Glassnode: Activity in Bitcoin and Ethereum networks falls to annual lows

Measures of active users, on-chain value transferred, and transaction fees in Bitcoin and Ethereum networks hit new lows after the May correction. Glassnode analysts shared these observations.

#Bitcoin on-chain activity has fallen dramatically this week, returning to levels not seen in 1yr.

Simultaneously, a seismic shift is underway in the #Bitcoin mining markets, as hash-rate falls and miners ramp up spending.

Read more in The Week On-chainhttps://t.co/nolMIQaFGK

— glassnode (@glassnode) June 21, 2021

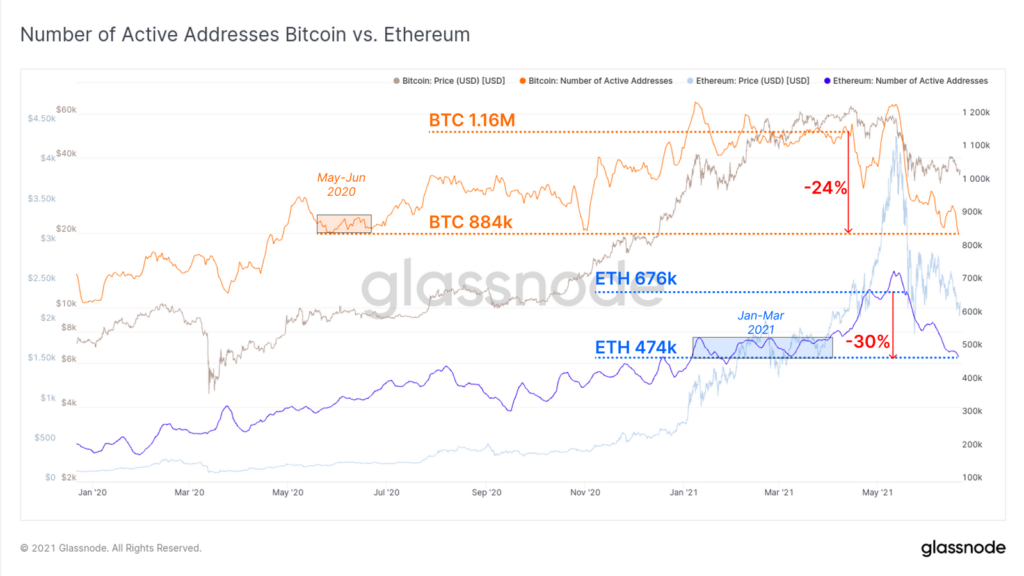

The number of active Bitcoin addresses fell 24% from recent peaks to 884,000. The decline in the analogous metric for the Ethereum network was even more dramatic — 30%, to 474,000.

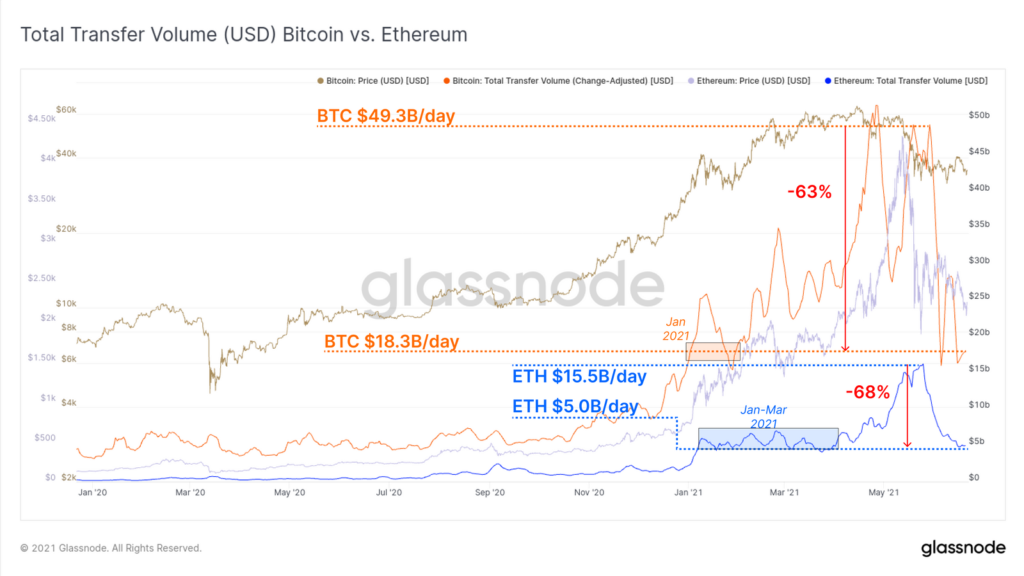

The total volume of on-chain value transferred in the blockchains of the two leading cryptocurrencies fell by 63% and 68%, to $18.3 billion and $5 billion respectively.

