DeFi Bulletin: Uniswap v3 launch, Polkaswap DEX announced, and more than $150 billion in locked funds

The decentralised finance (DeFi) sector continues to attract heightened attention from cryptocurrency investors. ForkLog has compiled the most important events and news of the past weeks in this digest.

Key metrics of the DeFi segment

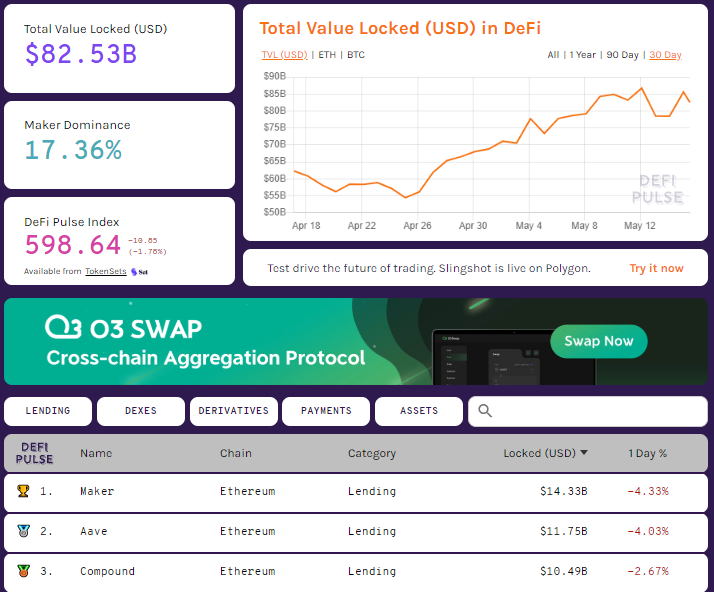

The total value locked (TVL) in DeFi protocols reached $163 billion. The top three are lending protocols MakerDAO ($14.3 billion), Aave ($13.91 billion) and Compound ($10.44 billion).

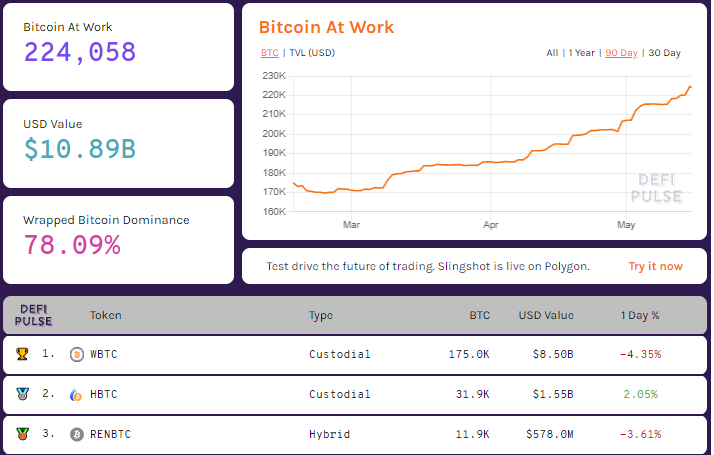

DeFi Llama includes in its final value a group of tokenised bitcoins. WBTC, at $8.48 billion, ranked sixth. hBTC with $1.55 billion ranked 24th.

TVL in Ethereum applications reached $82.53 billion. Over the last 30 days the figure rose by 32%.

The tokenised Bitcoin segment resumed growth. The total market value of WBTC, HBTC, renBTC and other Bitcoins on Ethereum reached $10.89 billion. Three weeks ago the figure stood at $9.98 billion.

Trading volume on decentralised exchanges (DEX) over the last 30 days stood at $96.7 billion.

60.6% of total non-custodial exchange turnover is attributed to Uniswap. The second DEX by trading volume is SushiSwap (14.8%), the third is 0x Native (8.7%).

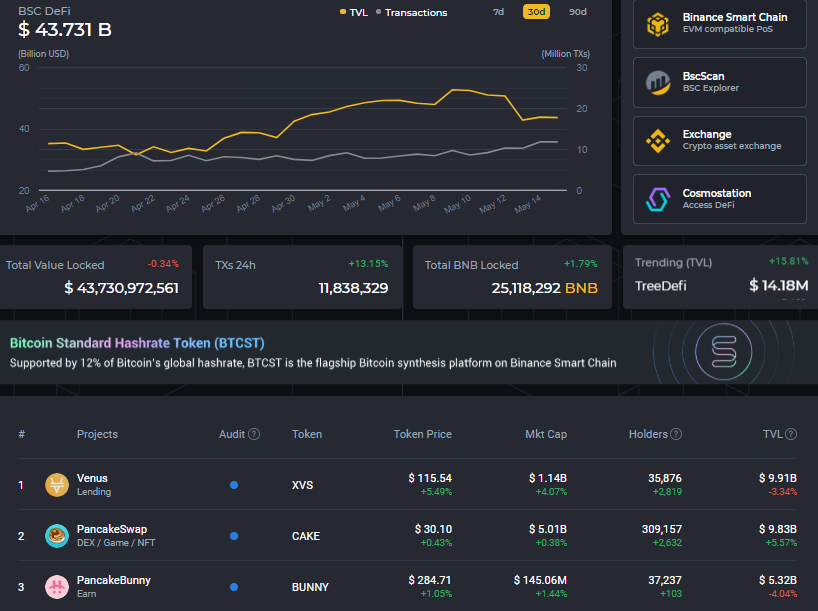

TVL of projects on the Binance Smart Chain is rising steadily. The aggregate figure reached $43.73 billion, a 125% rise over the last 30 days.

