promising projects that:

- develop open-source software for the Terra ecosystem and algorithmic stablecoins;

- conduct research and education in blockchain, cryptography, distributed systems and DeFi;

- create solutions for community development and building a collectively governed ecosystem.

In January 2022 Terraform Labs transferred 50m LUNA (over $3.2bn) to LFG. The organisation has already announced grants and funding programmes.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!