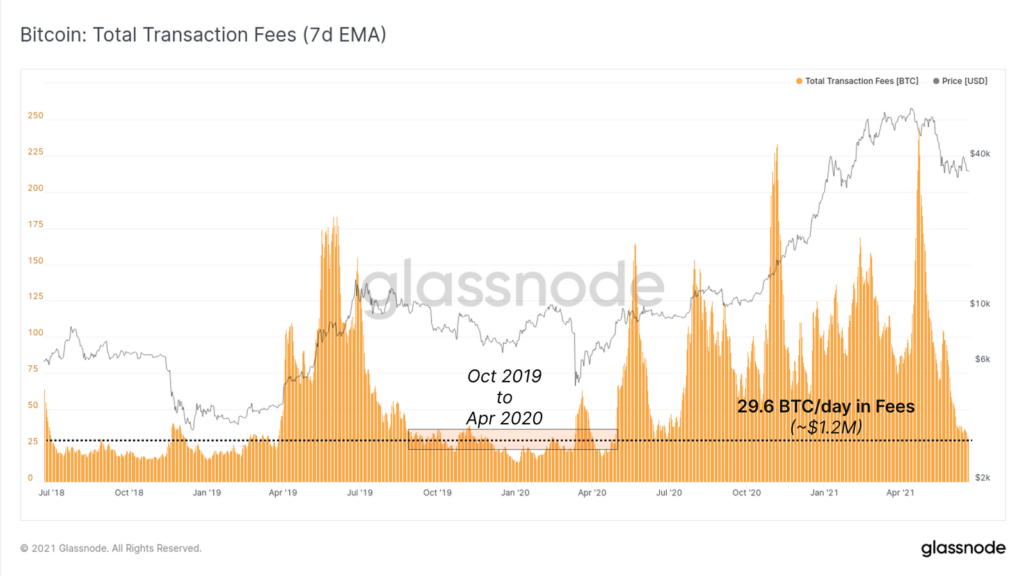

Fees for priority inclusion in Bitcoin blocks, amid mempool releases, fell to levels seen in 2020. The daily transaction fee rate dropped to 29.6 BTC ($1.2 million), its share of miners’ revenue fell to 4%.