Uniswap launches the third version of the protocol

On May 5 the launch of the third version of the Uniswap protocol on the Ethereum network took place, introducing radically new features and concepts, including concentrated liquidity, limit-range orders and multiple positions within a single pool.

On April 28 the UNI token price hit a historical high above $44. At the time of writing the asset trades at around $39, with a market capitalisation of $20.2 billion, according to CoinGecko.

Developers announce the launch of Polkaswap DEX on the Polkadot network

The technology provider Soramitsu announced a ‘soft launch’ of the SORA Network, which will connect the Polkaswap decentralised exchange in the Polkadot network with the Ethereum blockchain.

Polkaswap is a cross-chain DEX built on the AMM mechanism. It will enable low-fee exchange of ERC-20 tokens and assets from other networks connected to Polkadot via bridges.

Polkaswap is characterised by high throughput. The developers are confident that the new platform will take on the role of a ‘central bank’ in decentralised finance.

Chainlink hit an all-time high above $50

The Chainlink (LINK) token hit an all-time high above $50. At the time of writing the token trades at around $44, with a market capitalisation of $18.8 billion, according to CoinGecko.

Bender Labs launches a bridge between Ethereum and Tezos

The Bender Labs team launched a ‘bridge’ between the Ethereum and Tezos blockchains. With the Wrap Protocol holders of ERC-20 and ERC-721 tokens will be able to interact with the Tezos ecosystem.

The decentralised protocol enables transferring ERC-20 and ERC-721 into the FA2 standard. wTokens are compatible with most DeFi protocols on the Tezos blockchain, such as Quipuswap, Atomex or Kolibri. The value of wTokens is pegged to the underlying assets.

In a statement, Bender Labs noted that the new tool will address the issue of high fees on the Ethereum network. The issuance of wTokens by the protocol will take about an hour.

Investments in DeFi

The non-profit Solana Foundation raised $60 million for project development in Brazil, India, Russia and Ukraine from Hacken, Gate.io, Coin DCX and BRZ.

The funding will be directed to supporting the development of blockchain applications in areas such as DeFi, NFTs and cybersecurity. The funds will go directly to projects, and their distribution will be flexible.

The blockchain-compliance solutions provider Securrency raised $30 million in a Series B round with participation from WisdomTree Investments, State Street, U.S. Bank and Abu Dhabi Catalyst Partners.

The funds will be directed to launching DeFi products for banks and entering new markets. Securrency’s Chief Strategy Officer Patrick Campos described the product as cross-platform software that links blockchains and traditional systems on the basis of a common compliance framework.

Dispersion Holdings, a DeFi-focused investment firm, raised $15.3 million after an equity offering. The securities were listed on the British alternative trading system Aquis under the ticker DEFI.

Schroders, a major asset manager, was among the buyers. Dispersion Holdings’ market capitalisation stood at $25 million.

DEFI is positioned as an opportunity for investors to bet on the sector’s further development. Its hallmark is the absence of the need to directly engage with cryptocurrencies and the market, based on the use of smart contracts.

The Dispersion Holdings board includes Argo Blockchain co-founder Mike Edwards and a director of NFT Investments, Timothy Le Druillenec.

The firm plans to invest in early-stage projects based on Ethereum, Binance and Polkadot.

The decentralised exchange NiiFi, built on the Ethereum-based second-layer solution Nahmii 2.0, raised $3 million in a seed round with participation from DARMA Capital, A195 Capital, AU21 Capital, Blocksync Ventures, Lotus Capital, Matterblock, Moonwhale Ventures, Protocol Ventures and Three M Capital.

Features of NiiFi DEX will include instant settlement and AML/KYC integration, appealing to institutional investors.

Hacks and scams

A hacker attacked Spartan Protocol, a project operating on the Binance Smart Chain, and withdrawn $30 million from its liquidity pools. According to the protocol team, the attacker used about $61 million in BNB tokens for the attack.

Spartan also reported that they are trying to recover the stolen funds and have sought help from Binance.

PeckShield analysts disclosed the attack mechanism, noting that the attacker exploited a vulnerability in how the protocol determined its liquidity share. The hacker increased the pool balance before burning tokens in it to withdraw an excess of the base assets.

For the attack, he took an instant loan on PancakeSwap of 100,000 BNB, which he later repaid, paying a fee of 260 BNB.

The xToken protocol lost $25 million due to a hacker attack. Analysts noticed price and supply discrepancies about ten minutes after its onset and halted the smart contracts.

An unknown actor promptly drained the xBNTa and xSNXa liquidity pools. The BNT and SNX tokens remained in the xToken contracts. The hacker extracted 416 ETH from the xSNX contract, since it stores Ethereum as part of a debt-hedging strategy.

Bancor and Balancer liquidity pools lost assets worth about $25 million.

The Rari Capital project lost about $11 million as a result of the hack.

Rari Capital founder Jai Bhavani announced compensation payments to users affected by the hack. According to him, the protocol lost 2,600 ETH.

Also on ForkLog:

- CipherTrace: hackers stole $156 million from DeFi protocols in 2021.

- How to earn on loans for businesses: a review of BondAppétit’s DeFi protocol.

- The 1inch Network ecosystem expanded to Polygon network.

- DeFi project 1inch launched the 1inch Wallet app for iOS.

- WallStreetBets founder will launch a dapp for investing in ETPs.

Read ForkLog’s bitcoin news in our Telegram — cryptocurrency news, rates and analytics: Telegram.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!