Institutional investors increase investments in crypto funds for the first time in five weeks

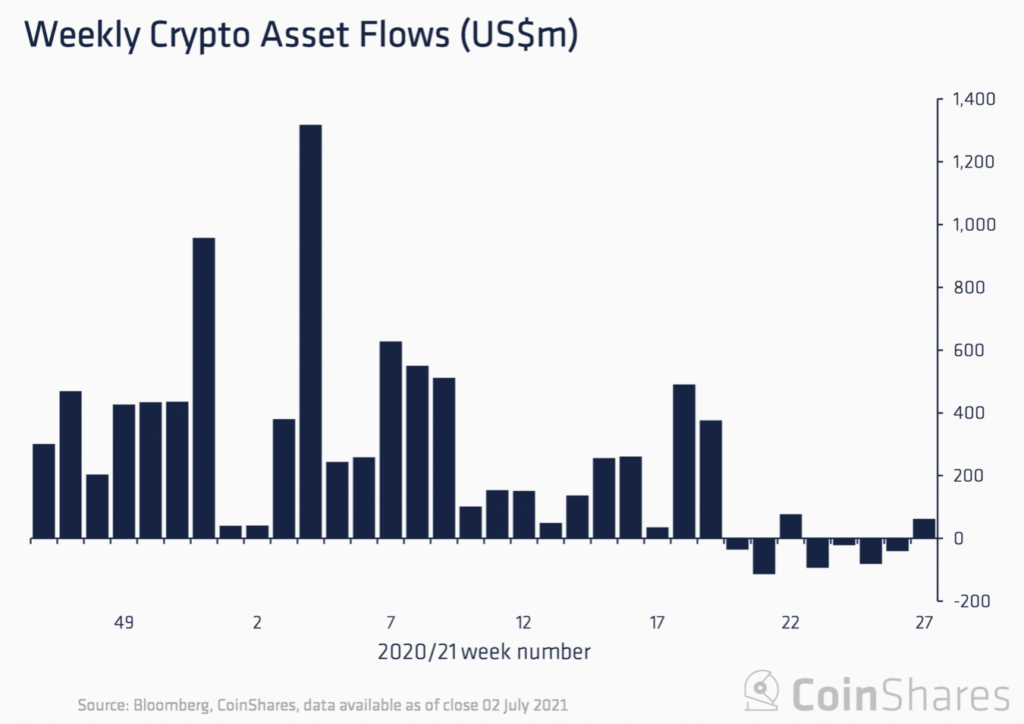

Net inflows into crypto-based investment products from June 25 to July 2 amounted to a record $63 million. CoinShares, a digital asset management company, reports the data.

0 / @CoinSharesCo posts Digital Asset Fund Flows Weekly Report. Read more from the 5 July 2021 report here: https://t.co/MbvaGEUdwi

— CoinShares ?? (@CoinSharesCo) July 5, 2021

For the first time in nine weeks, inflows were observed across the entire spectrum of digital assets. Analysts say this signals ‘a turning in investor sentiment’.

Investors placed $38.9 million into Bitcoin-based products, $17.7 million into Ethereum-based products. XRP funds attracted $1.2 million, Polkadot $2.1 million and Cardano $0.7 million, respectively.

Analysts noted a decline in trading volume for Bitcoin funds to the lowest levels since November 2020.

CryptoQuant analysts arrived at similar conclusions.

“A move in either direction in the market is likely to be met with a relatively strong price reaction”, —they wrote.

Experts also noted that ETH on exchanges’ balances fell to a two-and-a-half-year low.

$ETH all exchanges reserve reaches a 2.5 year low

View chart?https://t.co/E9Wve6QBFU pic.twitter.com/1kHBvF1rH5

— CryptoQuant.com (@cryptoquant_com) July 5, 2021

Santiment recorded the largest daily bitcoin accumulation spike by large holders this year.

Earlier, Grayscale Investments added Cardano to the Digital Large Cap Fund trust.

Subscribe to ForkLog news on Facebook!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!