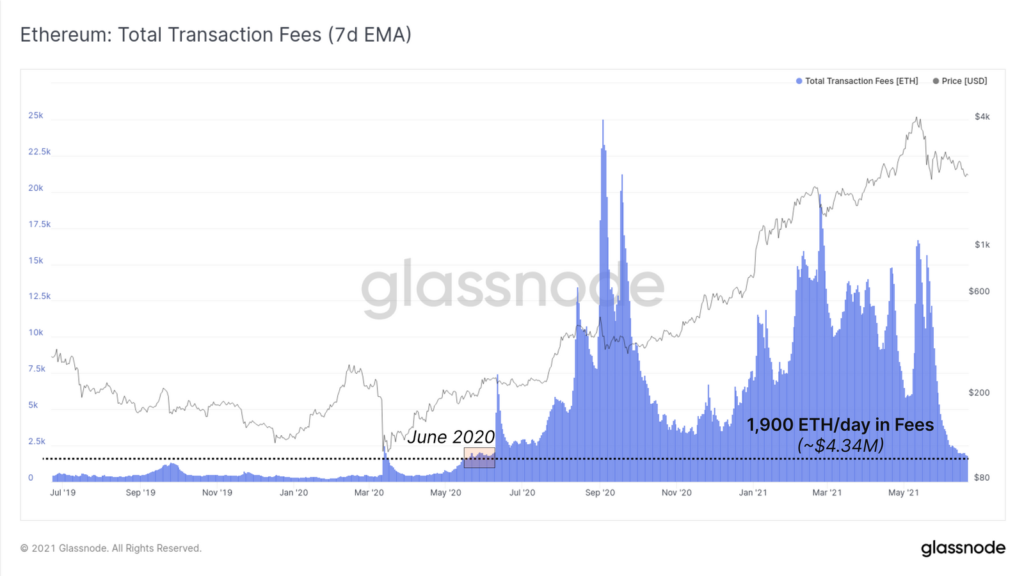

In the Ethereum network, the daily transaction fees fell to 1,900 ETH (~$4.34 million). The last time such levels were seen was on the eve of the 2020 DeFi summer. The share of fees in miners’ revenue fell to 10%.

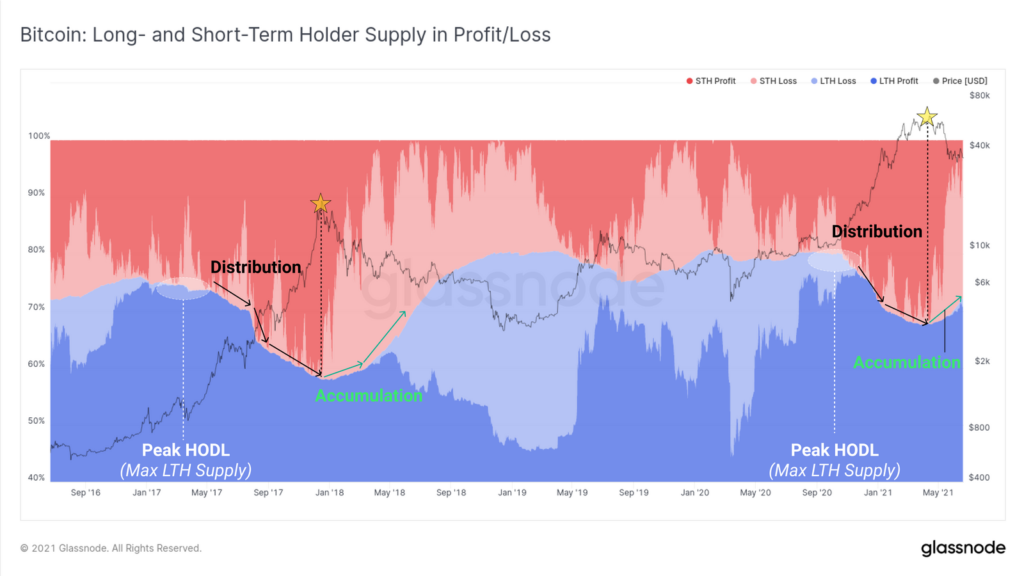

In the context of coin distribution, analysts saw similarities with 2017. The diagram below shows a shift of long-term holders toward accumulation, characteristic after the peak during the previous bull market.

The turning point in their actions occurred despite Bitcoin’s price dropping below the cost basis of some coins. Of the coins acquired in the last two months, an additional 5.25% of the market supply, around 1.5% of coins, is held with an unrealized loss.

In Glassnode, two conclusions:

- spрос на ончейн-транзакции крайне низок, что можно считать медвежьим фактором;

- долгосрочные инвесторы не выходят из позиции по текущим ценам (нейтрально-бычий фактор, по мнению аналитиков).

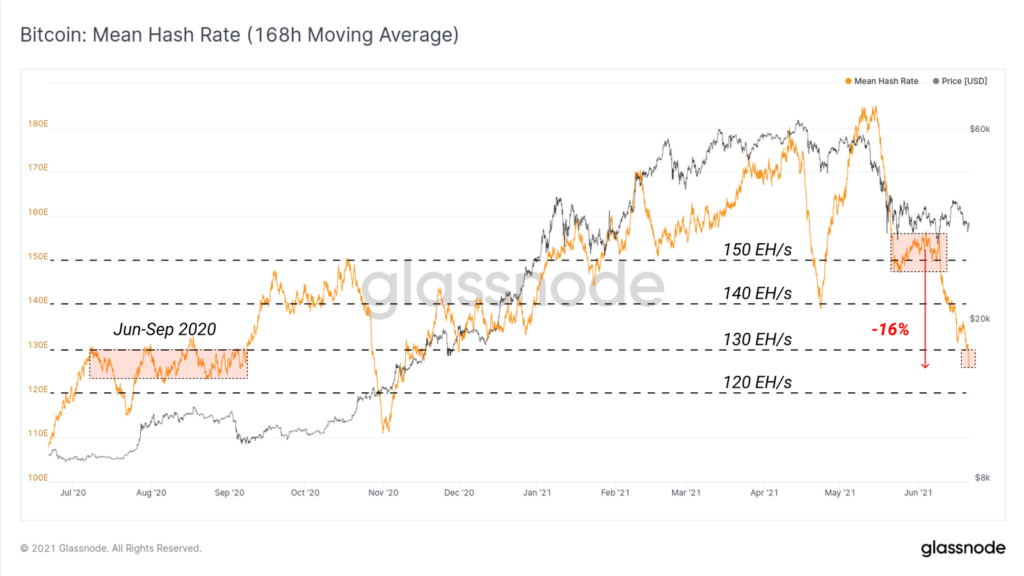

Experts also provided a chart of Bitcoin’s hash rate. They estimate that in the last two weeks the volume of computing power fell by 16% — from 155 EH/s to 125 EH/s (the lowest since mid-2020).

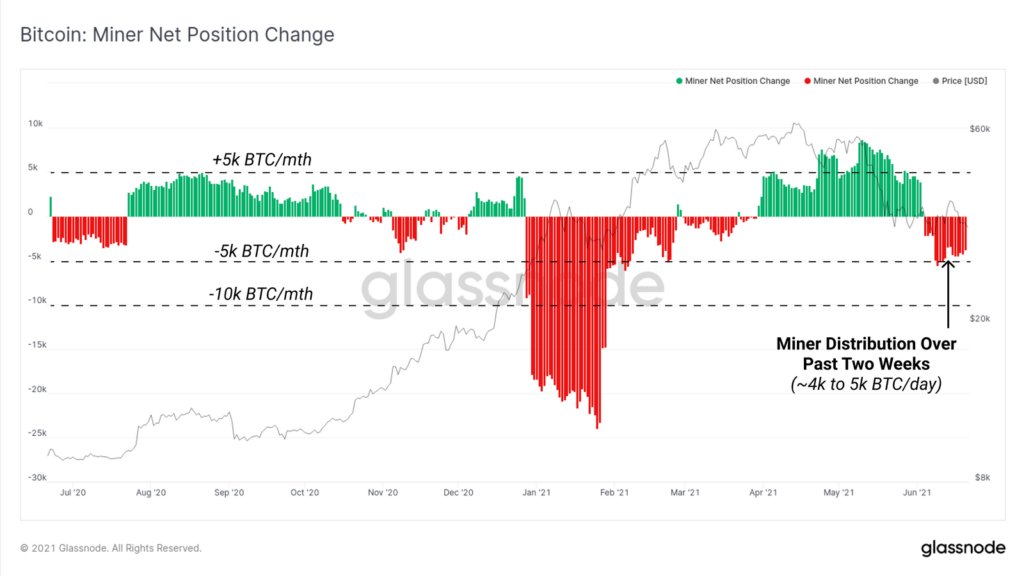

Such dynamics coincided with miners selling coin reserves to cover operating costs for relocation, equipment deployment, or exiting the business. In the last two weeks, daily sales by this group amounted to 4–5 thousand BTC.

According to CryptoQuant, the amount of coins flowing to spot exchanges on the eve reached the highest since March 2020.

The analyst Michaël van de Poppe said that Bitcoin could fall to $24,000 if May’s lows were breached.

#Bitcoin is still acting in support here, with the crucial breaker at $35.5K.

If this support doesn’t hold, I’m seeing $24K as the next area. pic.twitter.com/kk2CJixUyF

— Michaël van de Poppe (@CryptoMichNL) June 22, 2021

As of June 16, Pantera Capital founder Dan Morehead said that now is a good time to buy digital gold.

Tim Draper confirmed the forecast for Bitcoin to rise to $250 000 by the end of 2022 or early 2023, despite sharp price fluctuations.

Subscribe to ForkLog news on Facebook!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!